Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

P3-20 a. and b.

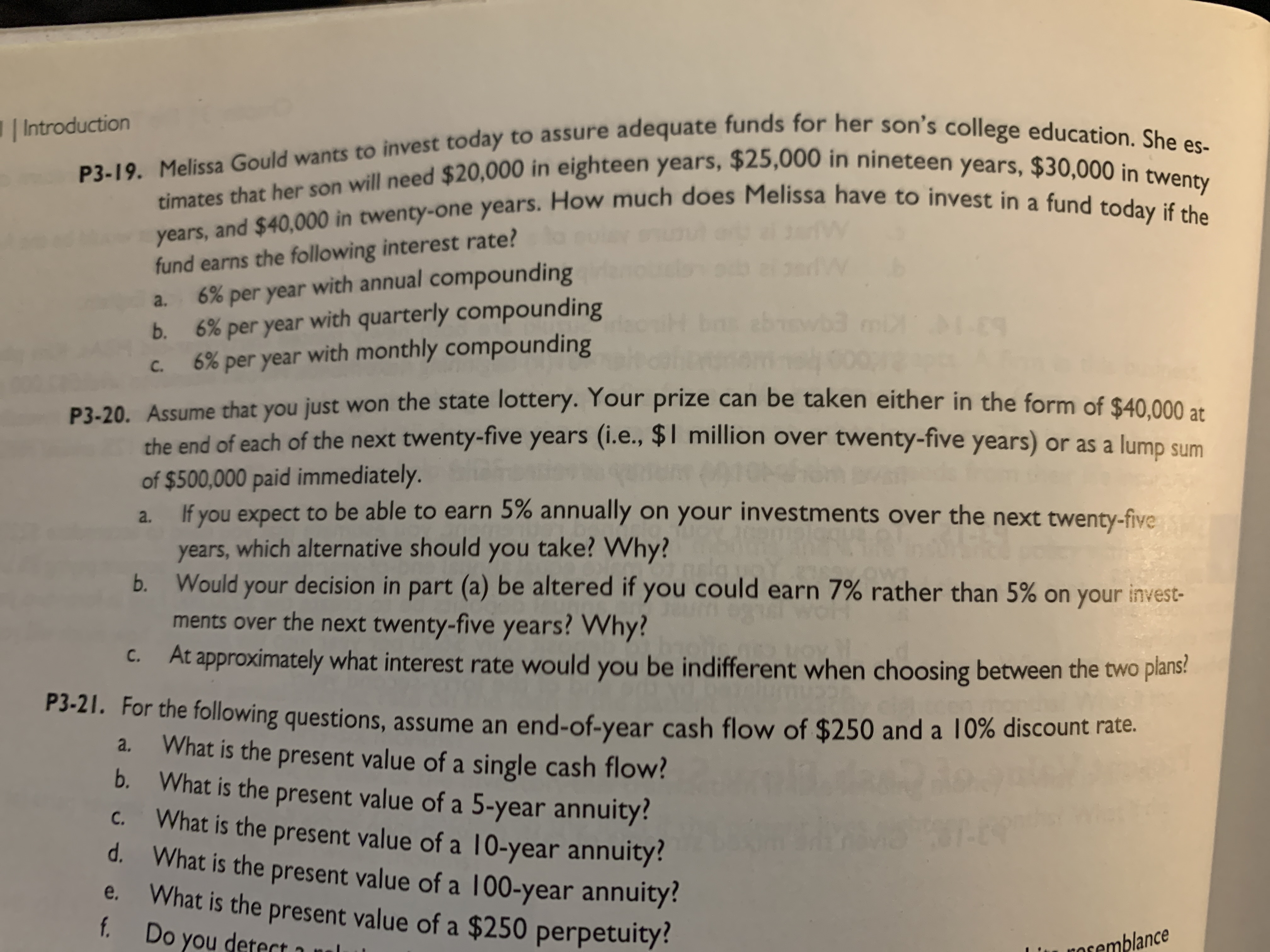

Transcribed Image Text:P3-20. Assume that you just won the state lottery. Your prize can be taken either in the form of $40,000 at

the end of each of the next twenty-five years (i.e., $1 million over twenty-five years) or as a lump sum

of $500,000 paid immediately.

If you expect to be able to earn 5% annually on your investments over the next twenty-five

a.

years, which alternative should you take? Why?

Would your decision in part (a) be altered if you could earn 7% rather than 5% on your invest-

ments over the next twenty-five years? Why?

Expert Solution

arrow_forward

Step 1

A concept that implies the future worth of the money is lower than its current value due to several factors such as inflation, and many more is term as the TVM (time value of money).

