FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

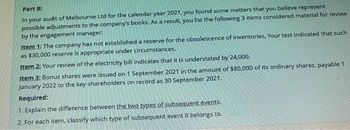

Transcribed Image Text:Part B:

In your audit of Melbourne Ltd for the calendar year 2021, you found some matters that you believe represent

possible adjustments to the company's books. As a result, you list the following 3 items considered material for review

by the engagement manager:

Item 1: The company has not established a reserve for the obsolescence of inventories, Your test indicated that such

as $30,000 reserve is appropriate under circumstances.

Item 2: Your review of the electricity bill indicates that it is understated by 24,000.

Item 3: Bonus shares were issued on 1 September 2021 in the amount of $80,000 of its ordinary shares, payable 1

January 2022 to the key shareholders on record as 30 September 2021.

Required:

1. Explain the difference between the two types of subsequent events.

2. For each item, classify which type of subsequent event it belongs to.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Ann Johnson has audited the financial report of Quick Ltd for the year ended 30 June 2020. Although Ann’s audit fieldwork was completed on 14 August 2020, her auditor’s report was signed on 20 August 2020 and sent to management that day. The management of Quick Ltd advised Ann that their annual report, which will be mailed to shareholders on 10 October 2020, will also include an unaudited financial report for the first quarter ended 30 September 2020. Under the circumstances, Ann is responsible for undertaking subsequent events audit procedures through to:Select one:a. 10 October 2020b. 20 August 2020c. 14 August 2020d. 30 September 2020arrow_forwardDuring the audit of Keats Island Brewery for the fiscal year ended June 30, 2022, the auditors identified the following issues: a. The company sells beer for $1 per bottle, plus $0.10 deposit on each bottle. The deposit collected is payable to the provincial recycling agency. During 2022, the company recorded $8,000 of deposits as revenue. The auditors believe this amount should have been recorded as a liability. b. The company had been using the first-in, first-out cost flow assumption for its inventories. In fiscal 2022, management decided to switch to the weighted-average method. This change reduced inventory by $20,000 at June 30, 2021, and $35,000 at June 30, 2022. C. The company has equipment costing $5,000,000 that it has been depreciating over 10 years on a straight- line basis. The depreciation for fiscal 2021 was $500,000 and accumulated depreciation on June 30, 2021, was $1,000,000. During 2022, management has new information and revises the estimate of useful life to 12…arrow_forwardFor the following independent events, assume that each has a material effect on the financial statements. The financial year of your audit client BLQ Ltd ended on 31 December 2018. Your audit report was signed on 20 February 2019 and the financial statements were issued on 4 March 2019. Listed below are events that have taken place. (a) On 14 February 2019: You discovered that 30% of BLQ Ltd’s inventory is destroyed by a fire on 7 January 2019. (b) On 10 March 2019, you discovered that BLQ Ltd had settled a class action lawsuit for $2 million on 30 January 2019. The class action was initiated by discontent customers in December 2017 for faulty products. The legal cost was disclosed as a provision worth $500,000 on the balance sheet. Required: For each of the events above, explain 1) the auditor’s responsibilities, 2) the appropriate accounting treatments and 3) the impact on audit report.arrow_forward

- Pat Colt is auditing the financial statements of Manning Company. The following is a summary of the uncorrected misstatements that Colt has identified during the past three years. These misstatements are immaterial and have related to isolated matters. In this summary, parentheses imply that the misstatements would have reduced balances if they had been corrected (e.g., in 2020, the misstatements would have reduced net income by $82,500, assets by $100,000, liabilities by $17,500, and equity by $82,500 if corrected). Year 2020 2021 2022 Effect on Net Income $ (82,500) (22,000) 30,000 Effect on Assets $ (100,000) (25,500) 30,000 Effect on Liabilities $ (17,500) (3,500) 0 During the most recent audit, Colt concluded that expenses totaling $130,000 were recognized in January 2024 (when Manning paid them) but should have been recognized in 2023. Required: a. What is the dollar impact of the misstatement identified in 2023 on each of the following (assume a 21% tax rate for Manning)? Note:…arrow_forwardwhat is the interim report of a company?arrow_forwardConsider the following independent situations relating to the audit of five different audit clients for year ended 30 June 20X8. Assume that all the situations are material. For each of the above cases, state the appropriate audit opinion that the auditor would require. Give reasons 1. new client has changed its valuation method of property, plant and equipment. It has adopted the Fair Value Revaluation Model to replace the Historic cost measurement method. Whilst the auditor does not object to the change in the valuation model, the new method has a material effect on the financial statements and has not been disclosed. A special meeting was held between the CFO and the Finance Team and the Lead Partner from the Audit team, but nothing was resolved 2. (ii) A new start-up company specialising in air-drone mail/package delivery has grown strongly in the past year. Over the past three years the company has made consistent losses, borrowed heavily, experienced staff turnover and dealt with…arrow_forward

