FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

What is the total equity that must be reported in the Statement of Changes in Equity for the year ended December 31, 2021?

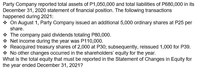

Transcribed Image Text:Party Company reported total assets of P1,050,000 and total liabilities of P680,000 in its

December 31, 2020 statement of financial position. The following transactions

happened during 2021:

* On August 1, Party Company issued an additional 5,000 ordinary shares at P25 per

share.

* The company paid dividends totaling P80,000.

* Net income during the year was P110,000.

* Reacquired treasury shares of 2,000 at P30; subsequently, reissued 1,000 for P39.

* No other changes occurred in the shareholders' equity for the year.

What is the total equity that must be reported in the Statement of Changes in Equity for

the year ended December 31, 2021?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Which of the items are normally classified as current liabilities for a company that has a oneyearoperating cycle? Salaries payablearrow_forwardIndicate where each of the following items is reported on financial statements. Choose from the followingcategories: (a) current assets, (b) long-term investments, (c) current liabilities, (d) long-term liabilities,(e) other revenues and gains, ( f ) other expenses and losses, and (g) equity. Held-to-maturity securities (due in 15 years)arrow_forwardSubject - Acountingarrow_forward

- Flint Industries changed from the double-declining-balance to the straight-line method in 2021 on all its equipment. There was no change in the assets' salvage values or useful lives. Plant assets, acquired on January 2, 2018, had an original cost of $1,491,200, with a $86,400 salvage value and an 8-year estimated useful life. Income before depreciation expense was $263,200 in 2020 and $252,800 in 2021. Prepare the journal entry to record depreciation expense in 2021. (Credit account titles are automatically Indented when amount is entered. Do not Indent manually. If no entry Is reguired, select "No Entry" for the account titles and enter 0 for the amounts.) Account Titles and Explanation Debit Credit Depreciation Expense Depreciationarrow_forwardWhen does a dividend become a liability? According to your text, it occurs on the: Date of record Date of payment Date of declaration Last day of fiscal year None of the abovearrow_forwardPlease refer to the attachment and write similar content/words of the income statement, statement of retained earnings, and balance sheet. The year will be 2020-2018.arrow_forward

- For this question, please refer to the Fact Pattern below (Same fact pattern as previous question). Given the set of transactions above, what was Adjusted EBITDA in 2021? O $1,107.2 O $1,082.2. O $1,068.2 $1,092.2 Activities during the year: Capital expenditures Cost of Goods Sold (excluding D&A) Dividend Payout Ratio (dividends/ net income to common shareholders) Income Tax Net Interest Expense Net Revenues Non-controlling Interest Expense (After-Tax) Litigation Expense Other Operating Expenses (excluding D&A) Purchases of intangible assets Preferred dividends Research And Development (excluding D&A) Proceeds from sale of land with book value of $15 Selling, General, & Administrative (excluding D&A) Write-down of PP&E 2021 580.0 3,256.0 40% 35% 45.6 5,800.0 25.0 97.0 16.5 45.0 5.0 56.3 20.0 1,488.0 7.0arrow_forwardOn the balance sheets, what is the most recent fiscal year reported? Fiscal year 2020, ending on February 1, 2020 Fiscal year 2020, ending on January 30, 2021 Fiscal year 2021, ending on February 1, 2020 Fiscal year 2021, ending on January 30, 2021arrow_forwardIndicate where each of the following items is reported on financial statements. Choose from the followingcategories: (a) current assets, (b) long-term investments, (c) current liabilities, (d) long-term liabilities,(e) other revenues and gains, ( f ) other expenses and losses, and (g) equity. Unrealized gain on available-for-sale securitiesarrow_forward

- Below are three independent scenarios concerning the GST account balance and the effect on the Statement of Financial Position in the previous year (2023) and the current year (2024). SFP as at 31/3/2023 Scenario 1 GST liability of $267 Scenario 2 GST asset of $267 Scenario 3 GST asset of $267 SFP as at 31/3/2024 GST asset of $769 GST asset of $769 GST liability of $769 Required: Correctly insert the opening and closing balances into the three independent GST general ledger accounts provided in the answer booklet. Balance each of the three GST general ledger accounts and insert the opening balance for 1 April 2024.arrow_forwardQ5. The following items would be presented in the Statement of Changes in Equity.Answer only TRUE or FALSE for each(i) Revaluation of investment property(ii) Rights issue made in the yeararrow_forwardhello, I need help pleasearrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education