FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

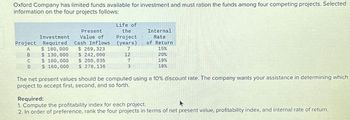

Transcribed Image Text:Oxford Company has limited funds available for investment and must ration the funds among four competing projects. Selected

information on the four projects follows:

Present

Value of

Investment

Project Required

Cash Inflows

A

$ 180,000

$ 269,323

B

$ 130,000

$ 242,000

C

$ 100,000

$ 200,035

D

$ 160,000 $ 278,136

Life of

the

Project

(years)

7

12

7

3

Internal

Rate

of Return

15%

20%

19%

18%

The net present values should be computed using a 10% discount rate. The company wants your assistance in determining which

project to accept first, second, and so forth.

Required:

1. Compute the profitability index for each project.

A

2. In order of preference, rank the four projects in terms of net present value, profitability index, and internal rate of return.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Similar questions

- Following is information on two alternative investments projects being considered by Tiger Company. The company requires a 15% return from its investments. (PV of $1, FV of $1, PVA of $1, and FVA of $1) (Use appropriate factor(s) from the tables provided.) Project X1 Initial investment $ (100,000) Net cash flows in: Year 1 37,000 Year 2 Year 3 47,500 72,500 Project X2 $ (150,000) 78,000 68,000 58,000 a. Compute each project's net present value. b. Compute each project's profitability index. If the company can choose only one project, which should it choose on th basis of profitability index? Complete this question by entering your answers in the tabs below. Required A Required B Compute each project's net present value. (Round your answers to the nearest whole dollar.) Net Cash Present Value of Present Value of Flows 1 at 15% Net Cash Flows Project X1 Year 1 Year 2 Year 3 Totals Initial investment Net present value $ 0 $ 0 $ 0 Project X2 Year 1 Year 2 Year 3 Totals $ 0 $ EA Initial…arrow_forwardQuestion: Altro Corporation is considering the following three investment projects: Project R Project S Project T Investment required $33,000 Present value of cash inflows $33,333 Required: $40,000 $46,800 $97,000 $112,520 Rank the projects according to the profitability index, from most profitable to least profitable. (Ignore income taxes in this problem)arrow_forwardCrenshaw Enterprises has gathered projected cash flows for two projects. Year Project Project J 0 1234 -$260,000-$260,000 114,000 105,000 89,000 78,000 91,000 100,000 a. Interest rate b. 102,000 109,000 a. At what interest rate would the company be indifferent between the two projects? (Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.) b. Which project is better if the required return is above this interest rate? do %arrow_forward

- Following is information on two alternative investment projects being considered by Tiger Company. The company requires a 4% return from its investments. (PV of $1, FV of $1, PVA of $1, and FVA of $1) Note: Use appropriate factor(s) from the tables provided. Initial investment Project X1 $ (80,000) Project X2 $ (120,000) Net cash flows in: Year 1 25,000 60,000 Year 2 Year 3 35,500 50,000 60,500 40,000 a. Compute each project's net present value. b. Compute each project's profitability index. c. If the company can choose only one project, which should it choose on the basis of profitability index? Complete this question by entering your answers in the tabs below. Required A Required B Required C Compute each project's net present value. Net Cash Flows Present Value of Present Value of Net 1 at 4% Cash Flows Project X1 Year 1 $ 25,000 Year 2 35,500 Year 3 60,500 0.8890 Totals $ 121,000 $ 0 Initial investment (80,000) Net present value $ (80,000) Project X2 Year 1 Year 2 Year 3 Totals…arrow_forwardDo not provide answer in image formatarrow_forwardYear 0 ($100,000)-Project Outlay (The bracket indicates a negative figure) Year 1 Year 2 Year 3 Year 4 Year 5 $ 18,000 $ 18,000 $18,000 $18,000 $ 18,000 Assume that cash flows are reinvested at the rate of 10%, compounded annually. Calculate the Modified Internal Rate of Return (MIRR) on this project. (Note that n=5) a 18.96% b 18% c 15.98% d 19.2%arrow_forward

- The management of Riker Inc. is exploring five different investment opportunities. Information on the five projects under study follow Project Number Investment required Present value of cash inflows at a 10% discount rate Net present value Life of the project Project 1 2 3 4 5 Profitability Index 1 2 3 $(390,000) $(330,000) $(350,000) 478,490 396,950 $ 88,490 $ 66,950 6 years 3 years First preference Second preference 433,190 $ (83,190) 5 years The company's required rate of return is 10%; thus, a 10% discount rate has been used in the preceding present value computations. Limited funds are available for investment, and so the company cannot accept all of the available projects. Third preference Fourth preference Fifth preference 4 $(330,000) Required: 1. Compute the profitability Index for each investment project. (Round your answers to 2 decimal places.) 300, 100 $ 29,900 12 years 5 $(480,000) 562,860 $82,860 6 years 2. Rank the five projects according to preference, in terms of (a)…arrow_forwardOxford Company has limited funds available for investment and must ration the funds among the four competing projects shown below: Project InvestmentRequired PresentValue of Cash Inflows Life oftheProject(years) InternalRateof Return A $ 170,000 $ 329,323 7 12% B $ 118,000 $ 302,000 12 17% C $ 105,000 $ 260,035 7 16% D $ 165,000 $ 338,136 3 15% The net present values above have been computed using a 10% discount rate. Required: Compute the profitability index for each project. In order of preference, rank the four projects in terms of net present value, profitability index, and internal rate of returnarrow_forwardPlease do not give solution in image format thankuarrow_forward

- A company is evaluating three possible investments. The following information is provided by the company: Project A Project B Project C Investment $238,000 $54,000 $238,000 Residual value 0 30,000 40,000 Net cash inflows: Year 1 70,000 30,000 100,000 Year 2 70,000 21,000 70,000 Year 3 70,000 17,000 80,000 Year 4 70,000 14,000 40,000 Year 5 70,000 0 0 What is the payback period for Project A? (Assume that the company uses the straight−line depreciation method.) (Round your answer to two decimal places.) A. 1.8 years B. 2.4 years C. 5.00 years D. 3.4 yearsarrow_forwardManshukharrow_forwardNonearrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education