A First Course in Probability (10th Edition)

10th Edition

ISBN: 9780134753119

Author: Sheldon Ross

Publisher: PEARSON

expand_more

expand_more

format_list_bulleted

Question

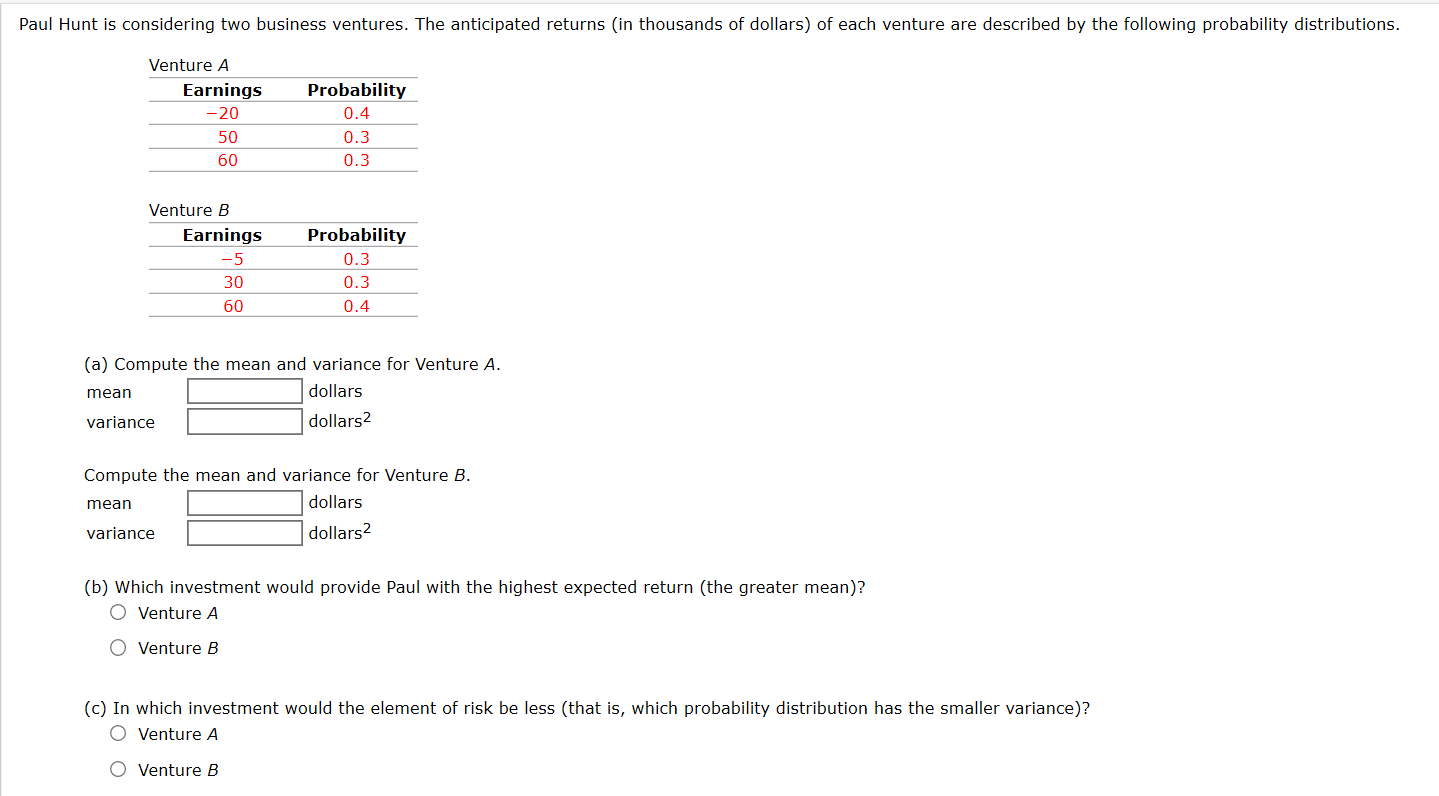

Transcribed Image Text:Paul Hunt is considering two business ventures. The anticipated returns (in thousands of dollars) of each venture are described by the following probability distributions.

Venture A

Earnings

Probability

-20

0.4

50

0.3

60

0.3

Venture B

Earnings

Probability

-5

0.3

30

0.3

60

0.4

(a) Compute the mean and variance for Venture A.

mean

dollars

variance

dollars2

Compute the mean and variance for Venture

mean

dollars

variance

dollars?

(b) Which investment would provide Paul with the highest expected return (the greater mean)?

O Venture A

O Venture B

(c) In which investment would the element of risk be less (that is, which probability distribution has the smaller variance)?