- Which required SEC filing would contain the following content? "Our auditors identified the following critical audit matter: The Company recorded $219.4 million as of December 31, 2020 in reserves for returns, allowances, markdowns and discounts within customer refund liability." Question 33 options: a) Proxy b) 10-K c) 8-Karrow_forwardYou are now in the completion stage of your audit of the financial statements of Endgame Inc. for the period ended December 31, 2021. In relation to this, you reviewed relevant subsequent events up to April 15, 2022, the date financial statements were approved for issuance by Endgame Inc.'s Board of Directors. The following information are deemed relevant as a result of your review: A The company has a 10%, P2 million Notes Payable due on March 31, 2024. A debt covenant requires Endgame Inc. to maintain current assets at least equal to 150% of its current liabilities. On December 31, 2021, however, Endgame Inc. is in violation of this covenant. On December 31, 2021, Endgame. obtained a grace period for another year, that is up to December 31, 2022, from Avenger Bank, having convinced the bank that the company's normal current ratio of 2:1 will be reestablished by the end of the year. B. The company has another P5 million, 5-year, non-cancelable 13% bonds issued at face value on March…arrow_forwardSG Motor Cars Co (PSG) manufactures a range of motor cars, and its year end is 30 June 2020. You are the assistant audit manager of Intermiami & Co and are currently preparing the audit programmes for the year-endaudit of PSG. You have had a meeting with your audit manager, and he has notified you of the following issues identified during the audit risk assessment process:Land and buildingsPSG has a policy of revaluing land and buildings; this is undertaken on a rolling basis over a five-year period. During the year PSG requested an external independent valuer to revalue a number of properties, including awarehouse purchased in January 2020. Depreciation is charged on a straight-line basis.Work in progressPSG undertakes continuous production of cars, 24 hours a day, seven days a week. An inventory count is to be undertaken at the year end and Intermiami & Co will attend. You are responsible for the audit of work inprogress (WIP) and will be part of the team attending the count…arrow_forward

- Problem You are the lead partner overseeing the audit for Camo Ltd, a privately owned company.The completion of the audit report is pending for the income year 2020 and you have noted severalsituations with possible actions.The situations are as follows: 1. Camo Corporation carries its property, plant, and equipment accounts at currentmarket values. Current market values exceed historical cost by a highly materialamount, and the effects are pervasive throughout the financial statements. 2. Management of Camo Corporation refuses to allow you to observe, or make,any counts of inventory. The recorded book value of inventory is highlymaterial. 3. You were unable to confirm accounts receivable with Camo’s customers.However, because of detailed sales and cash receipts records, you were able toperform reliable alternative audit procedures. 4. One week before the end of fieldwork, you discover that the audit manager onthe Camo engagement owns a material amount of Camo’s common stock. 5. You…arrow_forwardWhat is Hershey's operating cash flow to operating income ratio in 2022 under the replacement cost?arrow_forwardDuring the course of the audit, the following additional information was obtained: a. The trading securities were acquired on December 31, 2011. The securities have a fair value of P67,000 at December 31, 2012. b. In discussion with the company officials, it was determined that the doubtful accounts expense rate based on net sales should be reduced to 2% from 3%, effective January 1, 2012. c. As a result of errors in the physical count, inventories were overstated by P12,000 at December 31, 2011 and by P17,500 at December 31, 2012. d. On January 1, 2011, the cost of equipment purchased for P30,000 was debited to repairs and maintenance. PRTC depreciates equipment of this type by the straight-line method over a five-year life with no residual value. e. On July 1, 2012, fully depreciated equipment purchased for P21,000, was sold as scrap for P2,500. The only entry PRTC made was to debit cash and credit property and equipment for the scrap proceeds. The property and equipment (net) had a…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education