MATLAB: An Introduction with Applications

6th Edition

ISBN: 9781119256830

Author: Amos Gilat

Publisher: John Wiley & Sons Inc

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

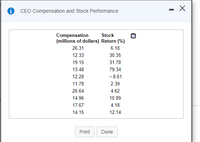

The given data represent the total compensation for 10 randomly selected CEOs and their company's stock performance in 2009. Analysis of this data reveals a

What would be the predicted stock return for a company whose CEO made $15 million?

What would be the predicted stock return for a company whose CEO made $25 million?

Critical Values for Correlation Coefficient

n

3 0.997

4 0.950

5 0.878

6 0.811

7 0.754

8 0.707

9 0.666

10 0.632

11 0.602

12 0.576

13 0.553

14 0.532

15 0.514

16 0.497

17 0.482

18 0.468

19 0.456

20 0.444

21 0.433

22 0.423

23 0.413

24 0.404

25 0.396

26 0.388

27 0.381

28 0.374

29 0.367

30 0.361

n

Transcribed Image Text:i CEO Compensation and Stock Performance

Compensation

(millions of dollars) Return (%)

Stock

26.31

6.18

12.33

30.35

19.15

31.78

13.48

79.34

12.28

- 8.61

11.78

2.39

26.64

4.62

14.96

10.89

17.67

4.18

14.15

12.14

Print

Done

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, statistics and related others by exploring similar questions and additional content below.Similar questions

- A researcher wanted to know the relationship between sales per 24h in a department store, the amount of rain that day (in mm) and the mean age of 1000 customers. The SPSS output is presented below. What is the correct way to report the correlation between sales per 24h and rainfall that day in APA style? Question 24 options: r(16) = -.909, p<.001 r(18) = -.909, p=.000 r(18) = -.909, p<.001 r(16) = -.909, p=.000arrow_forwardA value of r close to 0 indicates what type of linear correlation between the two variables? a. negative b. strong c. postive d. weakarrow_forwardSuppose a researcher is interested in examining the relationship between a person 's age and whether he or she likes the taste of cilantro. She collects a sample of n- 10 people and asks them whether they like the taste of cilantro. The following table summarizes the results. Does not like Cilantro Does like Cilantro 18 years old 2 18+ years old 3 The researcher wants to calculate the correlation between a person 's age and whether he or she likes the taste of cilantro. To do so, you (the researcher) must first create a table of the data by converting each variable to a numerical value. Assign a 0 to "< 18 years old" and 1 to "18+ years old." Then assign O to "does not like the taste of cilantro" and a 1 to " likes the taste of cilantro." Complete the top two rows of the your (the researcher's) data. Age (0 is <18; 1 is 18+) Likes the taste of Cilantro (0 is no; 1 is yes) a) ob) 1 a) Ob) 1 a) ob) 1 a) Ob) 1 1 1 1 1 1 1 1 The phi-coefficient is a) -0.09 b) -0.16 c) -0.20 d) 0.80arrow_forward

- The maximum weights (in kilograms) for which one repetition of a half-squat can be performed and the jump heights (in centimeters) for 12 international soccer players are given in the accompanying table. The correlation coefficient, rounded to three decimal places, is r=0.707. At & = 0.05, is there enough evidence to conclude that there is a significant linear correlation between the variables? Click the icon to view the soccer player data. Determine the null and alternative hypotheses. Ho:p = 0 Ha:p # 0 Determine the critical value(s). to = (Round to three decimal places as needed. Use a comma to separate answers as needed.)arrow_forwardIf you have a Pearson correlation coefficient of .30, what is the proportion of variance accounted for (r2) in a correlational study?arrow_forwardA correlation of 0.95 for two variables X and Y implies that if X increases, there is a 95% chance that Y will also increase. Is this statement true or false?arrow_forward

- Suppose that you are interested in the relationship between Reading and Writing scores. (a) Provide the scatterplot for the association between Reading and Writing scores. Based on the scatterplot, do you expect Reading to be correlated with Writing? If so, based only on the plot, would you expect the correlation to be positive or negative? Explain your answer. (b) Report the value of the correlation between Reading and Writing scores, and whether it is statistically significant. Do these results agree with your expectations from part (a)? RDG WRTG 34 44 47 36 42 59 39 41 36 49 50 46 63 65 44 52 47 41 44 50 50 62 44 41 47 40 42 59 42 41 47 41 60 65 39 49 57 54 73 65 47 46 39 44 35 39 39 41 48 49 31 41 52 63 47 54 36 44 47 44 34 46 52 57 42 40 37 44 44 33 71 58 47 46 42 33 42 36 47 41 52 54 52 54 39 39 31 41 60 54 47 31 39 28 42 36 47 57 42 49 36 41 50 33 34 34 55 55 28 46…arrow_forwardTen children took part in a study at their dentist’s office. The dentist collected data on how many pieces of candy the children ate after Halloween and the number of cavities six months later. A correlation was conducted between pieces of candy consumed after Halloween and number of new cavities after Halloween. The Pearson correlation was .892, with p < .001. What can you conclude about the relationship between pieces of candy consumed after Halloween and the number of new cavities after Halloween? Be sure to state your statistics in APA stylearrow_forwardStatistics Questionarrow_forward

