FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

thumb_up100%

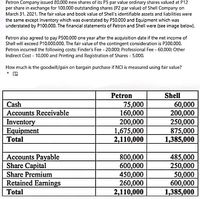

Transcribed Image Text:Petron Company issued 80.000 new shares of its P5 par value ordinary shares valued at P12

per share in exchange for 100,000 outstanding shares (P2 par value) of Shell Company on

March 31, 2021. The fair value and book value of Shell's identifiable assets and liabilities were

the same except Inventory which was overstated by P50.000 and Equipment which was

understated by P100,000. The financial statements of Petron and Shell were (see image below).

Petron also agreed to pay P500,000 one year after the acquisition date if the net income of

Shell will exceed P10,000,000. The fair value of the contingent consideration is P300,000.

Petron incurred the following costs: Finder's Fee - 20,000; Professional Fee - 60,000; Other

Indirect Cost - 10,000 and Printing and Registration of Shares - 5,000.

How much is the goodwill/gain on bargain purchase if NCI is measured using fair value?

Petron

Shell

75,000

160,000

200,000

1,675,000

2,110,000

60,000

200,000

250,000

875,000

1,385,000

Cash

Accounts Receivable

Inventory

Equipment

Total

Accounts Payable

Share Capital

800,000

600,000

450,000

260,000

2,110,000

485,000

250,000

50,000

600,000

1,385,000

Share Premium

Retained Earnings

Total

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- On 1 July 2019, Quick Buck Ltd took control of the assets and liabilities of Eldorado Ltd. Quick Buck Ltdissued 80,000 shares having a fair value of $2.40 per share in exchange for the net assets of EldoradoLtd. The costs of issuing the shares by Quick Buck Ltd cost $1,600.At this date the statement of financial position of Eldorado Ltd was as follows: c Carrying amount Fair valueMachinery $40,000 $67,000Fixtures & fittings 60,000 68,000Vehicles 35,000 35,000 Current assets 10,000 12,000Current liabilities (16,000) (18,000)Total net assets…arrow_forwardOn 1 July 2019, Quick Buck Ltd took control of the assets and liabilities of Eldorado Ltd. Quick Buck Ltd issued 80,000 shares having a fair value of $2.40 per share in exchange for the net assets of Eldorado Ltd. The costs of issuing the shares by Quick Buck Ltd cost $1,600. At this date the statement of financial position of Eldorado Ltd was as follows: Carrying amount Fair value Machinery $ 40,000 $ 67,000 Fixtures & fittings 60,0000 68,000 Vehicles 35,000 35,000 Current assets 10,000 12,000 Current liabilities (16,000) (18,000) Total net assets $ 129,000 Share capital (80,000 shares at $1.00 per share) $ 80,000 General reserve 20,000 Retained earnings 29,000 Total equity 129,000 Required:Prepare the journal entries in the records of Quick Buck Ltd at 1 July 2019 for the acquisition.arrow_forwardOn January 1, 20X2, Parent Inc. issued 32,000 shares of its P10 par value common stock for all the outstanding shares of Son Company. The fair value of Parent Inc.'s stock is P25 per share. Parent Inc. pays P50,000 in registering the stocks. Given below are the statements of financial position (SFP) of the companies before the acquisition: Parent Inc. Statement of Financial Position January 1, 20X2 Assets Liabilities and Equity P210,000 420,000 400,000 500,000 505,000 P2,035,000 Cash P200,000 Accounts Payable 185,000 Bonds Payable 190,000 Common Stock, P10 par value 300,000 Additional Paid-In Capital (APIC) 740,000 Retained Earnings 420,000 Total Liabilities and Equity P2,035,000 Accounts Receivable Inventory Land Building, net of depreciation Equipment, net of depreciation Total Assets Son Company Statement of Financial Position January 1, 20X2 Book Value Fair Value P55,000 150,000 130,000 500,000 300,000 P1,135,000 Accounts Receivable Inventory Land P55,000 130,000 85,000 320,000…arrow_forward

