FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

thumb_up100%

Ans?? General Accounting

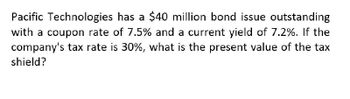

Transcribed Image Text:Pacific Technologies has a $40 million bond issue outstanding

with a coupon rate of 7.5% and a current yield of 7.2%. If the

company's tax rate is 30%, what is the present value of the tax

shield?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Suppose that LilyMac Photography expects EBIT to be approximately $ 210,000 per year for the foreseeable future, and that it has 1, 000 10-year, 9 percent annual coupon bonds outstanding. What would the appropriate tax rate be for use in the calculation of the debt component of Lily Mac's WACC?arrow_forwardBBA Ltd has just issued $10 million in debt (at par or face value). The firm will pay interest only on this debt. BBA’s marginal tax rate is expected to be 30% for the foreseeable future. a) Suppose BBA pays interest of 6% per year on its debt. What is its annual interest tax shield? b) What is the present value of the interest tax shield, assuming the tax shield’s risk is the same as that of the loan? c) Suppose instead that the interest rate on the debt is 5%. What is the present value of the interest tax shield in this case? Ten years have passed since BBA issued $10 million in perpetual interest-only debt with a 6% annual coupon. Tax rates have remained the same at 30% but interest rates have dropped so BBA’s current cost of debt capital is 4%. d) What is BBA’s annual interest tax shield now? e) What is the present value of the interest tax shield now?arrow_forwardSuppose that LilyMac Photography expects EBIT to be approximately $230,000 per year for the foreseeable future, and that it has 1,000 10-year, 9 percent annual coupon bonds outstanding. What would the appropriate tax rate be for use in the calculation of the debt component of LilyMac's WACC? Tax rate 37 %arrow_forward

- Arnell Industries has 5.5 million in permanent debt outstanding. The firm will pay interest only on this debt. Arnell's marginal tax rate is expected to be 40% for the foreseeable future. a. Suppose Arnell pays interest of 9% per year on its debt. What is its annual interest tax shield? b. What is the present value of the interest tax shield, assuming its risk is the same as the loan? c. Suppose instead the interest rate on the debt were 7%. What is the present value of the interest tax shield in this case?arrow_forwardLaurel, Inc., has debt outstanding with a coupon rate of 5.8%and a yield to maturity of 7.1%.Its tax rate is 38%.What is Laurel's effective (after-tax) cost of debt? NOTE: Assume that the debt has annual coupons. Note: Assume that the firm will always be able to utilize its full interest tax shield.arrow_forwardSuppose that LilyMac Photography expects EBIT to be approximately $46,000 per year for the foreseeable future, and that it has 500 10-year, 5 percent annual coupon bonds outstanding. (Use Table 11.1.)What would the appropriate tax rate be for use in the calculation of the debt component of LilyMac’s WACC?arrow_forward

- Laurel, Inc., has debt outstanding with a coupon rate of 5.8% and a yield to maturity of 7.1%. Its tax rate is 35%. What is Laurel's effective (after-tax) cost of debt? NOTE: Assume that the debt has annual coupons and that the firm will always be able to utilize its full interest tax shield. The effective after-tax cost of debt is __ % ? (Round to four decimal places.)arrow_forwardPDQ, Inc. expects EBIT to be approximately $11.4 million per year for the foreseeable future, and it has 20,000 20-year, 10 percent annual coupon bonds outstanding. (Use Table 11.1.)What would the appropriate tax rate be for use in the calculation of the debt component of PDQ’s WACC? (Round your answer to 2 decimal places.)arrow_forwardGeneral Accountingarrow_forward

- What is the after tax cost of debt if the company's bond with a coupon rate of 9% is selling above par at $1050,and the bond will mature in 19 years. The firm's tax bracket is 30%. (L1).arrow_forwardThe Holmes Company's currently outstanding bonds have an 8% coupon and a 10% yield to maturity. Holmes believes it could issue new bonds at par that would provide a similar yield to maturity. If its marginal tax rate is 25%, what is Holmes' after-tax cost of debt?arrow_forwardPDQ, Inc. expects EBIT to be approximately $12.2 million per year for the foreseeable future, and it has 100,000 20-year, 6 percent annual coupon bonds outstanding. (Use Table 11.1.)What would the appropriate tax rate be for use in the calculation of the debt component of PDQ’s WACC? (Round your answer to 2 decimal places.)arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education