Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

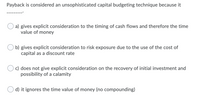

Payback is considered an unsophisticated capital budgeting technique because it _______.

Transcribed Image Text:### Understanding the Payback Period in Capital Budgeting

**Question:**

Payback is considered an unsophisticated capital budgeting technique because it _______.

**Options:**

- **a) gives explicit consideration to the timing of cash flows and therefore the time value of money**

- **b) gives explicit consideration to risk exposure due to the use of the cost of capital as a discount rate**

- **c) does not give explicit consideration on the recovery of initial investment and possibility of a calamity**

- **d) it ignores the time value of money (no compounding)**

**Explanation:**

**Option a:** This option suggests that the payback method does give consideration to the timing of cash flows and the time value of money. However, this is incorrect as the payback method does not account for the time value of money.

**Option b:** This implies that the payback method would consider risk exposure and the use of cost of capital, which is also not true for the payback period calculation.

**Option c:** Indicates the method does not consider the recovery of initial investment and the possibility of a calamity. This is also incorrect as the main purpose of the payback method is to determine how long it takes to recover the initial investment, even though it overlooks other risks and aspects.

**Option d:** This is the correct answer. The payback period calculation ignores the time value of money because it does not discount future cash flows, making it an unsophisticated method for capital budgeting compared to other methods like Net Present Value (NPV) or Internal Rate of Return (IRR) which do account for the time value of money through compounding.

By understanding these points, it becomes clear why the payback period is considered a basic and less sophisticated method in capital budgeting techniques. It provides a quick estimate of investment recovery time but lacks a comprehensive analysis of financial viability.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Most capital budgeting techniques involve analysis of net operating profits. True or False True Falsearrow_forwardThe Capital Asset Pricing Model is usually adopted in a variety of circumstances but it does have some problems. Discuss with reference to actual cases.arrow_forwardIn capital budgeting, one advantage of the internal rate of return is that it does not require the estimation of the weighted average cost of capital. Your answer must begin with True or False followed by your explanation.arrow_forward

- Briefly define capital risk and explain how a positive leverage-adjusted duration gap can contribute to an adverse impact on capital.arrow_forwardWhy are accruals called spontaneous sources of funds, what are their costs, and why don’tfirms use more of them?arrow_forwardA. it is very A disadvantage of the average rate of return method of capital investment analysis is that complex to compute B. it does not include the entire amount of income earned over the life of a project C. it does not emphasize accounting income, which is often used by investors and creditors in evaluating management performance D. it does not directly consider the timing of the expected cash flowsarrow_forward

- A declining trend in the capital outlay ratio could be an indicator of deferred replacement of capital assets. O Truc O False ptarrow_forwardWhat are the Factors That Complicate Capital Investment Analysis? What is Capital Rationing?arrow_forwardWhat capital budgeting rule is a simple but imperfect attempt to solve the capital rationing problem? a The profitability index b The accounting rate of return c The payback rule d The internal rate of return e The net present value rulearrow_forward

- What is capital budgeting? Explain various steps in its preparation and throw light on its limitations.arrow_forwardIn capital budgeting decisions, are there reasons a company might choose to take a project that was NPV negative? Explain.arrow_forwardexplain why it is important to understand that capital budgeting is subject to the validity of the forecasted data. Additionally, explain whether this reduces the reliability of these types of tools. Are there any other alternatives, or are these tools some of the most reliable that currently exist?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education