FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

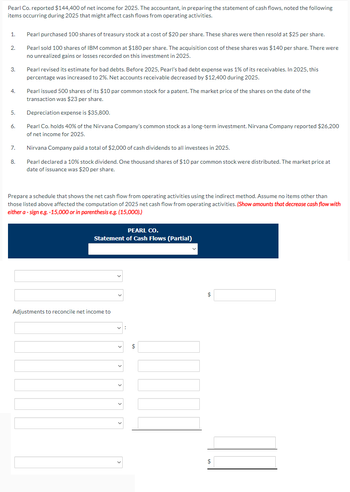

Transcribed Image Text:Pearl Co. reported $144,400 of net income for 2025. The accountant, in preparing the statement of cash flows, noted the following

items occurring during 2025 that might affect cash flows from operating activities.

1.

2.

3.

4.

5.

6.

7.

8.

Pearl purchased 100 shares of treasury stock at a cost of $20 per share. These shares were then resold at $25 per share.

Pearl sold 100 shares of IBM common at $180 per share. The acquisition cost of these shares was $140 per share. There were

no unrealized gains or losses recorded on this investment in 2025.

Pearl revised its estimate for bad debts. Before 2025, Pearl's bad debt expense was 1% of its receivables. In 2025, this

percentage was increased to 2%. Net accounts receivable decreased by $12,400 during 2025.

Pearl issued 500 shares of its $10 par common stock for a patent. The market price of the shares on the date of the

transaction was $23 per share.

Depreciation expense is $35,800.

Pearl Co. holds 40% of the Nirvana Company's common stock as a long-term investment. Nirvana Company reported $26,200

of net income for 2025.

Nirvana Company paid a total of $2,000 of cash dividends to all investees in 2025.

Pearl declared a 10% stock dividend. One thousand shares of $10 par common stock were distributed. The market price at

date of issuance was $20 per share.

Prepare a schedule that shows the net cash flow from operating activities using the indirect method. Assume no items other than

those listed above affected the computation of 2025 net cash flow from operating activities. (Show amounts that decrease cash flow with

either a - sign e.g.-15,000 or in parenthesis e.g. (15,000).)

PEARL CO.

Statement of Cash Flows (Partial)

Adjustments to reconcile net income to

$

$

$

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 3 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- On 1 January 2018, financial assets were $40,000 of which shares valued at $10,000 and the remainder are currency and deposits. Short term and long-term liabilities were $4000 and $6000, respectively. Suppose households conducted the following transactions in 2018 Spends $35,000 on consumption Receives $37,000 in wages and salaries Sells $6,500 worth of shares Repays $1,500 short-term and $2,500 long-term loans. In addition, the value of shares increased by 10% and households received $1500 worth of food voucher. Determine the household balance sheet as at 31 Dec 2018 and it revaluation account for 2018.arrow_forward[The following information applies to the questions displayed below.] In preparation for developing its statement of cash flows for the year ended December 31, 2021, Rapid Pac, Inc., collected the following information: ($ in millions) Fair value of shares issued in a stock dividend $ 96.0 Payment for the early extinguishment oflong-term bonds (book value: $88.0 million) 93.0 Proceeds from the sale of treasury stock (cost: $24.0 million) 29.0 Gain on sale of land 3.3 Proceeds from sale of land 9.9 Purchase of Microsoft common stock 156.0 Declaration of cash dividends 58.0 Distribution of cash dividends declared in 2020 54.0 Required:1. In Rapid Pac’s statement of cash flows, what were net cash inflows (or outflows) from investing activities for 2021? (Amounts to be deducted should be indicated with a minus sign. Enter your answers in millions rounded to 1 decimal place (i.e., 5,500,000 should be entered as 5.5).)…arrow_forwardBuffalo Co. reported $142,000 of net income for 2020. The accountant, in preparing the statement of cash flows, noted the following items occurring during 2020 that might affect cash flows from operating activities. 1. Buffalo purchased 100 shares of treasury stock at a cost of $20 per share. These shares were then resold at $25 per share. 2. Buffalo sold 100 shares of IBM common at $200 per share. The acquisition cost of these shares was $130 per share. There were no unrealized gains or losses recorded on this investment in 2020. 3. Buffalo revised its estimate for bad debts. Before 2020, Buffalo’s bad debt expense was 1% of its receivables. In 2020, this percentage was increased to 2%. Net account for 2020 were $545,900, and net accounts receivable decreased by $12,000 during 2020. 4. Buffalo issued 500 shares of its $10 par common stock for a patent. The market price of the shares on the date of the transaction was $23 per share. 5. Depreciation expense is…arrow_forward

