Principles of Accounting Volume 1

19th Edition

ISBN: 9781947172685

Author: OpenStax

Publisher: OpenStax College

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

Please provide me with a correct answer

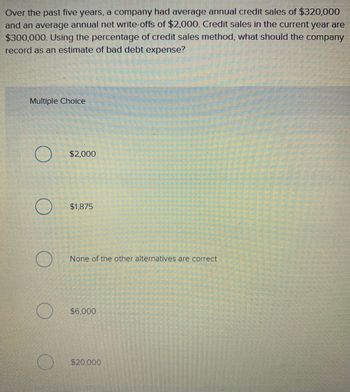

Transcribed Image Text:Over the past five years, a company had average annual credit sales of $320,000

and an average annual net write-offs of $2,000. Credit sales in the current year are

$300,000. Using the percentage of credit sales method, what should the company

record as an estimate of bad debt expense?

Multiple Choice

$2,000

$1,875

None of the other alternatives are correct

$6,000

$20,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 4 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Aerospace Electronics reports $567,000 in credit sales for 2018 and $632,500 in 2019. They have a $499,000 accounts receivable balance at the end of 2018, and $600,000 at the end of 2019. Aerospace uses the income statement method to record bad debt estimation at 5% during 2018. To manage earnings more favorably, Aerospace changes bad debt estimation to the balance sheet method at 7% during 2019. A. Determine the bad debt estimation for 2018. B. Determine the bad debt estimation for 2019. C. Describe a benefit to Aerospace Electronics in 2019 as a result of its earnings management.arrow_forwardDoer Company reports year-end credit sales in the amount of $390,000 and accounts receivable of $85,500. Doer uses the income statement method to report bad debt estimation. The estimation percentage is 3.5%. What is the estimated balance uncollectible using the income statement method? A. $13,650 B. $2,992.50 C. $136,500 D. $29,925arrow_forwardTonis Tech Shop has total credit sales for the year of 170,000 and estimates that 3% of its credit sales will be uncollectible. Allowance for Doubtful Accounts has a credit balance of 275. Prepare the adjusting entry at year-end for the estimated bad debt expense. (a) Based on an aging of its accounts receivable, Kyles Cyclery estimates that 3,200 of its year-end accounts receivable will be uncollectible. Allowance for Doubtful Accounts has a debit balance of 280 at year-end. Prepare the adjusting entry at year-end for the estimated uncollectible accounts.arrow_forward

- Michelle Company reports $345,000 in credit sales and $267,500 in accounts receivable at the end of 2019. Michelle currently uses the income statement method to record bad debt estimation at 4%. To manage earnings more efficiently, Michelle changes bed debt estimation to the balance sheet method at 4%. How much is the difference in net income between the income statement and balance sheet methods? A. $3,100 B. $13,800 C. $10,700 D. $77,500arrow_forwardAt the end of 20-3, Martel Co. had 410,000 in Accounts Receivable and a credit balance of 300 in Allowance for Doubtful Accounts. Martel has now been in business for three years and wants to base its estimate of uncollectible accounts on its own experience. Assume that Martel Co.s adjusting entry for uncollectible accounts on December 31, 20-2, was a debit to Bad Debt Expense and a credit to Allowance for Doubtful Accounts of 25,000. (a) Estimate Martels uncollectible accounts percentage based on its actual bad debt experience during the past two years. (b) Prepare the adjusting entry on December 31, 20-3, for Martel Co.s uncollectible accounts.arrow_forwardMcKinney Co. estimates its uncollectible accounts as a percentage of credit sales. McKinney made credit sales of 1,500,000 in 2019. McKinney estimates 2.5% of its sales will be uncollectible. Prepare the journal entry to record bad debt expense for McKinney at the end of 2019.arrow_forward

- Jars Plus recorded $861,430 in credit sales for the year and $488,000 in accounts receivable. The uncollectible percentage is 2.3% for the income statement method, and 3.6% for the balance sheet method. A. Record the year-end adjusting entry for 2018 bad debt using the income statement method. B. Record the year-end adjusting entry for 2018 bad debt using the balance sheet method. C. Assume there was a previous debit balance in Allowance for Doubtful Accounts of $10,220, record the year-end entry for bad debt using the income statement method, and then the entry using the balance sheet method. D. Assume there was a previous credit balance in Allowance for Doubtful Accounts of $5,470, record the year-end entry for bad debt using the income statement method, and then the entry using the balance sheet method.arrow_forwardTheon Company has $4,000,000 of sales and $200,000 of accounts receivable for the year. The company estimates 2% of its sales will become uncollectible. If Allowance for Doubtful Accounts has a $900 credit balance, the adjustment to record uncollectible accounts for the period will require a debit to bad debt expense for: Group of answer choices $79,100 $80,000 $3,100 $80,900arrow_forwardGilmore Electronics had the following data for a recent year:Cash sales $135,000Credit sales 512,000Accounts receivable determined to be uncollectible 9,650The firm’s estimated rate for bad debts is 2.2% of credit sales Required:1. Prepare the journal entry to write off the uncollectible accounts.2. Prepare the journal entry to record the estimate of bad debt expense.3. If Gilmore had written off $3,000 of receivables as uncollectible during the year, how much would bad debt expense reported on the income statement have changed?4. CONCEPTUAL CONNECTION If Gilmore’s estimate of bad debts is correct (2.2% of credit sales) and the gross margin is 20%, by how much did Gilmore’s income from operationsincrease assuming $150,000 of the sales would have been lost if credit sales were not offered?arrow_forward

- Superior Company has provided you with the following information before any year-end adjustments: Net credit sales are $125,000. Historical percentage of credit losses is 3%. Allowance for doubtful accounts has a credit balance of $400. Accounts receivables ending balance is $57,000. What is the estimated bad debt expense using the percentage of credit sales method? Multiple Choice $4,150. $3,750. $3,350. $1,710. ext > < Prev 19 of 67 MacBook Air ...arrow_forwardLouise Company has the following balances: Net Credit Sales $ 1,200,000 Accounts Receivable 240,000 Allowance for Doubtful Accounts (beginning balance) 3,000 Uncollectible accounts are estimated to be 6% of the receivables balance. Given this information, what is the company’s estimated bad debt expense for the year?arrow_forwardNiles Co. has the following data related to an item of inventory: Inventory, March 1 Purchase, March 7 400 units @ $2.10 1,400 units @ $2.20 Purchase, March 16 280 units @ $2.25 Inventory, March 31 520 units The value assigned to cost of goods sold if Niles uses FIFO with periodic inventory is Select one: A. $1,104. • B. $3,448. O C. $1,160. D. $3,392.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

- Principles of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,  Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:9781947172685

Author:OpenStax

Publisher:OpenStax College

Cornerstones of Financial Accounting

Accounting

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:9781337794756

Author:HEINTZ, James A.

Publisher:Cengage Learning,

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:Cengage Learning