Intermediate Financial Management (MindTap Course List)

13th Edition

ISBN: 9781337395083

Author: Eugene F. Brigham, Phillip R. Daves

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

Please correct answer and don't use hand rating and don't use Ai solution

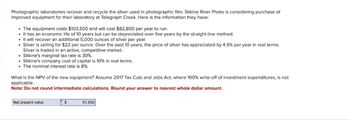

Transcribed Image Text:Photographic laboratories recover and recycle the silver used in photographic film. Stikine River Photo is considering purchase of

improved equipment for their laboratory at Telegraph Creek. Here is the information they have:

• The equipment costs $103,500 and will cost $82,800 per year to run.

It has an economic life of 10 years but can be depreciated over five years by the straight-line method.

• It will recover an additional 5,000 ounces of silver per year.

• Silver is selling for $22 per ounce. Over the past 10 years, the price of silver has appreciated by 4.5% per year in real terms.

Silver is traded in an active, competitive market.

• Stikine's marginal tax rate is 30%.

• Stikine's company cost of capital is 10% in real terms.

• The nominal interest rate is 8%.

What is the NPV of the new equipment? Assume 2017 Tax Cuts and Jobs Act, where 100% write-off of investment expenditures, is not

applicable.

Note: Do not round intermediate calculations. Round your answer to nearest whole dollar amount.

Net present value

$

51,650

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- After discovering a new gold vein in the Colorado mountains, CTC Mining Corporation must decide whether to go ahead and develop the deposit. The most cost-effective method of mining gold is sulfuric acid extraction, a process that could result in environmental damage. Before proceeding with the extraction, CTC must spend 900,000 for new mining equipment and pay 165,000 for its installation. The mined gold will net the firm an estimated 350,000 each year for the 5-year life of the vein. CTCs cost of capital is 14%. For the purposes of this problem, assume that the cash inflows occur at the end of the year. a. What are the projects NPV and IRR? b. Should this project be undertaken if environmental impacts were not a consideration? c. How should environmental effects be considered when evaluating this or any other project? How might these concepts affect the decision in part b?arrow_forwardGimli Miners recently purchased the rights to a diamond mine. It is estimated that there are one million tons of ore within the mine. Gimli paid $23,100,000 for the rights and expects to harvest the ore over the next ten years. The following is the expected extraction for the next five years. Year 1: 50,000 tons Year 2: 90,000 tons Year 3: 100,000 tons Year 4: 110,000 tons Year 5: 130,000 tons Calculate the depletion expense for the next five years, and create the journal entry for year one.arrow_forwardPhotographic laboratories recover and recycle the silver used in photographic film. Stikine River Photo is considering purchase of improved equipment for their Iaboratory at Telegraph Creek. Here is the information they have: + The equipment costs $100,000 and will cost $80,000 per year to run. + It has an economic life of 10 years but can be depreciated over five years by the straightline method (see Section 6-2). + It will recover an additional 5,000 ounces of silver per year. + Silver is selling for $20 per ounce. Over the past 10 years, the price of silver has appreciated by 4.5% per year in real terms. Silver is traded in n active, competitive market. + Stikine's marginal tax rate is 35%. Assume U.S, tax law. + Stikine's company cost of capital is 8% in real terms. + The nominal interest rate is 6%. What s the NPV of the new equipment? Make additional assumptions as necessary.arrow_forward

- Raytheon wishes to use an automated environmental chamber in the manufacture of electronic components. The chamber is to be used for rigorous reliability testing and burn-in. It is installed for $1.4 million and will have a salvage value of $200,000 after 8 years. Its use will create an opportunity to increase sales by $650,000 per year and will have operating expenses of $250,000 per year. All dollar amounts are expressed in real dollars. Depreciation follows MACRS 5-year property, taxes are 25%, the real after-tax MARR is 10%, and inflation is 4.2%. Solve, a. Determine the actual after-tax cash flows for each year. b. Determine the PW of the after-tax cash flows. c. Determine the AW of the after-tax cash flows. d. Determine the FW of the after-tax cash flows. e. Determine the combined IRR of the after-tax cash flows. f. Determine the combined ERR of the after-tax cash flows. g. Determine the real IRR of the after-tax cash flows. h. Determine the real ERR of the after-tax cash flows.arrow_forwardGoldsmith labs recover gold from printed circuit boards. It has developed a new equipment for the purpose. The following data is given.1) Equipment costs $250,0002) It will cost 100,000 per year to run3) It has an economic life of 5 years and is depreciated using straight-line method4) It will recover 1000 ounces of gold per year5) The current price of gold is $300 per ounce and it expected to increase at a rate 4% per year forthe foreseeable future6) The tax rate is 30%7) The cost of capital is 8% What is NPV of the equipment? (M)A. $580,400 C. $470,400B. $520,510 D. None of the abovearrow_forwardThe company you work for is planning to buy a new rock crushing machine to replace an existing one. The purchase price of a new machine is $60,000. Estimates for the operating and maintenance (O&M) costs for the new machine are that it will be $4,500 the first year and will then increase $3,000 per year every year there after. The new machine follows a declining balance depreciation model. The salvage values after the first year is estimated to be $48,000. The company uses a MARR of 6.5% for all financial analysis. Determine the depreciation rate of the new rock crushing machine What is the Economic Life of the new machine and the minimum Equivalent Annual Cost (EAC)? Show ALL your calculations to justify your answer.arrow_forward

