FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

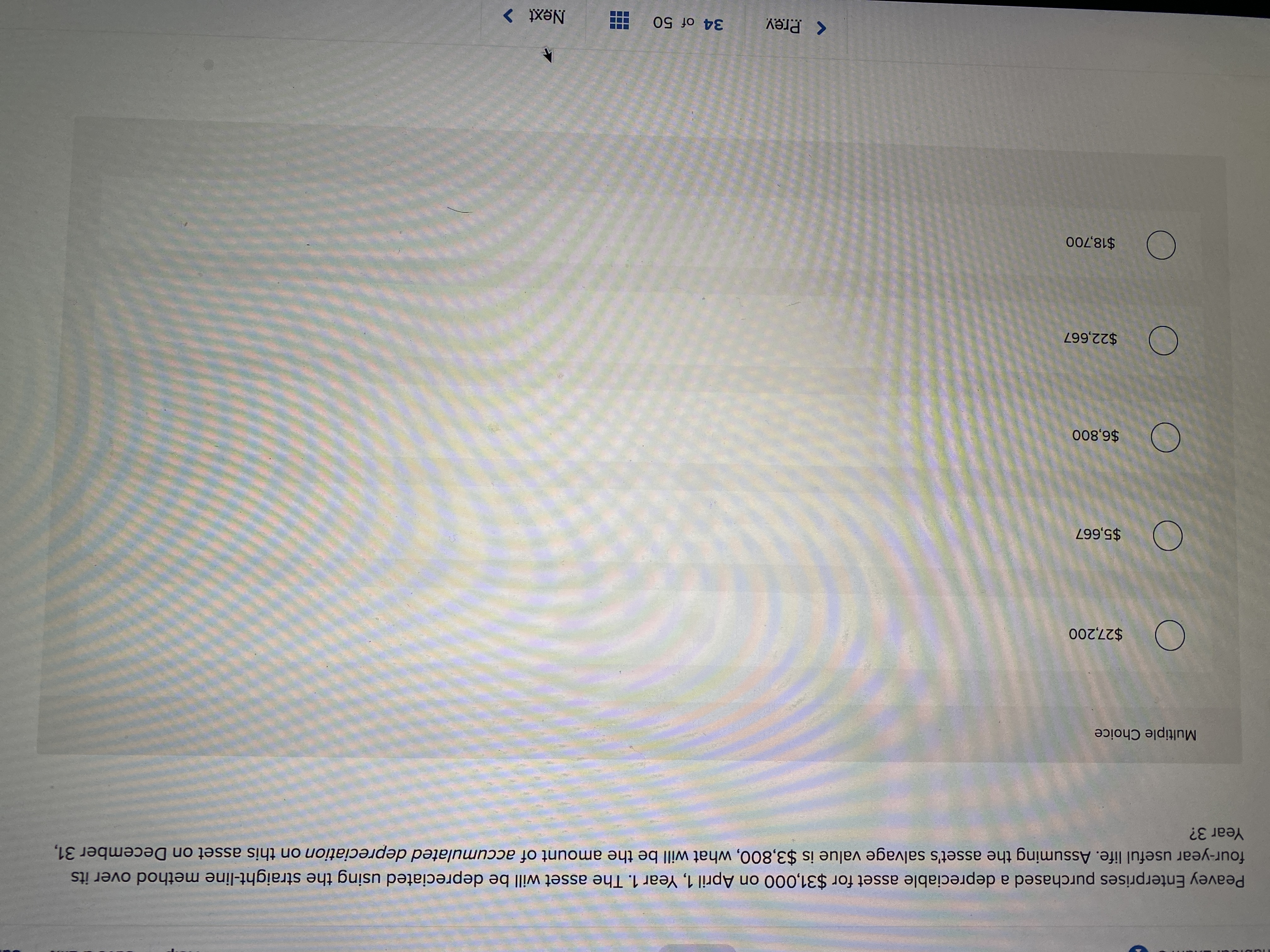

Transcribed Image Text:Peavey Enterprises purchased a depreciable asset for $31,000 on April 1, Year 1. The asset will be depreciated using the straight-line method over its

four-year useful life. Assuming the asset's salvage value is $3,800, what will be the amount of accumulated depreciation on this asset on December 31,

Year 3?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Beck man Enterprise purchased a depreciable asset on October 1, Year 1 at the cost of $152,000. The asset is expected to have a salvage value of $16300 at the end of its five-year useful life. If the asset is depreciated on the double-declining-balance method, the assets book value on December 31,year 2 will be?arrow_forwardA depreciable asset currently has a $40,100 book value. The company owning the asset uses straight-line depreciation. They paid $70,000 for this asset and consider it to have a $1,000 salvage value with a 12-year useful life. How long has the company owned this asset?arrow_forwardOn January 1, a machine with a useful life of five years and a salvage value of $20000 was purchased for $290000. What is the depreciation expense for year 2 under straight-line depreciation?arrow_forward

- Concord Corporation purchased a depreciable asset for $ 553000. The estimated salvage value is $ 28000, and the estimated useful life is 9000 hours. Carson used the asset for 1800 hours in the current year. The activity method will be used for depreciation. What is the depreciation expense on this asset in the current year? $ 525000 $ 52500 $ 105000 $ 116200arrow_forwardMartin Company purchases a machine at the beginning of the year at a cost of $126,000. The machine is depreciated using the double-declining-balance method. The machine’s useful life is estimated to be 4 years with a $10,500 salvage value. The machine’s book value at the end of year 3 is:arrow_forwardAn asset was purchased and installed for $304781. The asset is classified as MACRS 7year property. Its useful life is 10 years. The estimated salvage value at the end of 10 years is $22765. Using MACRS depreciation, the third year depreciation is: Enter your answer as: 123456.78 53306.2000arrow_forward

- Bob Co purchased a building for $50,000 and began depreciating assuming a salvage value of $5,000 and useful life of 20 years. After 5 years, it was determined that the salvage value would be $10,000, but the useful life would only be for an additional 10 years. Calculate the depreciation, assuming straight line, for Year 1 and Year 6 of the building, and prepare the necessary journals.arrow_forwardA plant asset was purchased on January 1 for $59000 with an estimated salvage value of $9000 at the end of its useful life. The current year's Depreciation Expense is $5000 calculated on the straight-line basis and the balance of the Accumulated Depreciation account at the end of the year is $30000. The remaining useful life of the plant asset is O 10.0 years. O 11.8 years. ○ 4.0 years. O 6.0 years.arrow_forwardOn May 1, 2025, Crane Company purchased factory equipment for $739700. The asset's useful life in hours is estimated to be 190000. The estimated salvage value is $35000 and the estimated useful life in years is 9. The machine was used for 19000 hours in the first year. If the activity method is used, what is depreciation expense for 2025? (Round the depreciation rate to 4 decimal places e.g. 15.2578.) $52200 $70469 $78300 O $74269arrow_forward

- A company purchased a piece of equipment for $50,000 on January 1, 2022. The equipment has an estimated useful life of 5 years and a residual value of $5,000. The company uses the straight-line method for depreciation. Calculate the annual depreciation expense for the equipment and its book value at the end of each year from 2022 to 2025.arrow_forwardOn January 1, Year 1, Missouri Co. purchased a truck that cost $56,000. The truck had an expected useful life of 10 years and a $5,000 salvage value. What is the amount of depreciation expense recognized in Year 2 assuming that Missouri uses the double declining-balance method?arrow_forwardXYZ Company purchased machinery on January 1, 20×1, for $50,000. The machinery has an estimated useful life of 5 years and a salvage value of $5,000. Calculate the annual depreciation expense using the straight-line method.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education