FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

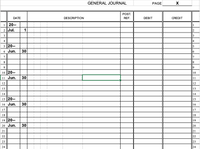

Transcribed Image Text:GENERAL JOURNAL

PAGE

POST.

DATE

DESCRIPTION

REF.

DEBIT

CREDIT

1

20--

1

2 Jul.

2

3

4

4

5 20--

15

6 Jun.

30

6

7

8

8

9

9

10 20--

10

11 Jun.

30

11

12

12

13

13

14

14

15 20--

15

16 Jun.

30

16

17

17

18

18

19 20--

19

20 Jun.

30

20

21

21

22

22

23

23

24

24

Transcribed Image Text:PA5. 13.3 Volunteer Inc. issued bonds with a $500,000 face value, 10% interest rate, and a 4-year term

on July 1, 2018 and received $540,000. Interest is payable annually. The premium is amortized using

the straightline method. Prepare journal entries for the following transactions.

A. July 1, 2018: entry to record issuing the bonds

B. June 30, 2019: entry to record payment of interest to bondholders

C. June 30, 2019: entry to record amortization of premium

D. June 30, 2020: entry to record payment of interest to bondholders

E. June 30, 2020: entry to record amortization of premium

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Legacy issues $660,000 of 5.5%, four-year bonds dated January 1, 2019, that pay interest semiannually on June 30 and December 31. They are issued at $648,412 when the market rate is 6%. Problem 14-4A Part 2 2. Determine the total bond interest expense to be recognized over the bonds' life. Total bond interest expense over life of bonds: Amount repaid: payments of Par value at maturity Total repaid 0 Less amount borrowed Total bond interest expense $0arrow_forward9.1 On Jan. 1, 2018, UMPI, Inc. issued $600,000, of 10% bonds, due in 5 years. The bonds pay interest semi-annually on July 1 and January 1. The bonds effective yield 8%. UMPI uses the effective-interest method (see PV Tables next page). Prepare UMPI’s journal entries for a thru c. The January 1 issuance The July 1 interest payment The December 31 adjusting journal entry Prepare a full Bond Amortization Schedulearrow_forward57 On January 1, 2024, Reyes Recreational Products issued $100,000, 11%, four-year bonds. Interest is paid semiannually on June 30 and December 31. The bonds were issued at $96,895 to yield an annual return of 12%. Required: 1. Prepare an amortization schedule that determines interest at the effective interest rate. 2. Prepare an amortization schedule by the straight-line method. 3. Prepare the journal entries to record interest expense on June 30, 2026, by each of the two approaches. 5. Assuming the market rate is still 12%, what price would a second investor pay the first investor on June 30, 2026, for $12,000 of the bonds? Note: Use tables, Excel, or a financial calculator. (FV of $1, PV of $1. FVA of $1, PVA of $1, FVAD of $1 and PVAD of $1) Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3 Required 5 Prepare an amortization schedule that determines interest at the effective interest rate. Note: Enter your answers in whole dollars.…arrow_forward

- A7arrow_forwardOmar Company issued a $140,000, 11%, 10-year bond payable at 97 on January 1, 2024 Interest is paid semiannually on January 1 and July 1 Read the requirements Requirement 1. Journalize the issuance of the bond payable on January 1, 2024 (Record debits first, then credits Select explanations on the last line of the journal entry.) Date Accounts and Explanation Debit Credit 2024 Jan. 1arrow_forwardOn August 1, 2022, Bramble Corp. issued $482,400, 8%, 10-year bonds at face value. Interest is payable annually on August 1. Bramble’s year-end is December 31. Prepare the journal entry to record the issuance of the bonds. (Credit account titles are automatically indented when amount is entered. Do not indent manually.) Date Account Titles and Explanation Debit Credit Aug. 1 enter an account title to record the issuance of the bonds on August 1 enter a debit amount enter a credit amount enter an account title to record the issuance of the bonds on August 1 enter a debit amount enter a credit amount eTextbook and Media List of Accounts Prepare the journal entry to record the accrual of interest on December 31, 2022. (Credit account titles are automatically indented when amount is entered. Do not indent manually.) Date Account Titles and Explanation Debit Credit Dec. 31 enter an…arrow_forward

- Legacy issues $660,000 of 5.5%, four-year bonds dated January 1, 2019, that pay interest semiannually on June 30 and December 31. They are issued at $648,412 when the market rate is 6%. Problem 14-4A Part 4 4. Prepare the journal entries to record the first two interest payments. Record the interest payment and amortization on June 30. Record the interest payment and amortization on December 31.arrow_forwardPB6. 13.3 Edward Inc. issued bonds with a $500,000 face value, 10% interest rate, and a 4-year term on July 1, 2018 and received $480,000. Interest is payable semiannually. The discount is amortized using the straightline method. Prepare journal entries for the following transactions. A. July 1, 2018: entry to record issuing the bonds B. Dec. 31, 2018: entry to record payment of interest to bondholders C. Dec. 31, 2018: entry to record amortization of discountarrow_forwardLandings Glassware Company issues $1,066,000 of 16%, 10 – year bonds at 94 on February 28, 2025. The bonds pay interest on February 28 and August 31. The journal entry to record the issuance includes a O A. credit to Discount on Bonds Payable for $63,960 O B. credit to Bonds Payable for $1,002,040 O C. debit to Cash for $1,066,000 O D. debit to Cash for $1,002,040arrow_forward

- H1.arrow_forwardABC company issued a 5 year $200,000 bond. The bond has a stated rate of 6% and the market rate of 8%. The company issued the bond at .91889 or $183,778 on January 1", 2019. AMORTIZATION OF BOND DISCOUNT st H J K Interest on Cash Interest Amortization Carrying Value (K + J) Carrying Year Payment. of Discount. Date Description Debit Credit Value. (A * D) (I - H) (K * E) Jan 1 2019 Jan 1, 2019 June 30, 2019 December 31, 2019 June 30, 2020 December 31, 2020 June 30, 2021 December 31, 2021 June 30, 2022 December 31, 2022 June 30, 2023 December 31, 2023 June 30, 2019 Dec 31, 2019 June 30, 2020 A Bond Par Value Discount on Bond Payable B Coupon Rate Jan 1, 2019 June 30, 2,019 Market Rate Dec 31, 2019 Dec 31, 2020 6month coupon rate (B/2) 6 month market rate (C/2) D June 30, 2020 E Dec 31, 2020 Money Received Discount (A-F) F Dec 31,2023arrow_forwardAn accounting example: Otter Products inc issued bonds on January 1, 2019. Interest to be paid semi-annually. Term in years is 2; Face value of bonds issued is $200,000; Issue Price $206,000; Specified Interest Rate each payment period is 6% Question. Calculate a. the amount of interest paid in cash every payment period. b. The amount of amortization to be recorded at each interest payment date (use straight-line method) c. complete amoritzation table by calculating interest expense and beginning and ending bond carrying amounts at the each period over 2 years. The term is for 2 years however 3 years is showing on the workbook. How do I calcuate the 3rd year if the problem only says the term is 2 years?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education