Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

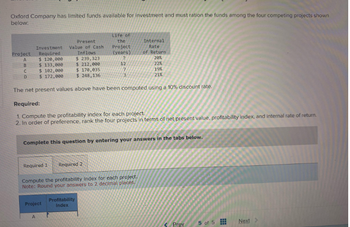

Transcribed Image Text:Oxford Company has limited funds available for investment and must ration the funds among the four competing projects shown

below:

Project Required

A

Inflows

$ 120,000

$ 239,323

$ 133,000

$ 212,000

$ 102,000

$ 170,035

$ 172,000

$ 248,136

The net present values above have been computed using a 10% discount rate.

Required:

1. Compute the profitability index for each project.

2. In order of preference, rank the four projects in terms of net present value, profitability index, and internal rate of return.

B

Present

Investment Value of Cash

C

D

Required 1 Required 2

Life of

the

Project

(years)

7

12

7

Complete this question by entering your answers in the tabs below.

Project

A

Compute the profitability Index for each project.

Note: Round your answers to 2 decimal places.

3

Profitability

Index

Internal

Rate

of Return

20%

22%

19%

21%

Prev

5 of 5

www

Next

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Similar questions

- Oxford Company has limited funds available for investment and must ration the funds among five competing projects. Selected information on the five projects follows: Project InvestmentRequired NetPresentValue Life of theProject(years) A $ 480,000 $ 132,969 7 B 405,000 126,000 12 C 300,000 105,105 7 D 525,000 114,408 3 E 450,000 (26,088 ) 6 The net present values above have been computed using a 10% discount rate. The company wants your assistance in determining which project to accept first, which to accept second, and so on. Required: 1. Compute the profitability index for each project. (Round your answers to 2 decimal places.) 2. In order of preference, rank the five projects in terms of (a) net present value, (b) profitability index.arrow_forwardd) ALMOND Company is considering two important proposals with the following cash flows. Project A Project B Period (Year) Cost (Initial Net cash flow Cost (Initial Outlay) Net cash flow Outlay) 0 $45,000 $60,000 1 $25,000 $24,000 2 $20,000 $25,000 3 $15,000 $30,000 For each project, compute its net present value using a discount rate of 15%. Which project should be accepted if the projects are mutually exclusive?arrow_forwardDuo Corporation is evaluating a project with the following cash flows: Year 0 1 2 3 4 5 Cash Flow -$ 15,300 6,400 7,600 7,200 6,000 -3, 400 The company uses an interest rate of 9 percent on all of its projects. Calculate the MIRR of the project using all three methods. Note: Do not round intermediate calculations and enter your answers as a percent rounded to 2 decimal places, e.g., 32.16. Discounting approach Reinvestment approach Combination approach % % %arrow_forward

- Crenshaw Enterprises has gathered projected cash flows for two projects. Year Project Project J 0 1234 -$260,000-$260,000 114,000 105,000 89,000 78,000 91,000 100,000 a. Interest rate b. 102,000 109,000 a. At what interest rate would the company be indifferent between the two projects? (Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.) b. Which project is better if the required return is above this interest rate? do %arrow_forwardCompute the IRR statistic for Project E. The appropriate cost of capital is 7 percent. (Do not round intermediate calculations and round your final answer to 2 decimal places.) Project E Time: 0 1 2 3 4 5 Cash flow −$3,600 $1,110 $1,050 $900 $680 $480 Should the project be accepted or rejected?multiple choice rejected acceptedarrow_forwardNonearrow_forward

- please answer allarrow_forwardCompute the NPV statistic for Project U if the appropriate cost of capital is 11 percent. (Negative amount should be indicated by a minus sign. Do not round intermediate calculations and roundyour final answer to 2 decimal places.) Project U Time: 0 1 2 3 4 5 Cash flow: -$2, 500 $750 $2, 480 -$720 $700 -$300arrow_forwardMonroe, Inc., is evaluating a project. The company uses a 13.8 percent discount rate for this project. Cost and cash flows are shown in the table. What is the NPV of the project? Year0 ($11,368,000)1 $2,112,5892 $3,787,5523 $3,300,6504 $4,115,8995. $ 4,556,424 Round to two decimal places. For year 0 , its initial investment .arrow_forward

- Compute the IRR statistic for Project E. The appropriate cost of capital is 8 percent. (Do not round intermediate calculations and round your final answer to 2 decimal places.) Project E Time: 0 1 2 3 4 5 Cash flow -$1,900 $710 $750 $700 $480 $280 IRR % 90 Should the project be accepted or rejected? O accepted O rejectedarrow_forwardCompute the MIRR statistic for Project I if the appropriate cost of capital is 13 percent. (Do not round intermediate calculations and round your final answer to 2 decimal places.) Project I Time: Cash flow: MIRR -$11,200 rejected O accepted 1 $5,430 % 2 $4,280 Should the project be accepted or rejected? 3 $1,620 $2,100arrow_forwardCompute the IRR statistic for Project F. The appropriate cost of capital is 12 percent. Note: Do not round intermediate calculations and round your final answer to 2 decimal places. Project F Time: 01234 Cash flow: -$11,000 $ 3,350 $ 4,180 $ 1,520 $2,000 Should the project be accepted or rejected?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education