FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

Transcribed Image Text:Compute the 2020 balance in the Land account.

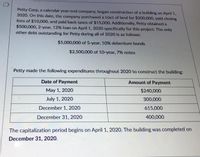

Question 18

Compute the 2020 weighted average accumulated expenditures qualifying for

capitalization of interest.

Transcribed Image Text:Petty Corp, a calendar year-end company, began construction of a building on April 1,

2020. On this date, the company purchased a tract of land for $200,000, paid closing

fees of $10,000, and paid back taxes of $15,000. Additionally, Petty obtained a

$500,000, 2-year, 12% loan on April 1, 2020 specifically for this project. The only

other debt outstanding for Petty during all of 2020 is as follows:

$5,000,000 of 5-year, 10% debenture bonds

$2,500,000 of 10-year, 7% notes

Petty made the following expenditures throughout 2020 to construct the building:

Date of Payment

Amount of Payment

May 1, 2020

$240,000

July 1, 2020

300,000

December 1, 2020

615,000

December 31, 2020

400,000

The capitalization period begins on April 1, 2020. The building was completed on

December 31, 2020.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 4 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Southern Atlantic Distributors began operations in January 2021 and purchased a delivery truck for $40,000. Southern Atlantic plans to use straight-line depreciation over a four-year expected useful life for financial reporting purposes. For tax purposes, the deduction is 50% of cost in 2021, 30% in 2022, and 20% in 2023. Pretax accounting income for 2021 was $300,000, which includes interest revenue of $40,000 from municipal governmental bonds. The enacted tax rate is 25%.Required:Assuming no differences between accounting income and taxable income other than those described above:1. Prepare the journal entry to record income taxes in 2021.2. What is Southern Atlantic’s 2021 net income?arrow_forwardThornton Industries began construction of a warehouse on July 1, 2024. The project was completed on March 31, 2025. No new loans were required to fund construction. Thornton does have the following two interest - bearing liabilities that were outstanding throughout the construction period:$4,000,000, 9% note$ 6,000,000, 6% bondsConstruction expenditures incurred were as follows:July 1, 2024$ 430, 000September 30, 2024630,000November 30, 2024630,000 January 30, 2025570,000 The companys fiscal year - end is December 31. Required:Calculate the amount of interest capitalized for 2024 and 2025.arrow_forwardVishnuarrow_forward

- kit Company borrows $6 million at 12% on January 1, 2019, specifically for the purpose of financing the construction of a building that is expected to take 18 montns to complete. Kit invests the total amount at 11 % until it makes payments for the construction project. During the first year of construction, kit incurs the following expenditures related to this construction project: 1. Compute the amount of interest expense Kit would capitalize related to the construction of the building. 2. Compute the amou1nt of interest revenue kit would recognize. 3. Assume that kit uses IFRS. what amount of interest would be capitalized related to the construction of the building?arrow_forwardSkysong Co. is building a new hockey arena at a cost of $2,310,000. It received a downpayment of $490,000 from local businesses to support the project, and now needs to borrow $1,820,000 to complete the project. It therefore decides to issue $1,820,000 of 12%, 10-year bonds. These bonds were issued on January 1, 2019, and pay interest annually on each January 1. The bonds yield 11%. Assume that on July 1, 2022, Skysong Co. redeems half of the bonds at a cost of $1,001,900 plus accrued interest. Prepare the journal entry to record this redemption. (to record Interest and to record reacquisition)arrow_forwardCrane Company is constructing a building. Construction began on January 1 and was completed on December 31. Expenditures were $6300000 on March 1, $5340000 on June 1, and $8850000 on December 31. Crane Company. borrowed $3170000 on January 1 on a5-year, 12% note to help finance construction of the building. In addition, the company had outstanding all year a 10%, 3-year $6350000 note payable and an 11%, 4-year, $12050000 note payable. What is the actual interest for Crane Company?arrow_forward

