FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

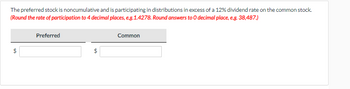

Transcribed Image Text:The preferred stock is noncumulative and is participating in distributions in excess of a 12% dividend rate on the common stock.

(Round the rate of participation to 4 decimal places, e.g.1.4278. Round answers to O decimal place, e.g. 38,487.)

$

tA

Preferred

Common

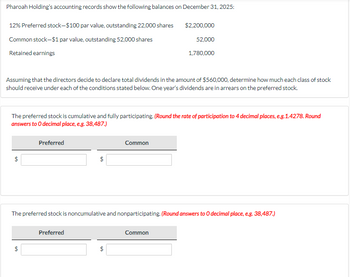

Transcribed Image Text:Pharoah Holding's accounting records show the following balances on December 31, 2025:

12% Preferred stock-$100 par value, outstanding 22,000 shares

$2,200,000

Common stock-$1 par value, outstanding 52,000 shares

52,000

Retained earnings

1,780,000

Assuming that the directors decide to declare total dividends in the amount of $560,000, determine how much each class of stock

should receive under each of the conditions stated below. One year's dividends are in arrears on the preferred stock.

The preferred stock is cumulative and fully participating. (Round the rate of participation to 4 decimal places, e.g.1.4278. Round

answers to O decimal place, e.g. 38,487.)

$

+A

Preferred

$

The preferred stock is noncumulative and nonparticipating. (Round answers to O decimal place, e.g. 38,487.)

Common

Preferred

Common

SAVE

AI-Generated Solution

info

AI-generated content may present inaccurate or offensive content that does not represent bartleby’s views.

Unlock instant AI solutions

Tap the button

to generate a solution

to generate a solution

Click the button to generate

a solution

a solution

Knowledge Booster

Similar questions

- #3 The market price of a share of preferred stock is $36.29. The market uses a discount rate of 6.32%. What is the dividend? Submit Answer format: Currency: Round to: 2 decimal places. unanswered not_submitted Attempts Remaining: Infinityarrow_forwardWhat is the required rate of return on a preferred stock with a $50 par value, a stated annual dividend of 12% of par, and a current market price of (a) $25, (b) $34, (c) $42, and (d) $63 (assume the market is in equilibrium with the required return equal to the expected return)? Do not round intermediate calculations. Round the answers to two decimal places. % % % %arrow_forwardam. 131.arrow_forward

- (Related to Checkpoint 10.3) (Preferred stock valuation) Calculate the value of a preferred stock that pays a dividend of $5.00 per share when the market's required yield on similar shares is 9 percent. The value of the preferred stock is S per share. (Round to the nearest cent.)arrow_forwardConsider the three stocks in the following table. Pt represents price at time t, and Qt represents shares outstanding at time t. Stock C splits two-for-one in the last period. A B C Ро 90 50 100 Rate of return 90 100 200 200 P1 95 45 110 Rate of return b. An equally weighted index Required: Calculate the first-period rates of return on the following indexes of the three stocks: (Do not round intermediate calculations. Round answers to 2 decimal places.) a. A market value-weighted index % 01 100 200 200 % P2 95 45 55 92 100 200 400arrow_forwardA perpetual preferred stock pays a $1.65 annual dividend and has a required return of 5.81%. The value is closest to A. $28.40. B. $31.33. C. $33.79. D. $36.55.arrow_forward

- Analogue Technology has preferred stock outstanding that pays a $18.80 annual dividend. It has a price of $204. What is the required rate of return (yield) on the preferred stock? (Do not round intermediate calculations. Input your answer as a percent rounded to 2 decimal places.)arrow_forwardAn index consists of the following securities. What is the value-weighted index return? Value-weighted Stock Shares Outstanding Beginning Share Price Ending Share Price L 4,000 $ 18 $ 26 M 3,000 $ 35 $ 41 Multiple Choice 22.03% 22.85% 25.25% 28.25% 30.00%arrow_forwardSuppose a stock had an initial price of $80 per share, paid a dividend of $.60 per share during the year, and had an ending share price of $88. Compute the percentage total return. (Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.)arrow_forward

- A 288.arrow_forwardConsider the three stocks in the following table. P+ represents price at time t, and Qt represents shares outstanding at time t. Stock C splits two-for-one in the last period. PO 98 58 100 51 103 e 200 116 200 53 126 100 200 200 103 100 53 63 200 400 Required: Calculate the first-period rates of return on the following indexes of the three stocks: (Do not round Intermediate calculations. Round your answers to 2 decimal places.) a. A market value-weighted Index Rate of return An equally weighted index ate of return % %arrow_forwardSuppose a market consists of four stocks. The number of shares outstanding for each stock as well as the stock prices in two consecutive days are as follows: Stock A Stock B Stock C Stock D Shares outstanding 200 1000 400 3000 I $5 $30 $100 $40 Ро $15 $25 $80 $50 a) Compute the percentage increase in the price-weighted index for this market. b) Compute the percentage increase in the value-weighted index for this market. P₁arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education