Financial And Managerial Accounting

15th Edition

ISBN: 9781337902663

Author: WARREN, Carl S.

Publisher: Cengage Learning,

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

answer in text form please (without image)

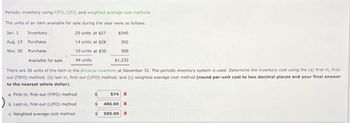

Transcribed Image Text:Periodic inventory using FIFO, LIFO, and weighted average cost methods

The units of an item available for sale during the year were as follows:

Jan. 1

20 units at $27

Aug. 13

14 units at $28

Nov. 30

10 units at $30

44 units

Inventory

$540

Purchase

392

Purchase

300

Available for sale

$1,232

There are 26 units of the item in the physical inventory at December 31. The periodic inventory system is used. Determine the inventory cost using the (a) first-in, first-

out (FIFO) method; (b) last-in, first-out (LIFO) method; and (c) weighted average cost method (round per-unit cost to two decimal places and your final answer

to the nearest whole dollar).

a. First-in, first-out (FIFO) method

b. Last-in, first-out (LIFO) method

c. Weighted average cost method

$

$

574 X

486.00 X

505.00 X

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Beginning inventory, purchases, and sales for WCS12 are as follows: Assuming a perpetual inventory system and using the weighted average method, determine (a) the weighted average unit cost after the October 22 purchase, (b) the cost of goods sold on October 29, and (c) the inventory on October 31.arrow_forwardBeginning inventory, purchases, and sales for WCS12 are as follows: Assuming a perpetual inventory system and using the weighted average method, determine (a) the weighted average unit cost after the October 22 purchase, (b) the cost of the merchandise sold on October 29, and (c) the inventory on October 31.arrow_forwardHurst Companys beginning inventory and purchases during the fiscal year ended December 31, 20-2, were as follows: There are 1,200 units of inventory on hand on December 31, 20-2. REQUIRED 1. Calculate the total amount to be assigned to the cost of goods sold for 20-2 and ending inventory on December 31 under each of the following periodic inventory methods: (a) FIFO (b) LIFO (c) Weighted-average (round calculations to two decimal places) 2. Assume that the market price per unit (cost to replace) of Hursts inventory on December 31 was 18. Calculate the total amount to be assigned to the ending inventory on December 31 under each of the following methods: (a) FIFO lower-of-cost-or-market (b) Weighted-average lower-of-cost-or-market 3. In addition to taking a physical inventory on December 31, Hurst decides to estimate the ending inventory and cost of goods sold. During the fiscal year ended December 31, 20-2, net sales of 100,000 were made at a normal gross profit rate of 35%. Use the gross profit method to estimate the cost of goods sold for the fiscal year ended December 31 and the inventory on December 31.arrow_forward

- Beginning inventory, purchases, and sales for 30xT are as follows: Assuming a perpetual inventory system and using the weighted average method, determine (a) the weighted average unit cost after the May 23 purchase, (b) the cost of the merchandise sold on May 26, and (c) the inventory on May 31.arrow_forwardCalculate the cost of goods sold dollar value for A67 Company for the month, considering the following transactions under three different cost allocation methods and using perpetual inventory updating. Provide calculations for weighted average (AVG).arrow_forwardBeginning inventory, purchases, and sales for Item Zebra 9x are as follows: Assuming a perpetual inventory system and using the last-in, first-out (LIFO) method, determine (a) the cost of merchandise sold on April 27 and (b) the inventory on April 30.arrow_forward

- Beginning inventory, purchases, and sales for Item ProX2 are as follows: Assuming a perpetual inventory system and using the first-in, first-out (FIFO) method, determine (a) the cost of merchandise sold on January 25 and (b) the inventory on January 31.arrow_forwardCarla Company uses the perpetual inventory system. The following information is available for January of the current year when Carla sold 1,600 units of inventory on January 14. Using the FIFO method, calculate Carlas cost of goods sold for January and its January 31 inventory.arrow_forwardBeginning inventory, purchases, and sales for Meta-B1 are as follows: Assuming a perpetual inventory system and using the weighted average method, determine (a) the weighted average unit cost after the July 23 purchase, (b) the cost of the merchandise sold on July 26, and (c) the inventory on July 31.arrow_forward

- Jessie Stores uses the periodic system of calculating inventory. The following information is available for December of the current year when Jessie sold 500 units of inventory. Using the FIFO method, calculate Jessies inventory on December 31 and its cost of goods sold for December. RE7-11 Using the information from RE7-10, calculate Jessie Storess inventory on December 31 and its cost of goods sold for December using the LIFO method.arrow_forwardAkira Company had the following transactions for the month. Calculate the ending inventory dollar value for the period for each of the following cost allocation methods, using periodic inventory updating. Provide your calculations. A. first-in, first-out (FIFO) B. last-in, first-out (LIFO) C. weighted average (AVG)arrow_forwardTrini Company had the following transactions for the month. Calculate the ending inventory dollar value for each of the following cost allocation methods, using periodic inventory updating. Provide your calculations. A. first-in, first-out (FIFO) B. last-in, first-out (LIFO) C. weighted average (AVG)arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning, Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:9781337902663

Author:WARREN, Carl S.

Publisher:Cengage Learning,

Financial Accounting

Accounting

ISBN:9781337272124

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:9781337794756

Author:HEINTZ, James A.

Publisher:Cengage Learning,

Financial Accounting

Accounting

ISBN:9781305088436

Author:Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:9781947172685

Author:OpenStax

Publisher:OpenStax College

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:Cengage Learning