- Acquirer Company issued new shares of its P5 par value ordinary shares valued at P12 per share in exchange for 90% outstanding shares (P2 par value) of Acquiree Company on March 31, 2022. The fair value and book value of Acquiree’s identifiable assets and liabilities were the same except inventory which was understated by P30,000 and equipment which was overstated by P90,000. The financial statements of Acquirer and Acquiree were (see image below).Acquirer incurred the following costs: Legal fees – P11,200; Audit fees for SEC registration of share issue - P5,000; Brokerage fee - P2,500; and Accountant fee for pre-acquisition audit – P15,000. The parent opted to measure NCI using proportionate share and the business combination resulted to a goodwill of P99,000. Answer the following: a. How much is the Consolidated Assets? b. How much is the Consolidated Equity? c. How many is the Number of Shares Issued?arrow_forwardOn 1 July 2021, Mel Ltd took control of the assets and liabilities of Syd Ltd. At this date the statement of financial position of Syd Ltd was as follows: Required Prepare the journal entries in the records of Mel Ltd at 1 July 2021 in each of the following situations, assuming the costs of issuing the shares by Mel Ltd cost $1600. Mel Ltd issued 80 000 shares having a fair value of $2.40 per share in exchange for the net assets of Syd Ltd Mel Ltd issued 80 000 shares having a fair value of $2.00 per share in exchange for the net assets of Syd Ltd. Mel Ltd acquired the shares of Syd Ltd. The agreement was that Mel Ltd would pay the shareholders of Syd Ltd one share in Mel Ltd for every two shares held in Syd Ltd plus $1 in cash for each share held in Syd Ltd. Shares in Mel Ltd have a fair value of $1.80 per share.arrow_forwardGold Ltd purchased Silver on 1 June 2023, acquiring all of the assets and liabilities. The price agreed on was $60, 000, payable $20, 000 in cash and the balance by the issue to Silver Ltd of 16, 000 fully paid shares in Gold Ltd, these shares having a fair value of $2.50 per share. The balances of the two companies accounts as at 1 June 2023 were as follows: Gold Ltd Silver LtdCash 30,000 -Accounts receivable 8,000 20,000Inventory 14,000 26,000Plant (net) 50,000 30,000Government bonds 12,000 -Goodwill - 10,000Total assets 114,000 86,000Accounts payable 2,000 20,000Retained earnings 12,000 (24,000)Share capital 100,000 90,000Total liabilities and equity 114,000 86,000 All the identifiable net assets of Silver Ltd were recorded by Silver Ltd at fair value except for the inventories, which were considered to be worth $28,000. The plant had an expected remaining life of 5 years. Gold Ltd incurred incidental costs of $500 in relation to the acquisition. Costs of issuing shares in Gold Ltd…arrow_forward

