FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

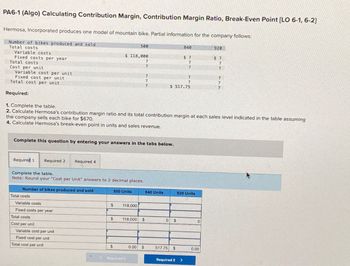

Transcribed Image Text:PA6-1 (Algo) Calculating Contribution Margin, Contribution Margin Ratio, Break-Even Point [LO 6-1, 6-2)

Hermosa, Incorporated produces one model of mountain bike. Partial information for the company follows:

Number of bikes produced and sold

Total costs

Variable costs

Fixed costs per year

Total costs

Cost per unit

Variable cost per unit

Fixed cost per unit

Total cost per unit

Required:

1. Complete the table.

500

840

920

$ 118,000

$ 7

?

7

$ 7

?

7

?

?

7

$ 517.75

?

?

2. Calculate Hermosa's contribution margin ratio and its total contribution margin at each sales level indicated in the table assuming

the company sells each bike for $670.

4. Calculate Hermosa's break-even point in units and sales revenue.

Complete this question by entering your answers in the tabs below.

Required 1

Required 2 Required 4

Complete the table.

Note: Round your "Cost per Unit" answers to 2 decimal places.

Number of bikes produced and sold

Total costs

Variable costs

Fixed costs per year

Total costs

Cost per unit

Variable cost per unit

Fixed cost per unit

Total cost per unit

500 Units

840 Units

920 Units

$

118,000

$

118,000 $

0 $

$

0.00

$

517.75 $

0.00

Required 1

Required 2 >

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 5 steps

Knowledge Booster

Similar questions

- Ashavinabhaiarrow_forwardSandy Bank, Inc., makes one model of wooden canoe. And, the information for it follows: Number of canoes produced and sold 550 750 900 Total costs Variable costs $ 110,000 $ 150,000 $ 180,000 Fixed costs $ 99,000 $ 99,000 $ 99,000 Total costs $ 209,000 $ 249,000 $ 279,000 Cost per unit Variable cost per unit $ 200.00 $ 200.00 $ 200.00 Fixed cost per unit 180.00 132.00 110.00 Total cost per unit $ 380.00 $ 332.00 $ 310.00 Required:1. Suppose that Sandy Bank raises its selling price to $500 per canoe. Calculate its new break-even point in units and in sales dollars. (Do not round intermediate calculations. Round your final answers to nearest whole number.) 2. If Sandy Bank sells 1,590 canoes, compute its margin of safety in dollars and as a percentage of sales. (Use the new sales price of $500.) (Round your answers to the nearest whole number.) 3. Calculate the number of…arrow_forwardEA10. Salvador Manufacturing builds and sells snowboards, skis and poles. The sales price and variable cost for each are shown: Sellings price per unit Variable cost Product per unit Snowboards Skis Poles $320.00 $400.00 S 50.00 $170.00 $225.00 $ 20.00 Their sales mix is reflected in the ratio 7:3:2. What is the overall unit contribution margin for Salvador with their current product mix?arrow_forward

- A6arrow_forwardRequired information The Foundational 15 (Algo) [LO5-1, LO5-2, LO5-3, LO5-4, LO5-5, LO5-6, LO5-7] [The following information applies to the questions displayed below.] Oslo Company prepared the following contribution format income statement based on a sales volume of 1,000 units (the relevant range of production is 500 units to 1,500 units): Sales Variable expenses Contribution margin Fixed expenses Net operating income $ 15,000 9,000 6,000 3, 120 $ 2,880 Foundational 5-13 (Algo) 13. Using the degree of operating leverage, what is the estimated percent increase in net operating income that would result from a 5% increase in unit sales? Note: Round your intermediate calculations and final answer to 2 decimal places. > Answer is complete but not entirely correct. Increase in net operating income 2.40 X %arrow_forwardPlease help me with show all calculation thankuarrow_forward

- Riverside Inc. makes one model of wooden canoe. Partial information for it follows: Number of Canoes Produced and Sold 455 605 755 Total costs Variable costs $ 65,065 149,700 $214,765 ? Fixed costs Total costs Cost per unit Variable cost per unit Fixed cost per unit Total cost per unit ? ? ? ? ? Required: 1. Complete the table. 3. Suppose Riverside sells its canoes for $505 each. Calculate the contribution margin per canoe and the contribution margin rati 4. Next year Riverside expects to sell 805 canoes. Complete the contribution margin income statement for the company. Complete this question by entering your answers in the tabs below. Required 1 Required 3 Required 4 Complete the table. (Round your cost per unit answers to 2 decimal places.) Number of Canoes Produced and Sold 455 605 755 Total Costs Variable Costs 2$ 65,065 Fixed Costs 149,700 Total Costs $ 214,765 $ $ Cost per Unit Variable Cost per Unit Fixed Cost per Unit Total Cost per Unit $ 0.00 $ 0.00 $ 0.00 Complete this…arrow_forwardPlease provide answer in text (Without image)arrow_forwardgo.9arrow_forward

- Sandy Bank, Incorporated, makes one model of wooden canoe. And, the information for it follows: Number of canoes produced and sold Total costs Variable costs Fixed costs Total costs Cost per unit Variable cost per unit Fixed cost per unit Total cost per unit Sandy Bank sells its canoes for $375 each. 450 Required 1 Required 2 $ 69,750 $ 468,000 $ 537,750 Required 3 $ 155.00 1,040.00 $ 1,195.00 650 $ 100,750 $ 468,000 $ 568,750 $ 155.00 720.00 $ 875.00 Complete this question by entering your answers in the tabs below. 800 Required: 1. Suppose that Sandy Bank raises its selling price to $500 per canoe. Calculate its new break-even point in units and in sales 2. If Sandy Bank sells 1,500 canoes, compute its margin of safety in dollars and as a percentage of sales. (Use the new sales pr $500) 3. Calculate the number of canoes that Sandy Bank must sell at $500 each to generate $110,000 profit. $ 124,000 $ 468,000 $ 592,000 $ 155.00 585.00 $ 740.00 Suppose that Sandy Bank raises its selling…arrow_forwardSubject:- accountingarrow_forwardPlease answer first two subparts only 1 2arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education