Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

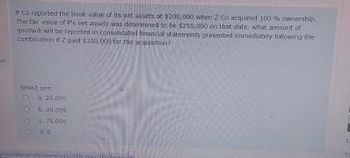

Transcribed Image Text:PCn reported the book value of its net assets at $200,000 when Z Co acquired 100 % ownership

The fair value of P's net assets was determined to be $255,000 on that date, what amount of

goodwil will be reported in consolidated financial statements presented immediately following the

combination if 2 paid $330,000 for the acquisition

Select one

25,000

Ob 20.000

€75,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps with 1 images

Knowledge Booster

Similar questions

- X Transactions for CCA Class 8 assets. Date Item Activity Amount March 11, 2002 Machine 1 Purchase $50,000 April 24, 2002 Machine 2 Purchase $150,000 November 3, 2005 Machine 3 Purchase $230,000 November 22, 2005 Machine 1 Sale $10,000 May 20, 2009 Machine 4 Purchase $50,000 August 3, 2014 Machine 5 Purchase $345,000 September 12, 2015 Machine 3 Sale $50,000 Churchill Metal Products opened for business in 2002. Its transactions for CCA Class 8 assets over the years are shown in the accompanying table. What CCA amount did Churchill Metal Products claim for the 20 percent UCC account in 2016? Click on the icon to view the transactions for CCA Class 8 assets. Churchill Metal Products claimed a CCA of $ in 2016. (Do not round until the final answer. Then round to the nearest dollar as needed.)arrow_forwardACME Co. paid $110,000 for the net assets of Comb Corp. At the time of the acquisition the following information was available related to Comb's balance sheet: Book Value Fair Value Current Assets $50,000 $ 50,000 Building 80,000 100,000 Equipment 40,000 50,000 Liabilities 30,000 30,000 What is the amount recorded by ACME for the Building? a. $110,000 b. $20,000 c. $80,000 d. $100,000arrow_forwardWhat accounting entry would you do 50:50 joint operation was commenced between two participants. Mary Company contributed cash of $90 000, and Strickland Company contributed a Building with a fair value of $90 000 and a carrying amount of $75 000. Using the line-by-line method of accounting, Strickland Company would record? DR Building in JO $75 000 CR Building $75 000 DR Building in JO $945000 CR Building $37 500 CR Gain on sale of building $7 500 DR Investment in joint operation $45 000 CR Building $37 500 CR Gain on sale of building $7 500 DR Cash in JO $45 000 DR Building in JO…arrow_forward

- ACME Co. paid $110,000 for the net assets of Comb Corp. At the time of the acquisition the following information was available related to Comb's balance sheet: Book Value Fair Value Current Assets $50,000 $ 50,000 Building 80,000 100,000 Equipment 40,000 50,000 Liabilities 30,000 30,000 What is the amount recorded by ACME for the Building? a. $110,000 b. $20,000 c. $80,000 d. $100,000arrow_forwardEdward sold four capital assets in the current year: Purchase Date 03/15/Year 7 04/05/Year 8 06/08/Year 9 09/15/Year 10 Sale Date AGI $ Cost 08/14/Year 10 $4,700 10/31/Year 10 $6,500 02/14/Year 10 $4,400 12/28/Year 10 $10,300 Sales Proceeds $7,800 $3,000 $4,700 $6,800 if Edward's AGI before the capital transactions was $120,400, what is Edward's AGI after the capital transactions?arrow_forwardNonearrow_forward

- Big Company purchased all of the assets of Small Company 5 years ago recording Goodwill at the time of the purchase. On 1/1 of the current year they evaluate the Goodwill for impairment. Data Goodwill recorded at time of purchase $150,000 Book Value of the Net Assets of Small Company on 1/1 $900,000 Estimated Fair Value of Small Company on 1/1 $850,000 Undiscounted Estimated Cash flow of Small Company on 1/1 $890,000 What amount of loss on impairment of goodwill should they record on 1/1 O Loss on Impairment of $40,000. Loss on Impairment of $ 0. Loss on Impairment of $ 10,00. O Loss on Impairment of $ 50,000.arrow_forwardQuestio n 12 On July 1, 2020 , Brandon SE purchased Mills Company by paying $140,000 cash. On July 1, 2020, the fair value of the net assets of Mills Company was as follows. Buildings (net) $ 30,000 Patent 8,000 Land 25,000 Accounts receivable 12,000 Cash 50,000 Accounts payable 10,000 What is the amount of goodwill to be reported at Brandon's statement of financial position on 31/12/2019? 25000 15000 Zero 35000 37°C Haze e to search DELLarrow_forwardA Ltd purchases the B Ltd for the following consideration of: Cash : $150 00 Land: carrying amount of the land is $120 000; fair value is $195 000. The statement of financial position of the B Ltd as at the date of acquisition shows assets of $390 000 and liabilities of $195 000. All assets are fairly valued except the B Ltd's building, which is in the accounts at $70 000 but has a fair value of $95 000. There are no contingent liabilities. Required: Calculate the value of goodwill? Note: Provide all workings. Do not just write the final answer.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education