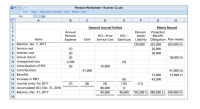

(Pension Worksheet—Missing Amounts) Kramer Co. has prepared the following pension worksheet. Unfortunately, several entries in the worksheet are not decipherable. The company has asked your assistance in completing the worksheet and completing the accounting tasks related to the pension plan for 2017.

Check the below image for pension worksheet.

Instructions

(a) Determine the missing amounts in the 2017 pension worksheet, indicating whether the amounts are debits or credits.

(b) Prepare the

(c) Determine the following for Kramer for 2017: (1) settlement rate used to measure the interest on the liability and (2) expected return on plan assets

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps with 2 images

- Prepare the journal entry to record pension expense and the employer's contribution to the pension plan in 2025. (Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter o for the amounts. List all debit entries before credit entries.) Account Titles and Explanation Debit Creditarrow_forwardPlease do not give solution in image format and fast answering please and explain proper steps by Step.arrow_forwardTB Problem 17-186 (Static) The following is an incomplete... The following is an incomplete pension spreadsheet for the current year for Sparky Corporation. Required: 1. Complete the pension spreadsheet. 2. Prepare the journal entries to record pension expense and funding of plan assets for the year. 3. Prepare the journal entry(ies) to record any gains or losses for the year. Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3 Complete the pension spreadsheet. ($ in millions) debit (credit) PBO Plan Assets Prior Service Cost Net(Gain)Los8 Pension Expense Net Pension Cash Beginning balance 450 60 55 (Liability) or Asset (10) Service cost (85) Interest cost (45) Expected return on assets 55 (Gain) or loss on assets Amortization of: Prior service cost Net (gain) or loss Loss on PBO Contributions to fund Retiree benefits paid Ending balance (32) 40 (562) 3 (1) 54 89arrow_forward

- Note:- Do not provide handwritten solution. Maintain accuracy and quality in your answer. Take care of plagiarism. Answer completely. You will get up vote for sure.arrow_forwardThe following incomplete (columns have missing amounts) pension spreadsheet is for Old Tucson Corporation (OTC). ($ in millions) debit (credit) PBO Plan assets Prior service cost Net (Gain) loss Pension Expenses Cash Net Pension (Liability)/ Asset Beginning Balance (540 ) 70 Service cost 74 Interest cost Expected return on assets (27 ) Gain/loss on assets (4 ) Amortization of: Prior service cost (10 ) Net gain loss Loss on PBO (29 ) 29 Contribution to funds…arrow_forwardSee attached picture 1. Determine the components of pension expense that the company would recognize in 2017. (With only one year involved, you need not prepare a worksheet) 2. Prepare the journal entry to record the pension expense and the company's funding of the pension plan in 2017arrow_forward

- Refer to the financial statements and related disclosure notes of Microsoft Corporation (www.microsoft.com).Required:1. What type of pension plan does Microsoft sponsor for its employees? Explain.2. Who bears the “risk” of factors that might reduce retirement benefits in this type of plan? Explain.3. Assuming that employee and employer contributions vest immediately, suppose a Microsoft employee contributes $1,000 to the pension plan during her first year of employment and directs investments to a bondmutual fund. If she leaves Microsoft early in her second year, after the mutual fund’s value has increased by2%, how much will she be entitled to roll over into an Individual Retirement Account (IRA)?4. How did Microsoft account for its participation in the pension plan in fiscal 2015?arrow_forwardPrepare the journal entry to record pension expense and the employer's contribution to the pension plan in 2020. ( Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter 0 for the amounts.) The following information is available for the pension plan of Sandhill Company for the year 2020.arrow_forwardThe following incomplete (columns have missing amounts) pension spreadsheet is for the current year for First Republic Corporation (FRC). ($ in millions)Debit(Credit)PBO Plan Assets Prior Service Cost Net(Gain)/Loss Pension Expense Cash Net Pension (Liability)/Asset Beginning balance (740) 32 (94) Service cost 66 Interest cost 37 Expected return on assets 72 Gain/loss on assets (4) Amortization of: Prior service cost (10) Net gain/loss 5 Loss on PBO (12) Contributions to fund (49) Retiree benefits paid (69) Ending balance 745 (85) What was the net pension asset/liability reported in the balance sheet at the end of the year? Multiple Choice Net pension liability of $41 million. Net pension asset of $58 million. Net pension…arrow_forward

- Please provide proper tables for each requirement. For the spreadhseet as well as the journal entries so it is easy to understand. Tables with titles and calculations and accounts etc.arrow_forwardActuary and trustee reports indicate the following changes in the PBO and plan assets of Lakeside Cable during 2024: Prior service cost at January 1, 2024, from plan amendment at the beginning of 2022 (amortization: $4 million per year) Net loss-pensions at January 1, 2024 (previous losses exceeded previous gains) Average remaining service life of the active employee group Actuary's discount rate ($ in millions) Beginning of 2024 Service cost Interest cost, 8% Loss (gain) on PBO Less: Retiree benefits End of 2024 Beginning of 2025 Service cost PBO $ 300 48 Interest cost, 8% Loss (gain) on PBO Less: Retiree benefits End of 2025 24 (2) (20) $ 350 PBO $ 350 38 28 5 Assume the following actuary and trustee reports indicating changes in the PBO and plan assets of Lakeside Cable during 2025: ($ in millions) (16) Beginning of 2024 Return on plan assets, 7.5% (10% expected) $ 405 Cash contributions Less: Retiree benefits End of 2024 Beginning of 2025 Return on plan assets, 15% (10% expected) $…arrow_forwardHow do I go about calculating pension payouts to determine a company's financial obligation? Additional info is below: Postretirement BenefitsPeyton Approved has revised its postretirement plan. It will now provide health insurance to retired employees. Management has requested that you report the short- and long-term financial implications of this. The company is currently employing 60, and actuaries estimate that the company has a pension liability of $107,041.70. The estimated cost of retired employees’ health insurance is $43,718.91. Prepare adjusting entries for the pension liability and the health insurance liabilityarrow_forward

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education