FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

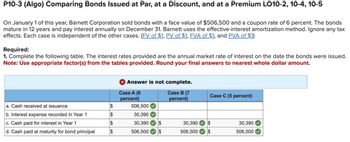

Transcribed Image Text:P10-3 (Algo) Comparing Bonds Issued at Par, at a Discount, and at a Premium LO10-2, 10-4, 10-5

On January 1 of this year, Barnett Corporation sold bonds with a face value of $506,500 and a coupon rate of 6 percent. The bonds

mature in 12 years and pay interest annually on December 31. Barnett uses the effective-interest amortization method. Ignore any tax

effects. Each case is independent of the other cases. (FV of $1, PV of $1, FVA of $1, and PVA of $1)

Required:

1. Complete the following table. The interest rates provided are the annual market rate of interest on the date the bonds were issued.

Note: Use appropriate factor(s) from the tables provided. Round your final answers to nearest whole dollar amount.

a. Cash received at issuance

b. Interest expense recorded in Year 1

c. Cash paid for interest in Year 1

d. Cash paid at maturity for bond principal

$

$

$

$

X Answer is not complete.

Case A (6

Case B (7

percent)

percent)

506,500

30,390

30,390 $

506,500 $

Case C (5 percent)

30,390 $

$

506,500

30,390

506,500

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Similar questions

- Do not give answer in image formatearrow_forwardM10-11 (Algo) Recording the Issuance and Interest Payments of a Bond Issued at a Discount (Straight- Line Amortization with a Discount Account) LO10-4 Wefald Company sold bonds with a face value of $608,000 for $562,000. The bonds have a coupon rate of 6 percent, mature in 5 years, and pay interest semiannually every June 30 and December 31. All of the bonds were sold on January 1 of this year. Using a discount account, record the sale of the bonds on January 1 and the payment of interest on June 30 of this year. Wefald uses the straight-line amortization method. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Round your final answers to nearest whole dollar amounts.) View transaction list Journal entry worksheet 1 2 Record the sale of the bonds on January 1. Note: Enter debits before credits. Date January 01 Record entry General Journal Clear entry Debit Credit View general journal >arrow_forwardnot use ai pleasearrow_forward

- P10-8 (Static) (Chapter Supplement) Recording and Reporting a Bond Issued at a Discount (without Discount Account) LO10-4 [The following information applies to the questions displayed below.] Claire Corporation is planning to issue bonds with a face value of $100,000 and a coupon rate of 8 percent. The bonds mature in two years and pay interest quarterly every March 31, June 30, September 30, and December 31. All of the bonds were sold on January 1 of this year. Claire uses the effective-interest amortization method and does not use a discount account. Assume an annual market rate of interest of 12 percent. (FV of $1, PV of $1, FVA of $1, and PVA of $1) Note: Use appropriate factor(s) from the tables provided. P10-8 Part 2 2. Provide the journal entry to record the interest payment on March 31, June 30, September 30, and December 31 of this year. Note: If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Round your final…arrow_forwardRequired Information P10-10 (Algo) Preparing a Bond Amortization Schedule for a Bond Issued at a Premium LO10-5 [The following information applies to the questions displayed below.] On January 1 of this year, Olive Corporation issued bonds. Interest is payable once a year on December 31. The bonds mature at the end of four years. Olive uses the effective-interest amortization method. The partially completed amortization schedule below pertains to the bonds: Interest $ 1,661 ? ? 1,640 Date January 1, Year 1 End of Year 1 End of Year 2 End of Year 3 End of Year 4 -10-10 Part 3 Cash $ 1,792 ? ? Cash received ? Amortization $ 131 ? 145 ? Balance 32,566 32,435 32,297 ? 32,000 $ . How much cash was received on the day the bonds were issued (sold)?arrow_forwardSunland Ltd. has issued bonds that never require the principal amount to be repaid to investors. Correspondingly, Sunland must make interest payments into the infinite future. If the bondholders receive annual payments of $94 and the current price of the bonds is $1,000.00. Your Answer Correct Answer What is the pre-tax cost of this debt? (Round answer to 2 decimal places, e.g. 15.25%.) Pre-tax cost of debt eTextbook and Media Your Answer Correct Answer do % What is the after-tax cost of this debt for Sunland if the firm is in the 40 percent marginal tax rate? (Round intermediate calculations to 4 decimal places, e.g. 1.2514 and final answer to 2 decimal places, e.g. 15.25%.)arrow_forward

- The existing 10 year, 6% bonds are trading in the market at $900. The corporate tax rate is 32% After-tax interest rate = YTM (1-T) 2a. Calculate the interest rate for the new bonds. 2b.What is the after-tax interest rate for the new bonds?arrow_forwardPresent entries to record the selected transactions described below: a. Issued $2,750,000 of 10-year, 8% bonds at 97. If an amount box does not require an entry, leave it blank. b. Amortized bond discount for a full year, using the straight-line method. If an amount box does not require an entry, leave it blank. c. Called bonds at 98. Assume the bonds were carried at $2,692,250 at the time of the redemption. If an amount box does not require an entry, leave it blank.arrow_forwardPlease correct answer and don't use hend raiting this questionarrow_forward

- Please do not give solution in image format ?arrow_forwardP10-6 (Algo) Recording and Reporting Bonds Issued at a Discount LO10-4 [The following information applies to the questions displayed below.] PowerTap Utilities is planning to issue bonds with a face value of $2,300,000 and a coupon rate of 7 percent. The bonds mature in 10 years and pay interest semiannually every June 30 and December 31. All of the bonds were sold on January 1 of this year. PowerTap uses the effective-interest amortization method. Assume an annual market rate of interest of 8 percent. (FV of $1, PV of $1, FVA of $1, and PVA of $1) Note: Use appropriate factor(s) from the tables provided. P10-6 Part 2 2. What amount of interest expense should be recorded on June 30 and December 31 of this year? Note: Round your final answers to nearest whole dollar amount. Interest expense > Answer is complete but not entirely correct. $ June 30 41,988 × $ December 31 43,528arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education