FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

thumb_up100%

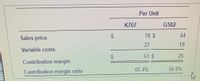

Transcribed Image Text:**Per Unit Analysis**

| | K707 | G582 |

|-------------------|------|------|

| **Sales Price** | $78 | $44 |

| **Variable Costs**| $27 | $19 |

| **Contribution Margin** | $51 | $25 |

| **Contribution Margin Ratio** | 65.4% | 56.8% |

**Explanation of Terms:**

- **Sales Price:** The amount at which each unit is sold.

- **Variable Costs:** Costs that vary with the production level. These are the direct costs attributable to each unit.

- **Contribution Margin:** Calculated as Sales Price minus Variable Costs. It represents the portion of sales that contributes to covering the fixed costs and generating profit.

- **Contribution Margin Ratio:** Expressed as a percentage, this ratio indicates how much of each dollar of sales contributes to cover fixed costs and profit after variable costs are met.

This table provides a clear financial analysis of products K707 and G582, showing how efficiently each product is generating profit above its variable cost.

Transcribed Image Text:**Requirement 3: Analysis for Division C's Product Lines**

Division C also produces two product lines. Because the division can sell all of the products it can produce, Dennison is expanding the plant and needs to decide which product line to emphasize. To make this decision, the division accountant assembled the following data:

- **Click the icon to view the Division C product data.**

After expansion, the factory will have a production capacity of 4,300 machine hours per month. The plant can manufacture either 28 units of K707s or 65 units of G582s per machine hour.

**3a. Identify the constraining factor for Division C.**

Division C's constraining factor is **machine hours**.

**3b. Prepare an analysis to show which product line to emphasize.**

| | K707 | G582 |

|---------|------|------|

| **Contribution margin per** | | |

**Instructions:**

To decide which product line to emphasize, consider how to best utilize the available machine hours based on the contribution margin per product. Calculate and compare the respective contribution margins.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- #15arrow_forwardNonearrow_forwardQUESTION 4 E22.13 E22.13 (LO 3, 4) Billings Company has the following information available for September 2020. Prepare CVP income statements. Unit selling price of video game consoles $ 400 Unit variable costs $ 280 Total fixed costs $54,000 Units sold 600 Instructions a. Compute the unit contribution margin. b. Prepare a CVP income statement that shows both total and per unit amounts. c. Compute Billings' break-even point in units. d. Prepare a CVP income statement for the break-even point that shows both total and per unit amounts.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education