Cornerstones of Cost Management (Cornerstones Series)

4th Edition

ISBN: 9781305970663

Author: Don R. Hansen, Maryanne M. Mowen

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

sanju

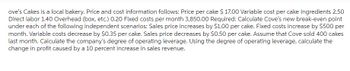

Transcribed Image Text:ove's Cakes is a local bakery. Price and cost information follows: Price per cake $ 17.00 Variable cost per cake Ingredients 2.50

Direct labor 1.40 Overhead (box, etc.) 0.20 Fixed costs per month 3,850.00 Required: Calculate Cove's new break-even point

under each of the following independent scenarios: Sales price increases by $1.00 per cake. Fixed costs increase by $500 per

month. Variable costs decrease by $0.35 per cake. Sales price decreases by $0.50 per cake. Assume that Cove sold 400 cakes

last month. Calculate the company's degree of operating leverage. Using the degree of operating leverage, calculate the

change in profit caused by a 10 percent increase in sales revenue.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps

Knowledge Booster

Similar questions

- Lotts Company produces and sells one product. The selling price is 10, and the unit variable cost is 6. Total fixed cost is 10,000. Required: 1. Prepare a CVP graph with Units Sold as the horizontal axis and Dollars as the vertical axis. Label the break-even point on the horizontal axis. 2. Prepare CVP graphs for each of the following independent scenarios: (a) Fixed cost increases by 5,000, (b) Unit variable cost increases to 7, (c) Unit selling price increases to 12, and (d) Fixed cost increases by 5,000 and unit variable cost is 7.arrow_forwardCove's Cakes is a local bakery. Price and cost information follows: Price per cake Variable cost per cake Ingredients Direct labor Overhead (box, etc.) Fixed costs per month Required: 1. Calculate Cove's new break-even point under each of the following independent scenarios: a. Sales price increases by $1.80 per cake. b. Fixed costs increase by $505 per month. c. Variable costs decrease by $0.37 per cake. $ 13.61 2.27 1.05 0.17 4,351.60 d. Sales price decreases by $0.50 per cake. 2. Assume that Cove sold 450 cakes last month. Calculate the company's degree of operating leverage. 3. Using the degree of operating leverage, calculate the change in profit caused by a 15 percent increase in sales revenue. Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3 Calculate Cove's new break-even point under each of the following independent scenarios: Note: Round your answers to the nearest whole number. 1a Salas nrice increases hy $1 A0 ner raka a.…arrow_forwardCove's Cakes is a local bakery. Price and cost information follows: Price per cake Variable cost per cake Ingredients Direct labor Overhead (box, etc.) Fixed costs per month Required: 1. Calculate Cove's new break-even point under each of the following independent scenarios: a. Sales price increases by $1.10 per cake. b. Fixed costs increase by $515 per month. c. Variable costs decrease by $0.30 per cake. d. Sales price decreases by $0.50 per cake. 2. Assume that Cove sold 485 cakes last month. Calculate the company's degree of operating leverage. 3. Using the degree of operating leverage, calculate the change in profit caused by a 9 percent increase in sales revenue. Required 1 $ 13.01 2.31 1.07 0.16 4,356.20 Complete this question by entering your answers in the tabs below. Required 2 Required 3 Calculate Cove's new break-even point under each of the following independent scenarios: Note: Round your answers to the nearest whole number. a. Sales price increases by $1.10 per cake. b.…arrow_forward

- Cove’s Cakes is a local bakery. Price and cost information follows: Price per cake $ 14.91 Variable cost per cake Ingredients 2.28 Direct labor 1.10 Overhead (box, etc.) 0.27 Fixed costs per month 3,828.40 Required: Calculate Cove’s new break-even point under each of the following independent scenarios: Sales price increases by $1.80 per cake. Fixed costs increase by $450 per month. Variable costs decrease by $0.33 per cake. Sales price decreases by $0.30 per cake. Assume that Cove sold 350 cakes last month. Calculate the company’s degree of operating leverage. Using the degree of operating leverage, calculate the change in profit caused by a 9 percent increase in sales revenue.arrow_forwardCove’s Cakes is a local bakery. Price and cost information follows: Price per cake $ 13.11 Variable cost per cake Ingredients 2.30 Direct labor 1.17 Overhead (box, etc.) 0.16 Fixed cost per month $ 3,602.40 Required: 1. Calculate Cove’s new break-even point under each of the following independent scenarios: a. Sales price increases by $1.50 per cake. b. Fixed costs increase by $475 per month. c. Variable costs decrease by $0.37 per cake. d. Sales price decreases by $0.50 per cake. 2. Assume that Cove sold 405 cakes last month. Calculate the company’s degree of operating leverage. 3. Using the degree of operating leverage, calculate the change in profit caused by a 11 percent increase in sales revenue. rev: 10_04_2019_QC_CS-184582 Next Visit question map Question4of7Total4 of 7 Prevarrow_forwardCove’s Cakes is a local bakery. Price and cost information follows: Price per cake $14.01 Variable cost per cake Ingredients 2.21 Direct labor 1.11 Overhead (box, etc.) 0.30 Fixed cost per month $4,156.00 Required: 1. Calculate Cove’s new break-even point under each of the following independent scenarios: a. Sales price increases by $1.50 per cake. b. Fixed costs increase by $515 per month. c. Variable costs decrease by $0.39 per cake. d. Sales price decreases by $0.60 per cake. 2. Assume that Cove sold 430 cakes last month. Calculate the company’s degree of operating leverage. 3. Using the degree of operating leverage, calculate the change in profit caused by a 15 percent increase in sales revenue.arrow_forward

