FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

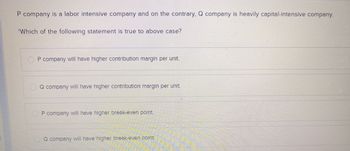

Transcribed Image Text:P company is a labor intensive company and on the contrary, Q company is heavily capital-intensive company.

'Which of the following statement is true to above case?

P company will have higher contribution margin per unit.

Q company will have higher contribution margin per unit.

P company will have higher break-even point.

Q company will have higher break-even point.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- 11. A primary objective in measuring productivity is to improve operations either by using fewer inputs to produce the same output, or to produce: a. More quickly. b. With fewer constraints. c. More outputs with the same inputs. d. More outputs with more inputs. 12. Which one of the following refers to the firm's ability to pay its current operating expenses and maturing debt? a. Discounted cash flow. b. Liquidity. c. Profitability.S d. Purchasing power.arrow_forwardA high operating margin implies that ______________ . The company is in a better position to increase its finance cost The company is in a better position to absorb the finance cost The company is in a better position to reduce its overheads The company is in a better position to increase its pricesarrow_forwardAll else being equal, a company like Wally World Theme Park which has a high operating leverage, will have relatively high variable costs. relatively high contribution margin ratio. relatively low fixed costs. relatively low risk.arrow_forward

- 10..arrow_forwardyou are the owner of a firm, and your firm is experiencing "economies of scale" in production. If this is the case, will the average total cost increase, decrease or remain unchanged as you increase the level of output?arrow_forwardThe lower the MARR (minimum attractive rate of return), the higher the price that a company should be willing to pay for equipment that reduces annual operating expenses. A) True (B) Falsearrow_forward

- In general, a firm with low operating leverage also has a small proportion of its total costs in the form of variable costs. T/F True Falsearrow_forwardA firm can reduce its breakeven volume by: decreasing fixed costs. B) decreasing contribution margin. Jy C increasing variable costs. lowering selling price.arrow_forwardConsider the following statements: 1. Businesses that are capital intensive tend to have high operating gearing. 2. Businesses with relatively high total variable cost compared with their total fixed cost, at their normal level of activity, are said to have high operating gearing. Are the above statements true or false?arrow_forward

- Which of the following statements about operating leverage is NOT true? Group of answer choices Operating leverage predicts the effect of fixed costs on operating income when sales volume changes. A higher proportion of fixed cost in a cost structure results in higher operating leverage. The higher the operating leverage, the higher the risk of loss when sales volume decreases. A higher proportion of fixed cost in a cost structure results in lower operating leverage.arrow_forward(7.10) For a given level of output, DOL (increases/decreases/remains constant) as the size of the increase in Q increases. When the base level of Q increase, the DOL (increases/decreases/remains constant). A capital-intensive production process has a (higher/lower) DOL than a less capital-intensive process, so that OCF and NPV increase (more/less) rapidly with an increase in sales; if sales are below the forecasted level, then NPV decreases (more/less) rapidly for the capital-intensive process. goitsarrow_forwardDegree of operating leverage (DOL) measures the sensitivity of OCF in response to changes of The higher the DOL, the the volatility of a firm's operating income. Select one: a. sales quantity; lower O b. sales quantity; higher O c. fixed costs; lower O d. fixed costs; higher O e. variable costs; higherarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education