FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

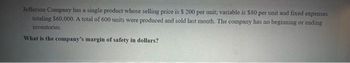

Transcribed Image Text:Jefferson Company has a single product whose selling price is $ 200 per unit; variable is $80 per unit and fixed expenses

totaling $60,000. A total of 600 units were produced and sold last month. The company has no beginning or ending

inventories.

What is the company's margin of safety in dollars?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Sphrantzes Company recently sold 175 units at a price of $650 per unit. During the same time the company reported total variable costs of $85,575 and net income of $13,975. If the company's price per unit were decreased by $35, its volume increased by 20 units and its fixed costs increased by $1,000, what would be the company's projected net income?arrow_forwarda company is planning to sell 45,800 units for $2.8 per unit and will break even at this level of sales expenses will be $41,220 what are the company's variable expenses per unitarrow_forwardAlder Inc. produced and sold 2,000 units of one product during the year. The company's net income was $40,000, its fixed cost per unit was $60, and the variable cost ratio was .25. What must the company's sales revenue be if it wants to earn $50,000 next year? $192,000 O $208,000 $226,667 $211,111 None of the abovearrow_forward

- The Sizemore Company recently sold 2,500 units for $100 each; reported total variable costs of $162,500 and a net income of $47,500. If the company's price per unit increased by $5 and its volume decreased by 250 units, what would be the company's net income?arrow_forwardLast year Minden Company introduced a new product and sold 25,700 units of it at a price of $100 per unit. The product's variable expenses are $70 per unit and its fixed expenses are $838,200 per year. Required: 1. What was this product's net operating income (loss) last year? 2. What is the product's break-even point in unit sales and dollar sales? 3. Assume the company has conducted a marketing study that estimates it can increase annual sales of this product by 5,000 units for each $2 reduction in its selling price. If the company will only consider price reductions in increments of $2 (e.g., $68, $66, etc.), what is the maximum annual profit that it can earn on this product? What sales volume and selling price per unit generate the maximum profit? 4. What would be the break-even point in unit sales and in dollar sales using the selling price that you determined in requirement 3? Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3 What…arrow_forwardMauro Products distributes a single product, a woven basket whose selling price is $21 per unit and whose variable expense is $18 per unit. The company's monthly fixed expense is $4,500. Required: 1. Calculate the company's break-even point in unit sales. 2. Calculate the company's break-even point in dollar sales. (Do not round intermediate calculations.) 3. If the company's fixed expenses increase by $600, what would become the new break-even point in unit sales? In dollar sales? (Do not round intermediate calculations.) 1. Break-even point in unit sales 2. Break-even point in dollar sales 3. Break-even point in unit sales 3. Break-even point in dollar sales 1,500 baskets basketsarrow_forward

- Mauro Products distributes a single product, a woven basket whose selling price is $16 per unit and whose variable expense is $14 per unit. The company's monthly fixed expense is $4,600. Required: 1. Calculate the company's break-even point in unit sales. 2. Calculate the company's break-even point in dollar sales. (Do not round intermediate calculations.) 3. If the company's fixed expenses increase by $600, what would become the new break-even point in unit sales? In dollar sales? (Do not round intermediate calculations.) 1. Break-even point in unit sales 2. Break-even point in dollar sales 3. Break-even point in unit sales 3. Break-even point in dollar sales 124 JUN 30 baskets baskets Aarrow_forwardLast year Minden Company introduced a new product and sold 25,800 units of it at a price of $95 per unit. The product's variable expenses are $65 per unit and its fixed expenses are $836,100 per year. Required: 1. What was this product's net operating income (loss) last year? 2. What is the product's break-even point in unit sales and dollar sales? 3. Assume the company has conducted a marketing study that estimates it can increase annual sales of this product by 5,000 units for each $2 reduction in its selling price. If the company will only consider price reductions in increments of $2 (e.g., $68, $66, etc.), what is the maximum annual profit that it can earn on this product? What sales volume and selling price per unit generate the maximum profit? 4. What would be the break-even point in unit sales and in dollar sales using the selling price that you determined in requirement 3? Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3…arrow_forwardEkor bakery sells doughnut. The annual demand is 10,000 per year. The ordering cost is $21, and holding cost is $3. If the demand exceeds the inventory, Ekor has two types of costs associated with the backorder. The loss of goodwill is $O.1 per unit short, and a "bookkeeping" cost of $0.3 per unit short per year. Calculate: economic order quantity, maximum acceptable inventory, cycle time, and minimal total annual average cost. Suppose the doughnuts are sold in packages of 150 units each. How many packages should sell? (Hint: Sensitivity of EOQ).arrow_forward

- Mauro Products distributes a single product, a woven basket whose selling price is $11 per unit and whose variable expense is $9 per unit. The company's monthly fixed expense is $2,800. Required: 1. Calculate the company's break-even point in unit sales. 2. Calculate the company's break-even point in dollar sales. (Do not round intermediate calculations.) 3. If the company's fixed expenses increase by $600, what would become the new break-even point in unit sales? In dollar sales? (Do not round intermediate calculations.) 1. Break-even point in unit sales baskets 2. Break-even point in dollar sales 3. Break-even point in unit sales baskets Break-even point in dollar salesarrow_forwardMaple Enterprises sells a single product with a selling price of $87 and variable costs per unit of $26. The company's monthly fixed expenses are $15,356. What dollar sales will Maple need in order to reach a target profit of $26,540? Round to the nearest whole dollar, no decimals.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education