Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

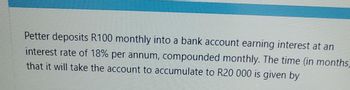

Transcribed Image Text:Petter deposits R100 monthly into a bank account earning interest at an

interest rate of 18% per annum, compounded monthly. The time (in months)

that it will take the account to accumulate to R20 000 is given by

![UA.

O B.

C.

D.

n

n =

n =

In [200(1,015)]

0,015

H

In [200(0, 015) + 1]

In(1+0,015)

In [200(1, 015) + 1] - In(1,015)

In [200(0, 015)-1]

In (1+0,015)](https://content.bartleby.com/qna-images/question/e94009f7-e130-40c2-8471-59a9697eb507/1759f12c-0031-47c2-8870-780b669196b4/oczdgrf_thumbnail.jpeg)

Transcribed Image Text:UA.

O B.

C.

D.

n

n =

n =

In [200(1,015)]

0,015

H

In [200(0, 015) + 1]

In(1+0,015)

In [200(1, 015) + 1] - In(1,015)

In [200(0, 015)-1]

In (1+0,015)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Similar questions

- Anna places $384 each quarter into an account that earns. If the account earns 1.41% interest compounded quarterly. After 7 years, the amount in the account should be? What kind of account is thisarrow_forwardYou deposit $83000 into an account which pays 5% compounded monthly. How much can you withdraw at the end of each month forever?arrow_forwardYou deposit $1,000 at the end of the year (k = 0) into an account that pays interest at a rate of 6% compounded annually. Two years after your deposit, the savings account interest rate changes to 12% nominal interest compounded monthly. Six years after your deposit, the savings account again changes its interest rate; this time the interest rate becomes 8% nominal interest compounded quarterly. Nine years after your deposit, the saving account changes its rate once more to 5% compounded annually. a. How much money should be in the savings account 18 years after the initial deposit, assuming no further changes in the account's interest rate? b. What interest rate, compounded annually, is equivalent to the interest pattern of the saving account in Part (a) over the entire 18 year period? a. S should be in the savings account 18 years after the initial deposit. (Round to the nearest dollar.) b. The interest rate equivalent to the interest pattern of the saving account in Part (a) over…arrow_forward

- You deposit $1,000 in the bank at an annual interest rate of 8%. Interest is compounded once per year. In one year's time you have $ ------ In two year's time you have $ ------- Enter numbers rounded to two decimal places as necessary.arrow_forwardIf you deposit $368.00 into an account paying 15.46% annual interest compounded quarterly, how many years until there is $76,431.00 in the account?arrow_forwardYou deposit $100 at the end of each month in a bank account that earns 6% interest compounded monthly what will the balance be after five yearsarrow_forward

- Samantha deposits $1,500 into the Park Street Bank. The account pays 1.12% annual interest, compounded daily. To the nearest cent, how much is in the account at the end of three non-leap years?arrow_forwardBank pays an annual interest of 4% on 2-year CDs and you deposit $10,000. What is your balance two years later?arrow_forwardYou deposit $83000 into an account which pays 6% compounded semiannually. How much can you withdraw at the end of every six months forever?arrow_forward

- Once per year Ritchie Rich deposits an amount of $800 in an account which pays 10% interest per year, compounded annually, with additional deposits of $800 continually made at the end of the year. If B, is the balance in the account, in dollars, immediately after Ritchie makes the nth deposit, then we can write B₁ = $800. (a) Complete the table to find the following. Report to the nearest $0.01. i) the balance, B, of the account on the day immediately after the second deposit. ii) the balance, B₁, of the account on the day immediately after the third deposit. iii) the balance, B₁, of the account on the day immediately after the fourth deposit 71 (Number of deposits) 1 2 OO B= $321158.22 (b) Suppose Ritchie makes 38 deposits. What is the balance of the account on the day immediately after the 38th deposit? 0 B$29923.47 B$29123.47 B= $264031.59 B, ($) $800 $ Number O B$291234.75 (It is more than $880.) $ Number S Number Q (c) Suppose Ritchie makes 438 deposits. Which is true about the…arrow_forwardYou deposit $600 each month into an account earning 4% interest compounded monthly. a) How much will you have in the account in 12 years? b) How much total money will you put into the account? c) How much total interest will you earn?arrow_forwardDeposits are made at the end of years 1 through 7 into an account paying 5% per year interest. The deposits start at $4,000 and increase by 15% each year. How much will be in the account immediately after the last deposit?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education