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Consider a project with an initial investment of $300,000, which must befinanced at an interest rate of l2% per year. Assuming that the required repayment period is six years, determine the repayment schedule by identifying the principal as well as the interest payments for each of the following repayment methods:(a) Equal repayment of the principal: $50,000 principal payment each year(b) Equal repayment of the interest: $36,000 interest payment each year(c) Equal annual installments: $72,968 each yeararrow_forwardA company is considering an iron ore extraction project that requires an initial investment of $508,000 and will yield annual cash inflows of $152,000 for four years. The company's discount rate is 9%. What is the NPV of the project? Present value of an ordinary annuity of $1: 8% 9% 10% 1 2 3 4 5 6 7 8 0.926 1.783 2.577 3.312 3.993 4.623 5.206 5.747 OA $101,600 OB. $15,520 OC. $(15,520) OD. $(101,000) 0.917 1.759 2.531 3.24 3.89 4.486 5.033 5.535 0.909 1.736 2.487 3.17 3.791 4.355 4.668 5.335arrow_forwardIf the difference between current assets and current liabilities is 94.2, bill payable 169.9, creditors 30, prepaid expenses 10, then what is the total current assets? Select one: O a. 294.10 O b. 304.10 O c. 209.90 O d. All the given choices are not correct O e. 124.20arrow_forward

- Nn. 115.arrow_forward9. What is the capital balance of Tak at December 31, 20x2? 28 A a. P180,000 b. P170,000 c. P165,000 d. Not given SIXOS mot and 100 to stile si 10. What is the capital balance of Gu at December 31, 20x2? a. P220,000 b. P215,000 c. P200,000 d. Not given 007 0902 3 nevig Vo ordub juongoro att mi to side odd ei four we 17 000.08 I s 000.079 000/03/1 8arrow_forwardA company that was to be liquidated had the following liabilities: Income Taxes Notes Payable secured by land Accounts Payable $ 15,000 120,000 48,000 Salaries Payable ($18,000 for Employee #1 and $5,000 for Employee #2) Administrative expenses for liquidation The company had the following assets: 23,000 Current Assets Land Building Saved 25,000 Book Fair Value Value $130,000 $115,000 60,000 100,000 175,000 220,000 Total liabilities with priority are calculated to be what amount? Multiple Choice О $106,650. $38,000.arrow_forward

- Items 23 through 25 are based on the following data: The January 31, 2020 balance sheet of Miko Corporation shows the following information: P8,000 Cash for 38,000 Accounts receivable (net of allowance uncollectible accounts of P2,000) 16,000 Inventory 40,000 Property, plant and equipment (net of allowance for accumulated depreciation of P60,000) P102,000 Total assets P82,500 Accounts payable Ordinary shares Retained earnings (deficit) Total liabilities and stockholder's equity 50,000 (30,500) P102,000 Additional information: Sales are budgeted as follows: February P110,000 March 120,000 Collections are expected to be 60% in the month of sale, 38% the next month, and 2% uncollectible. The gross margin is 25% sales. Purchases each month are 75% of the next month's projected sales. The purchases are paid in full the following month. o Other expenses for each month, paid in cash, are expected to be P16,500. Depreciation each month is P5,000.arrow_forwardote: Total Aet-Cuat linbiwbe Accumulated fundo tthistoation: The recepts and gagmetsalleunte of Liar c for the you Balane If Sub saptindn knded 2lst Delamt 1999 Wee ce Inserrance Rate l,000 ting 3,650 L, 700 600 Glavenalerpanes 6itor Reut fnnitume Sought lana /d 27,250 Sonatins 8,500 8,150 7,80 2,St0 27250 The fillowing nformetim Rates were 3600 2,F00 popaid Geneal Raputes prepaid Doo Raut Buing Subsaptim in Qureas 100 75 Foo 600 The foced assets funituns Cnd fifting Premies bepreciate thu Asets as at Ist jan 999 were; at1,500 A5,00 by o pepare; Youre veequired to Statemat of affats - m Come and"copenditwe allounts 2 Balane sheetas at 3lst Delember 1999,arrow_forwardAssume that USD 1 is equal to JPY 98.56 and also equal to CAD 1.22. Based on this, the CROSS-RATE is:arrow_forward

- 24 If K.mart.CO total assets is 600000, and total liabilities 400000, and goodwill 20000. Compute the identifiable net assets. Select one: a. 180000. b. 200000. c. 220000. d. 240000.arrow_forwardEB12. LO 5.3 Using the following Balance Sheet summary information, calculate for the two years presented: A. working capital B. current ratio Current assets Current liabilities 12/31/2018 $366,500 120,000 12/31/2019 $132,000 141,500arrow_forwardQ:Compute the present value of each stream if the discount rate is 14 percent.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education