- A university would like to describe the relationship between the GPA and the starting monthly salary of a graduate who earned a business degree from the university. The table shown below gives the monthly starting salaries for five graduates of the business school along with their corresponding GPAs. These data have a sample correlation coefficient, rounded to three decimal places, of 0.965. Using x=0.10, test if the population correlation coefficient between the starting salary and the GPA of a university business graduate is greater than zero. Starting Salary $2,600 $2,900 GPA 3.1 3.4 What are the correct null and alternative hypotheses? O A. Ho: p0. H₁₂₁: p=0 $2,400 2.6 O C. Ho: p≤0 H₁: p>0 What is the test statistic? t = (Round to two decimal places as needed.) What is the p-value? p-value = (Round to three decimal places as needed.) State the conclusion. Ho. There $2,900 3.7 $2,200 2.5 OB. Ho: p=0 H₁:p #0 O D. Ho: p20 H₁: p<0 enough evidence from the sample to conclude that p is…arrow_forwardWould A be the answer?arrow_forwardIs the correlation about 0.02, 0.22, or 0.92 with the outlier? Without this outlier, is the correlation about 0.18, 0.78, or 0.98? Is the outlier is an influential point to the correlation?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

MATLAB: An Introduction with ApplicationsStatisticsISBN:9781119256830Author:Amos GilatPublisher:John Wiley & Sons Inc

MATLAB: An Introduction with ApplicationsStatisticsISBN:9781119256830Author:Amos GilatPublisher:John Wiley & Sons Inc Probability and Statistics for Engineering and th...StatisticsISBN:9781305251809Author:Jay L. DevorePublisher:Cengage Learning

Probability and Statistics for Engineering and th...StatisticsISBN:9781305251809Author:Jay L. DevorePublisher:Cengage Learning Statistics for The Behavioral Sciences (MindTap C...StatisticsISBN:9781305504912Author:Frederick J Gravetter, Larry B. WallnauPublisher:Cengage Learning

Statistics for The Behavioral Sciences (MindTap C...StatisticsISBN:9781305504912Author:Frederick J Gravetter, Larry B. WallnauPublisher:Cengage Learning Elementary Statistics: Picturing the World (7th E...StatisticsISBN:9780134683416Author:Ron Larson, Betsy FarberPublisher:PEARSON

Elementary Statistics: Picturing the World (7th E...StatisticsISBN:9780134683416Author:Ron Larson, Betsy FarberPublisher:PEARSON The Basic Practice of StatisticsStatisticsISBN:9781319042578Author:David S. Moore, William I. Notz, Michael A. FlignerPublisher:W. H. Freeman

The Basic Practice of StatisticsStatisticsISBN:9781319042578Author:David S. Moore, William I. Notz, Michael A. FlignerPublisher:W. H. Freeman Introduction to the Practice of StatisticsStatisticsISBN:9781319013387Author:David S. Moore, George P. McCabe, Bruce A. CraigPublisher:W. H. Freeman

Introduction to the Practice of StatisticsStatisticsISBN:9781319013387Author:David S. Moore, George P. McCabe, Bruce A. CraigPublisher:W. H. Freeman

MATLAB: An Introduction with Applications

Statistics

ISBN:9781119256830

Author:Amos Gilat

Publisher:John Wiley & Sons Inc

Probability and Statistics for Engineering and th...

Statistics

ISBN:9781305251809

Author:Jay L. Devore

Publisher:Cengage Learning

Statistics for The Behavioral Sciences (MindTap C...

Statistics

ISBN:9781305504912

Author:Frederick J Gravetter, Larry B. Wallnau

Publisher:Cengage Learning

Elementary Statistics: Picturing the World (7th E...

Statistics

ISBN:9780134683416

Author:Ron Larson, Betsy Farber

Publisher:PEARSON

The Basic Practice of Statistics

Statistics

ISBN:9781319042578

Author:David S. Moore, William I. Notz, Michael A. Fligner

Publisher:W. H. Freeman

Introduction to the Practice of Statistics

Statistics

ISBN:9781319013387

Author:David S. Moore, George P. McCabe, Bruce A. Craig

Publisher:W. H. Freeman