- On January 1, 20x1, Patrick Corp. acquired the identifiable net assets of Jinky Corp. by paying cash of P1,500,000; issuing 50,000 ordinary shares with a market value of P60 per share. Patrick paid the broker’s fee of P25,000; cost if SEC registration of shares issued amounting to P2,000 and indirect cost of P5,000. The book values of assets of Patrick and Jinky are P15,200,000 and P2,500,000, respectively, and the book values of liability of Patrick and Jinky are P4,000,000 and P800,000. The book value reflects fair value of assets and liabilities except that the current asset of Patrick is overvalued by P200,000 and non-current asset of Jinky Corp is undervalued by P500,000. Patrick Corp. has estimated P400,000 representing cost of exiting the activity of Jinky Corp such as: cost of terminating employees and the cost of relocating terminated employees of Jinky. The agreement also provides that Patrick Corp shall pay cash on January 10, 20x1, equal 120% of the amount by which…arrow_forwardOn January 1, 20x1, Patrick Corp. acquired the identifiable net assets of Jinky Corp. by paying cash of P1,500,000; issuing 50,000 ordinary shares with a market value of P60 per share. Patrick paid the broker’s fee of P25,000; cost if SEC registration of shares issued amounting to P2,000 and indirect cost of P5,000. The book values of assets of Patrick and Jinky are P15,200,000 and P2,500,000, respectively, and the book values of liability of Patrick and Jinky are P4,000,000 and P800,000. The book value reflects fair value of assets and liabilities except that the current asset of Patrick is overvalued by P200,000 and non-current asset of Jinky Corp is undervalued by P500,000. Patrick Corp. has estimated P400,000 representing cost of exiting the activity of Jinky Corp such as: cost of terminating employees and the cost of relocating terminated employees of Jinky. The agreement also provides that Patrick Corp shall pay cash on January 10, 20x1, equal 120% of the amount by which…arrow_forward1 On January 2, 2021, Normal Inc. acquired 15% interest in Laco Co. by paying P1,500,000 for 7,500 ordinary shares. On this date, the net assets of Laco Co. totaled P9 million. The investment was classified as a financial asset at fair value through other comprehensive income. The fair values of Laco Co.’s identifiable assets and liabilities approximate their book values. On August 1, 2021, Normal received dividends of P4 per share from Laco Co. Fair value of the stocks on December 31, 2021 was P190. Net income reported by Laco for the year ended amounted to P1,500,000. On July 1, 2022, Normal Inc. paid P1 million to purchase 5,000 additional shares of Laco Co. from another shareholder. On this date the fair value of the net assets exceeds carrying value by P500,000 attributable to depreciable asset with estimated remaining life of 5 years. On February 1, 2022, cash dividends of P5 were received while dividends of P6 were received on August 1, 2022. Net income reported for the year…arrow_forward

- On January 1, 2021 Pail corp acquired 80 percent of Sand Company's stock fo 640,000 cash. The fair value of the noncontrolling interest at that date was determined to be 160,000. For the year ended December 31 2021 Pail reported dividends of 46,000 on its general ledger. Sand reported devidends of 37000 on its general ledger. What amount of dividends would be reported on 12/31/21 consolidated statement of retained earnings?arrow_forwardPalm Corporation and Staple Company have announced terms of an exchange agreement under which Palm will issue 8,500 shares of its $15 par value common stock to acquire all of Staple Company’s assets. Palm shares currently are trading at $59, and Staple $10 par value shares are trading at $23 each. Historical cost and fair value balance sheet data on January 1, 20X2, are as follows: Palm Corporation Staple Company Balance Sheet Item Book Value Fair Value Book Value Fair Value Assets Cash & Receivables $ 151,000 $ 151,000 $ 46,000 $ 46,000 Land 110,000 190,000 57,000 83,000 Buildings & Equipment (net) 313,000 411,000 176,000 230,000 Total Assets $ 574,000 $ 752,000 $ 279,000 $ 359,000 Equities Common Stock $ 200,000 $ 81,000 Additional Paid-In Capital 18,000 9,900 Retained Earnings…arrow_forward32 Petron Company issued 80,000 new shares of its P5 par value ordinary shares valued at P12 per share in exchange for 100,000 outstanding shares (P2 par value) of Shell Company on March 31, 2021. The fair value and book value of Shell's identifiable assets and liabilities were the same except Inventory which was overstated by P50,000 and Equipment which was understated by P100,000. The financial statements of Petron and Shell were (see image below). Petron also agreed to pay P500,000 one year after the acquisition date if the net income of Shell will exceed P10,000,000. The fair value of the contingent consideration is P300,000. Petron incurred the following costs: Finder's Fee - 20,000; Professional Fee - 60,000; Other Indirect Cost - 10,000 and Printing and Registration of Shares - 5,000. How much is the goodwill/gain on bargain purchase if NCI is measured using proportionate share? Shell Petron 75,000 160,000 200,000 1,675,000 2,110,000 60,000 200,000 250,000 875,000 1,385,000 Cash…arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education