- Sunland Co. is building a new hockey arena at a cost of $2,680,000. It received a downpayment of $500,000 from local businesses to support the project, and now needs to borrow $2,180,000 to complete the project. It therefore decides to issue $2,180,000 of 10.0%, 10-year bonds. These bonds were issued on January 1, 2024, and pay interest annually on each January 1. The bonds yield 9%. Click here to view factor table. (a) Prepare the journal entry to record the issuance of the bonds on January 1, 2024. (Round present value factor calculations to 5 decimal places, e.g. 1.25124 and the final answer to 0 decimal places, e.g. 58,971. If no entry is required, select "No Entry" for the account titles and enter 0 for the amounts. Credit account titles are automatically indented when the amount is entered. Do not indent manually. List all debit entries before credit entries.) Date January 1, 2024 Account Titles and Explanation Cash Discount on Bonds Payable Bonds Payable Debit 920,854 Credit…arrow_forwardFowler Incorporated purchased $86,000 of bonds on January 1, 2024. The bonds pay interest semiannually and mature in 25 years, at which time the $86,000 principal will be paid. The bonds do not pay any amounts other than interest and principal. Fowler's intention is to collect contractual cash flows and eventually sell the bonds within the next couple of years if the price is right. During 2024, the fair value of the bonds increased to $102,000. Fowler reports investments under IFRS No. 9. How much unrealized gain or loss will Fowler include in 2024 net income with respect to the bonds? Unrealized gain (loss) reported in net incomearrow_forwardOn January 1, 2024, the Marjlee Company began construction of an office building to be used as its corporate headquarters. The building was completed early in 2025. Construction expenditures for 2024, which were incurred evenly throughout the year, totaled $6,000,000. Marjlee had the following debt obligations which were outstanding during all of 2024: Construction loan, 11% Long-term note, 10% Long-term note, 7% Required: Calculate the amount of interest capitalized in 2024 for the building using the specific interest method. Interest capitalized $ 1,500,000 2,000,000 4,000,000 $ 255,000arrow_forward

- Coronado Co. is building a new hockey arena at a cost of $2,420,000. It received a downpayment of $510,000 from local businesses to support the project, and now needs to borrow $1,910,000 to complete the project. It therefore decides to issue $1,910,000 of 10.0%, 10-year bonds. These bonds were issued on January 1, 2024, and pay interest annually on each January 1. The bonds yield 9%. Click here to view factor table. (a) Your answer is partially correct. Prepare the journal entry to record the issuance of the bonds on January 1, 2024. (Round present value factor calculations to 5 decimal places, e.g. 1.25124 and the final answer to O decimal places, e.g. 58,971. If no entry is required, select "No Entry" for the account titles and enter O for the amounts. Credit account titles are automatically indented when the amount is entered. Do not indent manually. List all debit entries before credit entries.) Date January 1, 2024 Account Titles and Explanation Cash Premium on Bonds Payable…arrow_forwardOn December 31, 2019, Riverbed Inc. borrowed $3,660,000 at 13% payable annually to finance the construction of a new building. In 2020, the company made the following expenditures related to this building: March 1, $439,200; June 1, $732,000; July 1, $1,830,000; December 1, $1,830,000. The building was completed in February 2021. Additional information is provided as follows. 1. Other debt outstanding 10-year, 14% bond, December 31, 2013, interest payable annually $4,880,000 6-year, 11% note, dated December 31, 2017, interest payable annually $1,952,000 2. March 1, 2020, expenditure included land costs of $183,000 3. Interest revenue earned in 2020 $59,780 Prepare the journal entry to record the capitalization of interest and the recognition of interest expense, if any, at December 31, 2020. (Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the…arrow_forwardPina Co. is building a new hockey arena at a cost of $2,510, 000. It received a downpayment of $490,000 from local businesses to support the project, and now needs to borrow $ 2,020,000 to complete the project. It therefore decides to issue $2,020,000 of 10.0 %, 10- year bonds. These bonds were issued on January 1, 2024, and pay interest annually on each January 1. The bonds yield 9% . Assume that on July 1, 2027, Pina Co. redeems half of the bonds at a cost of $1,079, 300 plus accrued interest. Prepare the journal entry to record this redemption.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education