FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

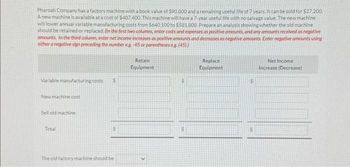

Transcribed Image Text:Pharoah Company has a factory machine with a book value of $90.800 and a remaining useful life of 7 years. It can be sold for $27.200.

A new machine is available at a cost of $407 400. This machine will have a 7-year useful life with no salvage value. The new machine

will lower annual variable manufacturing costs from $640,100 to $581.800 Prepare an analysis showing whether the old machine

should be retained or replaced. (In the first two columns, enter costs and expenses as positive amounts, and any amounts received as negative

amounts. In the third column, enter net income increases as positive amounts and decreases as negative amounts. Enter negative amounts using

either a negative sign preceding the number eg. -45 or parentheses eg. (45))

Variable manufacturing costs

New machine cost

Sell old machine

Total

S

The old factory machine should be

Retain

Equipment

$

Replace

Equipment

$

$

Net Income

Increase (Decrease)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Similar questions

- Dengerarrow_forwardFlamengo Co is a sporting goods manufacturing company. Last year, report the following information: Sales S700,000 Cost of goods sold $130,000 Selling and administrative expense $260,000 At the beginning of the year, the value of operating assets was $800,000. At the end of the year, the value of operating assets was $1,200,000. Flamengo- Co. requires a minimum rate of return of 15%. Calculate the Margin. Round all numbers to two decimal places. Do not answer as a percentage. For example, if the Margin is 17.63%, you should type 0.18.arrow_forwardMarkson and Sons leases a copy machine with terms that include a fixed fee each month of $500 plus a charge for each copy made. The company uses the high-low method to analyze costs and Markson paid $360 for 5,000 copies and $280 for 3,000 copies,arrow_forward

- A company with $795,000 in operating assets is considering the purchase of a machine that costs $85,000 and which is expected to reduce operating costs by $17,000 each year. These reductions in cost occur evenly throughout the year. The payback period for this machine in years is closest to (Ignore income taxes.): (Round your answer to 1 decimal place.) Multiple Cholce 5 years 9.4 years 0.2 years 46.8 yearsarrow_forwardUrmila benarrow_forwardCurrent operating income for Bay Area Cycles Company is $46,000. Selling price per unit is $100, the contribution margin ratio is 25%, and fixed expense is $184,000. Required: 1. Calculate Bay Area Cycle's per unit variable expense and contribution margin. How many units are currently being sold? 2. How many additional unit sales would be necessary to achieve operating income of $115,000? Complete this question by entering your answers in the tabs below. es Required 1 Required 2 Calculate Bay Area Cycle's per unit variable expense and contribution margin. How many units are currently being sold? Revenue Variable expense Contribution margin Fixed expense Operating income Per Unit Volume $ 100.00 Total Ratio 100 % + % 25 % (184,000) 46,000arrow_forward

- Your storage firm has been offered $96,900 in one year to store some goods for one year. Assume your costs are $95,200, payable immediately, and the cost of capital is 8.1%. Should you take the contract? The NPV will be $ Should you take the contract? The contract (Round to the nearest cent.) be taken (Select from the drop-down menu.)arrow_forwardJuniper Design Ltd. of Manchester, England, provides design services to residential developers. Last year, the company had net operating income of $430,000 on sales of $1,500,000. The company's average operating assets for the year were $1,700,000 and its minimum required rate of return was 10%. Required: Compute the company's residual income for the year. Residual income < Prev 2 of 13 Next 近arrow_forwardA firm has fixed costs of $25,000 associated with the manufacture of lawn mowers that cost $480 per mower to produce. The firm sells all the mowers it produces at $580 each. Find the cost, revenue and profit equations. Find the break-even quantity. (Let x be the number of mowers.)C(x) = R(x) = P(x) = break even quantity= ? mowersarrow_forward

- Garrett Company provided the following information: Common fixed cost totaled $46,000. Garrett allocates common fixed cost to Product 1and Product 2 on the basis of sales. If Product 2 is dropped, which of the following is true?a. Sales will increase by $300,000.b. Overall operating income will increase by $2,600.c. Overall operating income will decrease by $25,000.d. Overall operating income will not change.e. Common fixed cost will decrease by $27,600.arrow_forwardDeluxe Homes is a residential Home Builder. Based on their current production of 300 homes per year, they currently make a profit of $20,000 per unit, based on the following costs per unit: Direct labor $ 20,000 Direct materials 200,000 Variable overhead 30,000 Fixed overhead 40,000 Variable selling costs 10,000 Fixed selling costs 10,000 Total costs per unit $310,000 Required Each of these are separate situations: A. Prepare an income statement based on the information provided. B. What is the profit and cost per unit if production is increased to 400 homes per year, and there is an increase of $1.50 million in total fixed overhead costs?arrow_forwardBig Chill, Inc. sells portable dehumidifier units at $193. Unit variable costs are $110. Fixed costs are $4,175,000. Management has set a profit objective of 15.1% return on sales. Calculate the sales volume in dollars that will provide a 15.1% return on sales. Round your answer to the nearest dollar .arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education