- Henrie’s Drapery Service is investigating the purchase of a new machine for cleaning and blocking drapes. The machine would cost $137,320, including freight and installation. Henrie’s estimated the new machine would increase the company’s cash inflows, net of expenses, by $40,000 per year. The machine would have a five-year useful life and no salvage value. Click here to view Exhibit 14B-1 and Exhibit 14B-2, to determine the appropriate discount factor(s) using table. Required: 1. What is the machine’s internal rate of return? 2. Using a discount rate of 14%, what is the machine’s net present value? Interpret your results. 3. Suppose the new machine would increase the company’s annual cash inflows, net of expenses, by only $38,090 per year. Under these conditions, what is the internal rate of return?arrow_forwardHenrie’s Drapery Service is investigating the purchase of a new machine for cleaning and blocking drapes. The machine would cost $137,320, including freight and installation. Henrie’s estimated the new machine would increase the company’s cash inflows, net of expenses, by $40,000 per year. The machine would have a five-year useful life and no salvage value. Click here to view Exhibit 13B-1 and Exhibit 13B-2, to determine the appropriate discount factor(s) using table. Required: 1. What is the machine’s internal rate of return? (Round your answer to whole decimal place i.e. 0.123 should be considered as 12%.) 2. Using a discount rate of 14%, what is the machine’s net present value? Interpret your results. 3. Suppose the new machine would increase the company’s annual cash inflows, net of expenses, by only $31,720 per year. Under these conditions, what is the internal rate of return? (Round your answer to whole decimal place i.e. 0.123 should be considered as 12%.)arrow_forwardHenrie's Drapery Service is investigating the purchase of a new machine for cleaning and blocking drapes. The machine would cost $171,650, including freight and installation. Henrie's estimated the new machine would increase the company's cash inflows, net of expenses, by $50,000 per year. The machine would have a five-year useful life and no salvage value. Click here to view Exhibit 7B-1 and Exhibit 7B-2, to determine the appropriate discount factor(s) using table. Required: 1. What is the machine's internal rate of return? Note: Round your answer to the nearest whole percentage, i.e. 0.123 should be considered as 12%. 2. Using a discount rate of 14%, what is the machine's net present value? Interpret your results. 3. Suppose the new machine would increase the company's annual cash inflows, net of expenses, by only $44,130 per year. Under these conditions, what is the internal rate of return? Note: Round your answer to the nearest whole percentage, i.e. 0.123 should be considered as…arrow_forward

- Henrie's Drapery Service Is Investigating the purchase of a new machine for cleaning and blocking drapes. The machine would cost $170,595, Including freight and Installation. Henrie's estimated the new machine would increase the company's cash Inflows, net of expenses. by $45,000 per year. The machine would have a five-year useful life and no salvage value. Click here to view Exhibit 12B-1 and Exhibit 128-2, to determine the appropriate discount factor(s) using table. Required: 1. What is the machine's Internal rate of return? (Round your answer to the nearest whole percentage, L.e. 0.123 should be considered as 12%.) 2. Using a discount rate of 10%, what is the machine's net present value? Interpret your results. 3. Suppose the new machine would increase the company's annual cash Inflows, net of expenses, by only $40,500 per year. Under these conditions, what is the internal rate of return? (Round your answer to the nearest whole percentage. l.e. 0.123 should be considered as 12%.) 1.…arrow_forwardThe XYZ company is thinking about upgrading their 5-year-old machine with a new one. The machine was initially purchased for $50,000, with a projected lifespan of 10 years. The operation and maintenance cost of the old machine began at $500 in year 1 and has increased by $100 each year. This is predicted to continue until the end of the machine's useful life. The estimated salvage value if sold now is $15,000, or $10,000 at the end of year 10. The current yearly revenue with this machine is $15000The new machine will initially be purchased for $60,000 with a lifespan of 8 years. The first year's operating and maintenance cost will be $1500 due to installation, will be to $500 in the second year, then increase by $50 per year until the end of useful life. The yearly revenue is estimated at $17000 for the new machine, with a salvage value of $15000 at the end of 8 years. Both machines are depreciable with CCA (30%), MARR is 20%, and the tax rate is 40%. Should the XYZ company replace the…arrow_forwardDhapaarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Intermediate Financial Management (MindTap Course...

Finance

ISBN:9781337395083

Author:Eugene F. Brigham, Phillip R. Daves

Publisher:Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:9781947172685

Author:OpenStax

Publisher:OpenStax College