FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

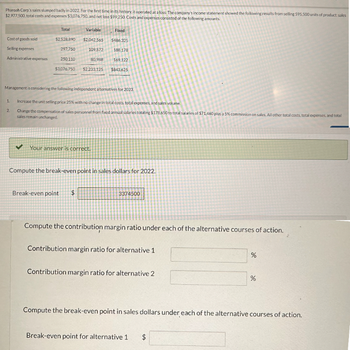

Transcribed Image Text:Pharoah Corp's sales slumped badly in 2022. For the first time in its history, it operated at a loss. The company's income statement showed the following results from selling 595,500 units of product: sales

$2,977,500, total costs and expenses $3,076,750, and net loss $99,250. Costs and expenses consisted of the following amounts.

Total

Variable

Fixed

Cost of goods sold

$2,528,890

$2,042.565

$486,325

Selling expenses

Administrative expenses

297,750

250.110

109.572

188,178

80,988

169.122

$3,076,750

$2,233,125 $843,625

Management is considering the following independent alternatives for 2023.

1.

Increase the unit selling price 25% with no change in total costs, total expenses, and sales volume

2.

Change the compensation of sales personnel from fixed annual salaries totaling $178,650 to total salaries of $71,460 plus a 5% commission on sales. All other total costs, total expenses, and total

sales remain unchanged.

く

Your answer is correct.

Compute the break-even point in sales dollars for 2022.

Break-even point

$

3374500

Compute the contribution margin ratio under each of the alternative courses of action.

Contribution margin ratio for alternative 1

Contribution margin ratio for alternative 2

%

୪୧

de

%

Compute the break-even point in sales dollars under each of the alternative courses of action.

Break-even point for alternative 1

+A

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- KR Corporation's break-even-point in sales is Rs. 900,000, and its variable expenses are 75% of sales. If the company lost Rs. 32,000 last year, sales must have amounted to: _____________ (Don’t try to write any $, Rs or any alphanumeric value in the Provided answer space)arrow_forwardAcme Company's break-even-point in sales revenue is $840,000 and its variable expense ratio is 75%. If Acme reports an operating loss of $34,000, actual sales revenue must be: $596,000 $704,000 $772,000 $806,000arrow_forwardNonearrow_forward

- Company A's gross profit rate last year was 32.0% and this year it is 28.4%. Which of the following would not be a possible cause for this decline in the gross profit rate? O Company A's average margin between unit selling price and inventory unit cost is decreasing. O Company A may have seen a decline in total gross profit while maintaining net sales. Company A may have begun selling products with a higher markup. O Company A must have paid higher prices to suppliers without passing these costs on to customers.arrow_forwardKling Inc. has only two retail and two wholesale customers. Information relating to each customer for 2020 follows: (Click the icon to view the customer-level operating income.) (Click the icon to view the data.) Kling's annual distribution-channel costs are $32,000 for wholesale customers and $13,000 for retail customers. The company's annual corporate costs are $45,000. There is no cause-and-effect or benefits-received relationship between any cost-allocation base and corporate-sustaining costs. That is, Kling could save corporate-sustaining costs only if the company completely shuts down. Requirement Prepare a customer-cost hierarchy report. First, determine the formula and then enter the amounts to calculate the total customer costs for each customer. (Abbreviations used: W. = West; E. = East; Dist. = Distribution; oper. = operating; inc. = = income.) W. Region E. Region Stock Inc. Darby Corp + + + || || Total customer-level costsarrow_forwardFlamengo Co is a sporting goods manufacturing. It had an operating income of $57,000, sales of $222.000, and a turnover ratio of 0.55. What is Flamengo's return on investment (ROI)? (Note: Round all numbers to two decimal places.) O 64.60% O Flamengo's ROI cannot be determined from this information. O 18.75% O 50.60% O 14.30%arrow_forward

- Ready Electronics is facing stiff competition from imported goods. Its operating income margin has been declining steadily for the past several years. The company has been forced to lower prices so that it can maintain its market share. The operating results for the past 3 years are as follows: Year 1 Year 2 Year 3 Sales 14,500,000 9,500,000 9,000,000 Operating income 1,200,000 1,145,000 945,000 Average assets 15,000,000 15,000,000 16,750,000 For the coming year, Ready's president plans to install a JIT purchasing and manufacturing system. She estimates that inventories will be reduced by 70% during the first year of operations, producing a 20% reduction in the average operating assets of the company, which would remain unchanged without the JIT system. She also estimates that sales and operating income will be restored to Year 1 levels because of simultaneous reductions in operating expenses and selling prices. Lower selling prices will allow Ready to expand its market share. 1.…arrow_forwardQuestion: Naylor Company had $153,600 of net income in 2013 when the selling price per unit was $163, the variable costs per unit were $103, and the fixed costs were $574,800. Management expects per unit data and total fixed costs to remain the same in 2014. The president of Naylor Company is under pressure from stockholders to increase net income by $63,600 in 2014. Compute the number of units sold in 2013. Compute the number of units that would have to be sold in 2014 to reach the stockholders' desired profit level. Assume that Naylor Company sells the same number of units in 2014 as it did in 2013. What would the selling price have to be in order to reach the stockholders' desired profit level?arrow_forwardFlamengo Co is a sporting goods manufacturing. Last year, report the following Income Statement: Sales $620,000 Cost of goods sold 316,000 Gross margin $304,000 Selling and administrative expense 246,000 Operating income $ 58,000 Less: Income taxes (at 40%) 34,000 Net income $ 24,000 At the beginning of the year, the value of operating assets was $263,000. At the end of the year, the value of operating assets was $363,000. Flamengo Co. requires a minimum rate of return of 15%. Total capital employed equals $350,000 and the actual cost of capital is 6%, Calculate the Return on Investment. (Carry computations out to two decimal places.)arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education