Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

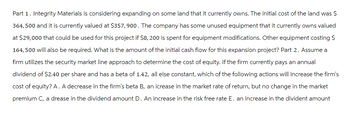

Transcribed Image Text:Part 1. Integrity Materials is considering expanding on some land that it currently owns. The initial cost of the land was $

364,500 and it is currently valued at $357,900. The company has some unused equipment that it currently owns valued

at $29,000 that could be used for this project if $8, 200 is spent for equipment modifications. Other equipment costing $

164,500 will also be required. What is the amount of the initial cash flow for this expansion project? Part 2. Assume a

firm utilizes the security market line approach to determine the cost of equity. If the firm currently pays an annual

dividend of $2.40 per share and has a beta of 1.42, all else constant, which of the following actions will increase the firm's

cost of equity? A. A decrease in the firm's beta B, an icrease in the market rate of return, but no change in the market

premium C, a drease in the dividend amount D. An increase in the risk free rate E. an increase in the divident amount

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Similar questions

- How do i solve the chart?arrow_forwardGive typing answer with explanation and conclusion Consolidated Industries is considering a 4- year project. The project is expected to generate operating cash flows of $2 million, $6, million, $5 million, and $3 million over the four years, respectively. It will require initial capital expenditures of $12 million dollars and an intitial investment in NWC of $6 million. The firm expects to generate a $8 million after tax salvage value from the sale of equipment when the project ends, and it expects to recover 100% of its nwc investments. Assuming the firm requires a return of 10% for projects of this risk level, what is the project's NPV? $4,061,769 $3,854,536 $3,937,429 $3,771,643 $4,144,662arrow_forwardShaylee Corp has $2.10 million to invest in new projects. The company’s managers have presented a number of possible options that the board must prioritize. Information about the projects follows: Project A Project B Project C Project D Initial investment $ 720,000 $ 400,000 $ 960,000 $ 1,115,000 Present value of future cash flows 935,000 500,000 1,650,000 1,310,000 Required:1. Is Shaylee able to invest in all of these projects simultaneously?multiple choice No Yes 2-a. Calculate the profitability index for each project. (Round your answers to 4 decimal places.)arrow_forward

- Perit Industries has $155,000 to invest in one of the following two projects: Cost of equipment required Working capital investment required Annual cash inflows Salvage value of equipment in six years Life of the project Project A $ 155,000 $ 25,000 $ 8,600 6 1. Net present value project A 2. Net present value project B 3. Which investment alternative (if either) would you recommend that the company accept? X Answer is complete but not entirely correct. Project B $0 $ 155,000 $ 40,000 years The working capital needed for project B will be released at the end of six years for investment elsewhere. Perit Industries' discount rate is 14%. Click here to view Exhibit 14B-1 and Exhibit 14B-2, to determine the appropriate discount factor(s) using tables. Required: 1. Compute the net present value of Project A. Note: Enter negative values with a minus sign. Round your final answer to the nearest whole dollar amount. 2. Compute the net present value of Project B. $(53,971) 70,527 X Project B $0…arrow_forward(Calculating free cash flows) Vandelay Industries is considering a new project with a 4-year life with the following cost and revenue data. This project will require an investment of $140,000 in new equipment. This new equipment will be depreciated down to zero over 4 years using the simplified straight-line method and has no salvage value. This new project will generate additional sales revenue of $112,000 while additional operating costs, excluding depreciation, will be $68,000. Vandelay's marginal tax rate is 35 percent. What is the project's free cash flow in year 1? The project's free cash flow in year 1 is $ (Round to the nearest dollar.) Carrow_forwardFCF and NPV for a project: Archer Daniels Midland Company is considering buying a new farm that it plans to operate for 10 years. The farm will require an initial investment of $12 million. This investment will consist of $2 million for land and $10 million for trucks and other equipment. The land, all trucks, and all other equipment are expected to be sold at the end of 10 years for a price of $5 million, which is $2 million above book value. The farm is expected to produce revenue of $2 million each year, and annual cash flow from operations equals $1.8 million. The marginal tax rate is 25 percent, and the appropriate discount rate is 10 percent. Calculate the NPV of this investment.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education