Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

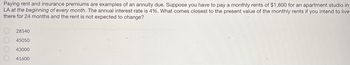

Transcribed Image Text:Paying rent and insurance premiums are examples of an annuity due. Suppose you have to pay a monthly rents of $1,800 for an apartment studio in

LA at the beginning of every month. The annual interest rate is 4%. What comes closest to the present value of the monthly rents if you intend to live

there for 24 months and the rent is not expected to change?

28540

45050

43000

41600

000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Do all parts its urgentarrow_forwardSuppose that you’d like to retire in 40 years and you want to have a future value of $ 1000000 in a savings account. Also suppose that your employer makes regular monthly payments into your retirement account. If you can expect an APR of 6.5% for your account, how much do you need your employer to deposit each month? Employer Contribution = The formulas we have been using assume that the interest rate is constant over the period in question. Over a period of 40 years, though, interest rates can vary widely. To see what difference the interest rate can make, let’s assume a constant APR of 5% for your retirement account. How much do you need your employer to deposit each month under this assumption? Employer Contribution =arrow_forwardSuppose you take out a 30 year mortgage for $ 250000 at 9% interest. The monthly payments on this loan are $ 2011.56. If you pay an extra 50% per month on your mortgage, how soon will you pay off the loan?New length in yearsarrow_forward

- You can afford to pay $15,000 at the end of each of the next 30 years to repay a home loan. If the interest rate is 7.50%, what is the most you can borrow?arrow_forward1. You have just purchased a home by borrowing $400, 000 for 30-years at a fixed APR of 3.87%. The loan payments are monthly and interest is compounded monthly. What is the periodic interest rate? (l.e., what is the monthly interest rate?) O 0.0129 0.0032 0.0394 0.0013 4arrow_forwardYou would like to save $250,000 for retirement. If you are planning to retire 30 years from now, how much should you deposit each month into an account that pays 7.2% interest compounded monthly? What is the total interest earned? marrow_forward

- Suppose you take out a 30 year mortgage for $ 200000 at 7.75% interest. The monthly payments on this loan are $ 1432.82. If you pay an extra 60% per month on your mortgage, how soon will you pay off the loan?New length in years = How much will you save in interest by making the extra payments?Saving =arrow_forward19) Special Loan You take out a $100,000 loan to buy a new yacht. The annual loan rate is ? = 0.04 and the loan period is ? = 10. a. How much is the monthly loan repayment amount? b. If you double your loan repayment each month for the first year, how long will it take to repay the loan? E.g., you double your loan payment amount from part (a) for the first twelve months only, t=1, t=2, ..., t=12. 17)arrow_forward(Annuity payments) To buy a new house, you must borrow $150,000. To do this, you take out a $150,000, 35-year, 11 percent mortgage. Your mortgage payments, which are made at the end of each year (one payment each year), include both principal and 11 percent interest on the declining balance. How large will your annual payments be? The amount of your annual payment will be $ **** (Round to the nearest cent.)arrow_forward

- You need a 25-year, fixed-rate mortgage to buy a new home for $240,000. Your mortgage bank will lend you the money at an APR of 5.35 percent for this 300-month loan. However, you can afford monthly payments of only $800, so you offer to pay off any remaining loan balance at the end of the loan in the form of a single balloon payment. How large will this balloon payment have to be for you to keep your monthly payments at $800? (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) Balloon paymentarrow_forwardYou have saved $6,946 for a down payment on a new car. The monthly payment you can afford is $495. You will make payments for 48 months (starting 1 month from today). If the relevant interest rate is 0.44% per month (this is an Effective Monthly Rate), the price of the car you can afford (taking into account the down payment as well) is $ Hint: Loan problems are typically PV annuity problems, where the amount you are borrowing is the PV of the series of future payments. Margin of error for correct responses: +/- .05arrow_forwardYou buy a car costing $28,000 today. What will be the monthly payment on this car if you put no money down (i.e., you borrow/finance the full amount), and the rate of interest on the loan is 7.2%? The loan is to be paid back in equal monthly installments over the next 5 years, with the first payment due one month from the purchase date. $395.54 $500.12 $475.38 $557.08 $484.95arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education