FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

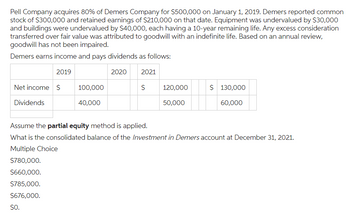

Transcribed Image Text:Pell Company acquires 80% of Demers Company for $500,000 on January 1, 2019. Demers reported common

stock of $300,000 and retained earnings of $210,000 on that date. Equipment was undervalued by $30,000

and buildings were undervalued by $40,000, each having a 10-year remaining life. Any excess consideration

transferred over fair value was attributed to goodwill with an indefinite life. Based on an annual review,

goodwill has not been impaired.

Demers earns income and pays dividends as follows:

2019

2020 2021

Net income $

Dividends

100,000

40,000

Multiple Choice

$780,000.

$660,000.

$785,000.

$676,000.

SO.

$

120,000

50,000

$ 130,000

60,000

Assume the partial equity method is applied.

What is the consolidated balance of the Investment in Demers account at December 31, 2021.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- IIn 2018, Martin Corp. acquired Glynco and recorded goodwill of $100 million. Martin considers Glynco a separate reporting unit. By the end of 2021, the net assets (including goodwill) of Glynco are $320 million and its estimated fair value is $260 million. The amount of the impairment loss that Martin would record for goodwill at the end of 2021 is:arrow_forwardplease answer all parts within 30 minutes...arrow_forwardin Reynolds buys building (10 year useful life) on January 1, 2019 for $1,000,000. Straight line depreciation is used. On the same day, Reynolds sells building to 90% owned subsidiary for $1,200,000. Subsidiary also uses a remaining useful life of 10 years. What is the appropriate worksheet entry for "excess depreciation" that must be prepared at December 31, 2019? shift O Dr. Depreciation Expense $120,000. Cr. Accumulated Depreciation $120,000 O Dr. Depreciation Expense $20,000. Cr. Accumulated Depreciation $20,000 tab O Dr. Accumulated Depreciation $20,000 Cr. Depreciation Expense $20,000 caps lock O Dr. Accumulated Depreciation $120,000. Cr. Depreciation Expense $120,000 esc 1 9,680 ! 1 Q A T control option Z 72 W S OCT 25 #3 X H command 80 F3 E D $ 4 с 160 000 000 F4 R tv F 175⁰ % F5 V T Garrow_forwardarrow_back_iosarrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education