- Cove’s Cakes is a local bakery. Price and cost information follows: Price per cake $ 13.21 Variable cost per cake Ingredients 2.31 Direct labor 1.07 Overhead (box, etc.) 0.23 Fixed cost per month $ 3,456.00 Required: 1. Calculate Cove’s new break-even point under each of the following independent scenarios: a. Sales price increases by $1.70 per cake. b. Fixed costs increase by $470 per month. c. Variable costs decrease by $0.39 per cake. d. Sales price decreases by $0.80 per cake. 2. Assume that Cove sold 380 cakes last month. Calculate the company’s degree of operating leverage. 3. Using the degree of operating leverage, calculate the change in profit caused by a 13 percent increase in sales revenue. Using the degree of operating leverage, calculate the change in profit caused by a 13 percent increase in sales revenue. (Round your intermediate values to 2 decimal places. (i.e. 0.1234 should be entered as 12.34%.)) I am having…arrow_forwardSaved Cove's Cakes is a local bakery. Price and cost information follows: Price per cake Variable cost per cake Ingredients Direct labor Overhead (box, etc.) Fixed cost per month $ 13.01 2.21 1.19 0.24 $4,216.50 Required: 1. Determine Cove's break-even point in units and sales dollars. 2. Determine the bakery's margin of safety if it currently sells 540 cakes per month. 3. Determine the number of cakes that Cove must sell to generate $2,500 in profit. Complete this question by entering your answers in the tabs below. es Required 1 Required 2 Required 3 EDetermino thearrow_forwardIzzy Ice Cream has the following price and cost information: Price per 2-scoop sundae Variable costs per sundae: Ingredients Direct labor Overhead Fixed costs per month Required: 1. Determine Izzy's break-even point in units and sales dollars. 2. Determine how many sundaes must be sold to generate a profit of $18,000. $5.00 3. Calculate Izzy's new break-even point in units for each of the following independent scenarios: a. Sales price decreases by $0.50. b. Fixed costs decrease by $300 per month. c. Variable costs increase by $0.50 per sundae. 4. Based on the original information, how many sundaes must Izzy sell to generate a profit of $50,000, if sales price increases by $0.50 and variable costs increase by $0.30? Required 1 Required 2 1.35 0.45 0.20 $ 9,000 Complete this question by entering your answers in the tabs below. Break-even units Break-even sales Required 3 Required 4 Determine Izzy's break-even point in units and sales dollars. sundaesarrow_forward

- Cove's Cakes is a local bakery. Price and cost information follows: Price per cake Variable cost per cake Ingredients Direct labor Overhead (box, etc.) Fixed cost per month $ 14.41 2.24 1.16 0.25 $4,842.00 Required: 1. Determine Cove's break-even point in units and sales dollars. 2. Determine the bakery's margin of safety if it currently sells 540 cakes per month. 3. Determine the number of cakes that Cove must sell to generate $2,100 in profit. tAarrow_forwardCove's Cakes is a local bakery. Price and cost information follows: Price per cake Variable cost per cake Ingredients Direct labor Overhead (box, etc.) Fixed costs per month Required: 1. Determine Cove's break-even point in units and sales dollars. 2. Determine the bakery's margin of safety in sales dollars if it currently sells 360 cakes per month. 3. Determine the number of cakes that Cove must sell to generate $1,900 in profit. Required 1 Required 2 $13.81 Complete this question by entering your answers in the tabs below. 2.28 1.07 0.14 3,302.40 Required 3 Break-Even Units Break-Even Sales Dollars Determine Cove's break-even point in units and sales dollars. Note: Round your Break-Even Units answer to the nearest whole number. Round your other intermediate cal sales dollars answer to 2 decimal places. Cakesarrow_forwardCove's Cakes is a local bakery. Price and cost information follows: Price per cake Variable cost per cake Ingredients Direct labor Overhead (box, etc.) Fixed costs per month $ 14.01 2.25 1.06 0.12 4,443.60 Required: 1. Determine Cove's break-even point in units and sales dollars. 2. Determine the bakery's margin of safety in sales dollars if it currently sells 520 cakes per month. 3. Determine the number of cakes that Cove must sell to generate $2,000 in profit.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...

Accounting

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...

Accounting

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Cengage Learning