Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

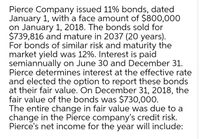

Transcribed Image Text:Pierce Company issued 11% bonds, dated

January 1, with a face amount of $800,000

on January 1, 2018. The bonds sold for

$739,816 and mature in 2037 (20 years).

For bonds of similar risk and maturity the

market yield was 12%. Interest is paid

semiannually on June 30 and December 31.

Pierce determines interest at the effective rate

and elected the option to report these bonds

at their fair value. On December 31, 2018, the

fair value of the bonds was $730,000.

The entire change in fair value was due to a

change in the Pierce company's credit risk.

Pierce's net income for the year will include:

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- On January 1, 2018, for $17.4 million, Cenotaph Company purchased 8% bonds, dated January 1, 2018, with a face amount of $19.4 million. For bonds of similar risk and maturity, the market yield is 10%. Interest is paid semiannually on June 30 and December 31. Required: 1. Prepare the journal entry to record interest on June 30, 2018, using the effective interest method. 2. Prepare the journal entry to record interest on December 31, 2018, using the effective interest method. Complete this question by entering your answers in the tabs below. Required 1 Required 2 Prepare the journal entry to record interest on June 30, 2018, using the effective interest method. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Enter your answers in whole dollars.) View transaction list Journal entry worksheet 1 > Record the entry to interest on June 30, 2018, using the effective interest method. Note: Enter debits before credits. Date General…arrow_forwardOn May 1, 2024, Green Corporation issued $1,200,000 of 8% bonds, dated January 1, 2024, for $1,104,000 plus accrued interest. The market rate of interest was 9%.The bonds pay interest semiannually on june 30 and december 31,.Green's fiscal year ends on December 31 each year. Determine the amount of accrued interest that was included in the proceeds received from the bond sale. Prepare the journal entry for the issuance of the bonds. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.). Need answer in detail with explanation computation formulas with stepsarrow_forwardOn January 1, 2022, Aaron Incorporated issued $1,530,000 par value, 6%, 7-year bonds (i.e., there were 1,530 of $1,000 par value bonds in the issue). Interest is payable semiannually each January 1 and July 1 with the first interest payment due at the end of the period on July 1. The issue price of the bonds based on a 12% market rate of interest is $1,103,360. Prepare the amortization table for the first 2 years, assuming Aaron uses the straight-line method. (Round each calculation to the nearest whole number and then use the rounded value for each subsequent calculation in the table.) Date January 1, 2022 July 1, 2022 January 1, 2023 July 1, 2023 January 1, 2024 Cash Interest Straight-Line Interest Discount/Premium Amortization Carrying Valuearrow_forward

- On January 1, 2021, Solis Co. issued its 10% bonds in the face amount of P3,000,000, which mature on January 1, 2026. The bonds were issued for P3,405,000 to yield 8%, resulting in bond premium of P405,000. Solis uses the effective-interest method of amortizing bond premium. Interest is payable annually on December 31. At December 31, 2021, the carrying value of the bonds should be a.) P3,405,000 b.) P3,377,400 c.) P3,364,500 d.) P3,304,500arrow_forwardThe Bradford Company issued 12% bonds, dated January 1, with a face amount of $97 million on January 1, 2021. The bonds mature on December 31, 2030 (10 years). For bonds of similar risk and maturity, the market yield is 14%. Interest is paid semiannually on June 30 and December 31. (FV of $1, PV of $1, FVA of $1, PVA of $1, FVAD OF $1, and PVAD of $1) Required: 1.Determine the price of the bonds at January 1, 2021. Price of bonds ____________________ 2.to 4. Prepare the journal entries to record their issuance by The Bradford Company on January 1, 2021. Record the bond issuance by the Bradford Company. Record the interest on June 30, 2021 (at the effective rate). Record the interest on December 31, 2021 (at the effective rate).arrow_forwardEllis Company issues 8.0%, five-year bonds dated January 1, 2021, with a $530,000 par value. The bonds pay interest on June 30 and December 31 and are issued at a price of $540,871. The annual market rate is 7.5% on the issue date. Required: 1. Compute the total bond interest expense over the bonds' life. 2. Prepare an effective interest amortization table for the bonds' life. 3. Prepare the journal entries to record the first two interest payments. Please need answer for all with working please answer do not waste time or question by holding attempt if you can otherwise skiparrow_forward

