Financial Accounting

15th Edition

ISBN: 9781337272124

Author: Carl Warren, James M. Reeve, Jonathan Duchac

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

None

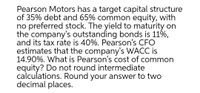

Transcribed Image Text:Pearson Motors has a target capital structure

of 35% debt and 65% common equity, with

no preferred stock. The yield to maturity on

the company's outstanding bonds is 11%,

and its tax rate is 40%. Pearson's CFO

estimates that the company's WACC is

14.90%. What is Pearson's cost of common

equity? Do not round intermediate

calculations. Round your answer to two

decimal places.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- A firm has a weighted average cost of capital of 8.4%, a cost of equity is 11%, and a pretax cost of debt of 5.8%. The tax rate is 25%. What is the company's target debt-equity ratio, expressed as a percentage? (Please, do not round your intermediate calculations; rou necessary, your final answer, expressed as a percentage, to two decimal places without the % symbol. Example, if your final answer calcula or X/Y, or X+Y, or X-Y, is 0.124556, enter it as 12.46)arrow_forwardEvans Technology has the following capital structure. Debt Common equity The aftertax cost of debt is 8.50 percent, and the cost of common equity (in the form of retained earnings) is 15.50 percent. a. What is the firm's weighted average cost of capital? Note: Do not round intermediate calculations. Input your answers as a percent rounded to 2 decimal places. 48% 60 Debt Common equity Weighted average cost of capital Weighted Cost % % An outside consultant has suggested that because debt is cheaper than equity, the firm should switch to a capital structure that is 50 percent debt and 50 percent equity. Under this new and more debt-oriented arrangement, the aftertax cost of debt is 9.50 percent, and the cost of common equity (in the form of retained earnings) is 17.50 percent. b. Recalculate the firm's weighted average cost of canitalarrow_forwardPearson Motors has a target capital structure of 30% debt and 70% common equity, with no preferred stock. The yield to maturity on the company's outstanding bonds is 8%, and its tax rate is 25%. Pearson's CFO estimates that the company's WACC is 12.70%. What is Pearson's cost of common equity? Do not round intermediate calculations. Round your answer to two decimal places. ? %arrow_forward

- Clifford, Inc., has a target debt-equity ratio of .80. Its WACC is 9.1 percent, and the tax rate is 25 percent. a. If the company's cost of equity is 13 percent, what is its pretax cost of debt? (Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.) b. If instead you know that the aftertax cost of debt is 5.8 percent, what is the cost of equity? (Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.) a. Cost of debt % b. Cost of equity %arrow_forwardPearson Motors has a target capital structure of35%debt and65%common equity. with no preferred stock. The yield to maturity on the company's outstanding bonds is 894, and its tax rate is 25\%. Pearton's CFO estimates that the company's WACC is 11 .505\%. What is Pearson's' cost of common equity? Do not round intermediate calculatione. Plound your answer to two decimal places.arrow_forwardJones Soda estimates that its required return on equity is 11.0 percent and the yield to maturity on its debt is 6.0 percent. The company's equity-to-asset ratio is 0.2 and the marginal tax rate is 30%. What is the company's weighted average cost of capital? Enter your answer as a percent and round to two decimals, but don't include the % sign. Numeric Responsearrow_forward

- Please answer multi-choice question in photo.arrow_forwardJones Soda estimates that its required return on equity is 11.0 percent and the yield to maturity on its debt is 5.0 percent. The company's equity-to-asset ratio is 0.7 and the marginal tax rate is 30%. What is the company's weighted average cost of capital? Enter your answer as a percent and round to two decimals, but don't include the % sign.arrow_forwardFama’s Llamas has a weighted average cost of capital of 10.4 percent. The company’s cost of equity is 13 percent and its pretax cost of debt is 7.9 percent. The tax rate is 24 percent. What is the company's debt-equity ratio? (Do not round intermediate calculations and round your answer to 4 decimal places, e.g., 32.1616.) Debt-equity ratio:______?arrow_forward

- Take It All Away has a cost of equity of 10.57 percent, a pretax cost of debt of 5.29 percent, and a tax rate of 21 percent. The company's capital structure consists of 69 percent debt on a book value basis, but debt is 29 percent of the company's value on a market value basis. What is the company's WACC? Multiple Choice a)7.30% b)8.72% c)11.96% d)9.04% e)9.64%arrow_forwardJace Motors has a target capital structure of 45% debt and 55% common equity, with no preferred stock. The yield to maturity on the company's outstanding bonds is 10%, and its tax rate is 25%. Jace's CFO estimates that the company's WACC is 12.00%. What is Jace's cost of common equity? Do not round intermediate calculations. Round your answer to two decimal places.arrow_forwardFama's Llamas has a weighted average cost of capital of 9.4 percent. The company's cost of equity is 13 percent, and its pretax cost of debt is 6.7 percent. The tax rate is 22 percent. What is the company's target debt-equity ratio? (Do not round intermediate calculations and round your answer to 4 decimal places, e.g., .1616.) L Debt-equity ratioarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

Financial Accounting

Accounting

ISBN:9781337272124

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:9781337514835

Author:MOYER

Publisher:CENGAGE LEARNING - CONSIGNMENT