- 1 Norris Company issued 10,000 shares of Si par common stock for $25 per share during 2010. The company paid dividends of $24,000 and issued long-term notes payable of $220,000 during the year. What amount of cash flows from financing activities will be reported on the statement of cash flows? $6.000 net cash inflow. $226,000 net cash inflow. $470,000 net cash outflow. $446,000 net cash inflow.arrow_forwardIn 2012, ABC Corporation purchased treasury stock with a cost of $25,000. During the year, the company paid dividends of $15,000 and issued bonds payable for $750,000. Cash flows from financing activities for 2012 are _____.arrow_forwardDuring the current year, Royal Industries sold treasury stock for $32,000 cash. The treasury stock was purchased last year for $28,000. The company also issued bonds payable for $430,000 cash and declared and paid dividends of $40,000. What amount did Royal report on its statement of cash flows for cash provided by financing activities? O $390,000 O $394,000 O $422,000 O $434,000arrow_forward

- In preparation for developing its statement of cash flows for the year ended December 31, 2021, Rapid Pac, Inc., collected the following information: ($ in millions) Fair value of shares issued in a stock dividend $ 116.0 Payment for the early extinguishment oflong-term bonds (book value: $93.0 million) 98.0 Proceeds from the sale of treasury stock (cost: $29.0 million) 34.0 Gain on sale of land 3.8 Proceeds from sale of land 11.4 Purchase of Microsoft common stock 166.0 Declaration of cash dividends 63.0 Distribution of cash dividends declared in 2020 60.0 2. In Rapid Pac’s statement of cash flows, what were net cash inflows (or outflows) from financing activities for 2021?arrow_forwardJones Industries received $800,000 from issuing shares of its common stock and $650,000 from issuing bonds. During the year, Jones Industries also paid dividends of $110,000. How are the effects of these transactions reported on the statement of cash flows? Use the minus sign to indicate cash outflows, cash payments, decreases in cash and for any adjustments, if required. If a transaction has no effect on the statement of cash flows, select "No effect" from the drop down menu and leave the amount box blank.arrow_forwardMarigold Corp.had the following transactions during 2022:1. Issued $257500 of par value common stock for cash.2. Recorded and paid wages expense of $123600.3. Acquired land by issuing common stock of par value $103000.4. Declared and paid a cash dividend of $20600.5. Sold a long-term investment (cost $6180) for cash of $6180.6. Recorded cash sales of $824000.7. Bought inventory for cash of $329600.8. Acquired an investment in Zynga stock for cash of $43260.9. Converted bonds payable to common stock in the amount of $1030000.10. Repaid a 6-year note payable in the amount of $453200.What is the net cash provided by investing activities? $436720 ($140080). $889920. ($37080).arrow_forward

- Ace Co. issued 1,000 shares of its $10 par value common stock for $15 per share in cash. How should this transaction be reported in Ace's statement of cash flows for the year of issuance? A. $15,000 cash inflow from financing activities. B. $10,000 cash inflow from financing activities and $5,000 adjustment to arrive at cash flows from operating activities. C. $15,000 cash flow from investing activities. D. $10,000 cash flow from investing activities and $5,000 adjustment to arrive at cash flows from operating activitiesarrow_forwardThe accountant for Robinson Company is preparing the company's statement of cash flows for the fiscal year just ended. The following information is available: RETAINED EARNINGS BALANCE AT BEGINNING OF YEAR $156,000 CAHS DIVIDENS DECLARED FOR THE YEAR $46,000 PROCEEDS FROM SALE OF EQUIPMENT $81,000 GAIN ON SALE OF EQUIPMENT $7,000 CASH DIVIDENDS PAYABLE BEGINNING OF YEAR $18,000 CASH DIVIDENDS PAYABLE ENDING OF YEAR $40,000 NET INCOME $92,000 The amount of cash dividends paid during the year would be:arrow_forwardKiley Corporation had these transactions during 2022. Analyze the transactions and indicate whether each transaction is an operating activity, investing activity, financing activity, or noncash investing and financing activity. (a) Purchased a machine for $30,000, giving a long-term note in exchange. (b) Issued $50,000 par value common stock for cash. C (d) Declared and paid a cash dividend of $13,000 (e) Issued $200,000 par value common stock upon conversion of bonds having a face value of $200,000. (0) Sold a long term investment with a cost of $15.000 for $15,000 cash Collected $16.000 from sale of goods. Paid $18,000 to suppliers.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education