O Venture A

O Venture B

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps with 4 images

Knowledge Booster

Similar questions

- I've been stuck on this question all day and need help solving it, thanks so mucharrow_forwardAn automotive center keeps track of customer complaints received each week. The probability distributions of complaints are shown below. The random variable, xi, represents the number of complaints, and p(xi) is the probability of receiving xi complaints for two of the stores. The cost impact of each complaint is believed to be y=$10x3 where x is the number of complaints. Store A xi 0 1 2 3 4 5 6 p(xi) 0.10 0.15 0.20 0.25 0.15 0.10 0.05 Store B xi 0 1 2 3 4 5 6 p(xi) 0.10 0.15 0.25 0.22 0.13 0.08 0.07 Sample from these distributions to compute the total number of complaints (store A+B) per week for 52 weeks.arrow_forwardQ17. A single share of a stock was purchased prior to the company's release of its quarterly report. There is a 58% chance that the company will meet the quarterly sales expectations for its new product two weeks from now, and the value of the stock will go to $440. Otherwise, the company will not meet the quarterly sales expectations, and the value of the stock will go down to $100. What is the expected value of the stock two weeks from now? (Round to the nearest dollar. Do not enter $ sign.)arrow_forward

- The management of Brinkley Corporation is interested in using simulation to estimate the profit per unit for a new product. The selling price for the product will be $45 per unit. Probability distributions for the purchase cost, the labor cost, and the transportation cost are estimated as follows: Procurement Cost ($) Probability Labor Cost ($) Probability Transportation Cost ($) Probability 10 0.25 20 0.10 3 0.75 11 0.45 22 0.25 5 0.25 12 0.30 24 0.35 25 0.30 Compute profit per unit for the base-case, worst-case, and best-case scenarios. Construct a simulation model to estimate the mean profit per unit. Why is the simulation approach to risk analysis preferable to generating a variety of what-if scenarios? Management believes the project may not be sustainable if the profit per unit is less than $5. Use simulation to estimate the probability the profit per unit will be less than $5.arrow_forwardSuppose that you are offered the following "deal." You roll a six sided die. If you roll a 6, you win $7. If you roll a 4 or 5, you win $2. Otherwise, you pay $8.a. Complete the PDF Table. List the X values, where X is the profit, from smallest to largest. Round to 4 decimal places where appropriate. Probability Distribution Table X P(X) b. Find the expected profit. $ (Round to the nearest cent)c. Interpret the expected value. If you play many games you will likely lose on average very close to $2.17 per game. You will win this much if you play a game. This is the most likely amount of money you will win. d. Based on the expected value, should you play this game? No, since the expected value is negative, you would be very likely to come home with less money if you played many games. Yes, since the expected value is positive, you would be very likely to come home with more money if you played many games. Yes, since the expected value is 0, you would be…arrow_forwardYou are given the following probability distribution for the returns on Security A and Security B: Probability 0.3 0.3 0.3 0.1 Return on Security A 37% 7% 20% -15% Return on Security B 13% 19% 26% -22% Assume you invest $4,000 in Security A and $6,000 in Security B. What are the expected return and standard deviation of your portfolio?arrow_forward

- Suppose that you are offered the following "deal." You roll a six sided die. If you roll a 6, you win $9. If you roll a 3, 4 or 5, you win $2. Otherwise, you pay $3.a. Complete the PDF Table. List the X values, where X is the profit, from smallest to largest. Round to 4 decimal places where appropriate. Probability Distribution Table X P(X) b. Find the expected profit. $ (Round to the nearest cent)c. Interpret the expected value. You will win this much if you play a game. If you play many games, on average, you will likely win, or lose if negative, close to this amount. This is the most likely amount of money you will win. d. Based on the expected value, should you play this game? No, this is a gambling game and it is always a bad idea to gamble. Yes, because you can win $9.00 which is greater than the $3.00 that you can lose. No, since the expected value is negative, you would be very likely to come home with less money if you played many games. Yes,…arrow_forwardSuppose that the price of a share of a particular stock listed on the New York Stock Exchange is currently $39. The following probability distribution shows how the price per share is expected to change over a three-month period: Stock Price Change Probability -2 0.05 -2 0.10 0 0.25 1 0.20 2 0.20 3 0.10 4 0.10 a. Construct a spreadsheet simulation model that computes the value of the stock price in 3 months by simulating the price change 100 times. b. For a current price of $39 per share, what is the average stock price per share 3 months from now based on your simulation?arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

A First Course in Probability (10th Edition)ProbabilityISBN:9780134753119Author:Sheldon RossPublisher:PEARSON

A First Course in Probability (10th Edition)ProbabilityISBN:9780134753119Author:Sheldon RossPublisher:PEARSON

A First Course in Probability (10th Edition)

Probability

ISBN:9780134753119

Author:Sheldon Ross

Publisher:PEARSON