- The Gorman Group issued $930,000 of 11% bonds on June 30, 2021, for $1,009,794. The bonds were dated on June 30 and mature on June 30, 2041 (20 years). The market yield for bonds of similar risk and maturity is 10%. Interest is paid semiannually on December 31 and June 30. Required: 1.to3. Prepare the journal entries to record their issuance by The Gorman Group on Jun 30, 2021, interest on December 31, 2021, and interest on June 30, 2022 (at the effective rate). Record the issuance of the bond on June 30, 2021. Record the interest on December 31, 2021 (at the effective rate). Record the interest on June 30, 2022 (at the effective rate).arrow_forwardCoronado Inc. issued $920,000 of 10%, 10-year bonds on June 30, 2025, for $814,472. This price provided a yield of 12% on the bonds. Interest is payable semiannually on December 31 and June 30. If Coronado uses the effective-interest method, determine the amount of interest expense to record if financial statements are issued on October 31, 2025. (Round intermediate calculations to 6 decimal places, e.g. 1.251247 and final answer to 0 decimal places, e.g. 38,548.) Interest expense to be recordedarrow_forwardOn January 1, 2021, Essence Communications issued $700,000 of its 10-year, 10% bonds for $619,711. The bonds were priced to yield 12%. Interest is payable semiannually on June 30 and December 31. Essence Communications records interest at the effective rate and elected the option to report these bonds at their fair value. On December 31, 2021, the market interest rate for bonds of similar risk and maturity was 11%. The bonds are not traded on an active exchange. The decrease in the market interest rate was due to a 1% decrease In general (risk-free) interest rates. (EV of $1. PV of $1. EVA of $1. PVA of $1. EVAD of $1 and PVAD of $1) (Use appropriate factor(s) from the tables provided.) Required: 1. Using the information provided, estimate the fair value of the bonds at December 31, 2021. 2. to 4. Prepare the journal entries to record interest on June 30, 2021 (the first interest payment), on December 31, 2021 (the second Interest payment) and to adjust the bonds to their fair value…arrow_forward

- On January 1, 2020, Pine Co. issued 10%, 10-year bonds with a face value of $12,000,000. The bonds were issued for $13,620,000 to yield 8%. Interest is payable annually on December 31. Pine amortizes bond premium using the effective-interest method. The bond premium reported on Pine’s balance sheet dated December 31, 2020, would bearrow_forwardFederal Semiconductors issued 11% bonds, dated January 1, with a face amount of $800 million on January 1, 2021. The bonds sold for $739,814,813 and mature on December 31, 2040 (20 years). For bonds of similar risk and maturity the market yield was 12%. Interest is paid semiannually on June 30 and December 31. Required: 1. to 3. Prepare the journal entries to record their issuance by Federal on January 1, 2021, interest on June 30, 2021 (at the effective rate) and interest on December 31, 2021 (at the effective rate). 4. At what amount will Federal report the bonds among its liabilities in the December 31, 2021, balance sheet? Complete this question by entering your answers in the tabs below. Req 1 to 3 Req 4 重 At what amount will Federal report the bonds among its liabilities in the December 31, 2021, balance sheet? (Enter your answers in whole dollans.) Cash Interest Paid Bond Interest Expense Discount Amortization Period-End Carrying Value 01/01/2021 06/30/2021 12/31/2021 く Req 1 to…arrow_forwardOn February 1, 2024, Strauss-Lombardi issued 9% bonds, dated February 1, with a face amount of $860,000. The bonds sold for $786,220 and mature on January 31, 2044 (20 years). The market yield for bonds of similar risk and maturity was 10%. Interest is paid semiannually on July 31 and January 31. Strauss-Lombardi’s fiscal year ends December 31. Question: 1 to 4. Prepare the journal entries to record their issuance by Strauss-Lombardi on February 1, 2024, interest on July 31, 2024 (at the effective rate), adjusting entry to accrue interest on December 31, 2024 and interest on January 31, 2025. Note: Do not round intermediate calculations and round your final answers to the nearest whole dollar. If no entry is required for a transaction/event, select "No journal entry required" in the first account field.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education