FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

A4

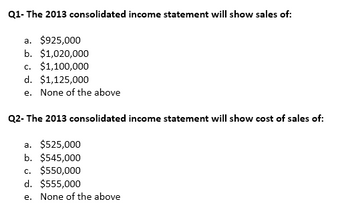

Transcribed Image Text:Q1- The 2013 consolidated income statement will show sales of:

a. $925,000

b. $1,020,000

c. $1,100,000

d. $1,125,000

e. None of the above

Q2-The 2013 consolidated income statement will show cost of sales of:

a. $525,000

b. $545,000

c. $550,000

d. $555,000

e. None of the above

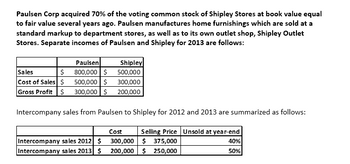

Transcribed Image Text:Paulsen Corp acquired 70% of the voting common stock of Shipley Stores at book value equal

to fair value several years ago. Paulsen manufactures home furnishings which are sold at a

standard markup to department stores, as well as to its own outlet shop, Shipley Outlet

Stores. Separate incomes of Paulsen and Shipley for 2013 are follows:

Sales

$

Cost of Sales $

Gross Profit $

Paulsen

800,000 $

500,000 $

300,000

300,000 $ 200,000

Shipley

500,000

Intercompany sales from Paulsen to Shipley for 2012 and 2013 are summarized as follows:

Intercompany sales 2012 $

Intercompany sales 2013 $

Cost

300,000

200,000

Selling Price Unsold at year-end

$375,000

40%

$250,000

50%

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 4 steps with 4 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- The following information is provided for the first month of operations for Legal Services Inc.: A. The business was started by selling $103,000 worth of common stock. B. Six months' rent was paid in advance, $4,100. C. Provided services in the amount of $1,500. The customer will pay at a later date. D. An office worker was hired. The worker will be paid $277 per week. E. Received $520 in payment from the customer in "C". F. Purchased $300 worth of supplies on credit. G. Received the electricity bill. We will pay the $120 in thirty days. H. Paid the worker hired in "D" for one week's work. I. Received $130 from a customer for services we will provide next week. J. Dividends in the amount of $1,800 were distributed. Prepare the necessary journal entries to record these transactions. If no entry is required, select "No Entry Required" and leave the amount boxes blank. If an amount box does not require an entry, leave it blank. A. B. 111arrow_forwardHow to solve:S= 1/1.06[1-1/(1.06)^20]/1-1/1.06arrow_forwardCalculate: 1 1 (1+ r)" х 30 where r=0.093, and n=16arrow_forward

- E10.15arrow_forwardHansen Corporation. a C Corporation (mot a manufacturer) reports the following items in income and expenses for 2021 Gross Revenue $900,000 Dividend Received from 30% owned Corp 200,000 LTCG 30,000 STCL 12000 City of Lee's Summit Bond Interest 10000 COGS 375000 Administrative Expenses 325000 Charitable Contribution 60,000 Compute Hansen's C Corp Taxable income?arrow_forwardNow, assume that the state of the limit order book is as follows just before the call of CBA's opening call auction: Buy Quantity Price $8.08 $8.01 $7.99 $7.96 $7.91 $7.87 $7.84 $7.82 0 0 0 a. $7.96 O b. $8.01 O c. Other O d. $7.99 e. $7.91 1800 800 1100 1900 800 Sell Quantity 1600 1800 1200 0 0 0 0 If no more orders are entered, the call price would be:arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education