FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

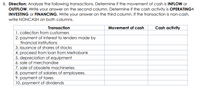

Transcribed Image Text:I. Direction: Analyze the following transactions. Determine if the movement of cash is INFLOW or

OUTFLOW. Write your answer on the second column. Determine if the cash activity is OPERATING<

INVESTING Or FINANCING. Write your answer on the third column. If the transaction is non-cash,

write NONCASH on both columns.

Transaction

Movement of cash

Cash activity

1. collection from customers

2. payment of interest to lenders made by

financial institutions

3. issuance of shares of stocks

4. proceed from loan from Metrobank

5. depreciation of equipment

6. sale of merchandise

7. sale of obsolete machineries

8. payment of salaries of employees.

9. payment of taxes

10. payment of dividends

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Which of the following is not an operating activity shown on the Statement of Cash Flows? Cash received from customers for cash sales Cash payment for equipment Cash received for payment on an accounts receivable Cash payments for insurancearrow_forwardhe comparative balance sheet of Orange Angel Enterprises Inc. at December 31, 20Y8 and 20Y7, is as follows: abels and Amount Descriptions Labels Dec. 31, Dec. 31, December 31, 20Y8 For the Year Ended December 31, 20Y8 Amount Descriptions Cash paid for equipment Cash received from issuing common 20Y8 20Υ7 12 Assets 3 Cash $145,670.00 $179,640.00 4 Accounts receivable (net) 225,480.00 241,430.00 stock 5 Merchandise inventory 320,660.00 298,210.00 Cash dividends 6 Prepaid expenses 12,990.00 8,900.00 Cash paid to retire mortgage note 7 Equipment 655,730.00 537,410.00 payable Decrease in merchandise inventory 8 Accumulated depreciation-equipment (171,620.00) (132,200.00) Total assets $1,188,910.00 $1,133,3 Decrease in accounts payable Decrease in accounts receivable 10 Liabilities and Stockholders' Equity Decrease in prepaid expenses Depreciation Increase in accounts payable 11 Accounts payable (merchandise creditors) $250,770.00 $237.180.00 12 Mortgage note payable 00 336,110.00 13 Common…arrow_forwardWhich of the following balance sheet items are commonly associated with the purchases and cash disbursements cycle? A Inventory and accounts payable B Purchases and accounts receivable C Cash paid to vendors D Cash received from the sale of inventoryarrow_forward

- The primary purpose of the statement of cash flows is to provide information about the investing and financing activities during a period. facilitate banking relationships. provide information about the cash receipts and cash payments during a period. prove that revenues exceed expenses if there is a net income.arrow_forwardState the section(s) of the statement of cash flows prepared by the indirect method (operating activities, investing activities, financing activities, or not reported) and the amount that would be reported for each of the following transac Note: Only consider the cash component of each transaction. Use the minus sign to indicate amounts that are cash out flows, cash payments, decreases in cash, or any negative adjustments. If your answer is not reported in an amount box does not require an entry, leave it blank or enter "0". a. Received $120,000 from the sale of land costing $70,000. b. Purchased investments for $75,000. c. Declared $35,000 cash dividends on stock. $5,000 dividends were payable at the beginning of the year, and $6,000 were payable at the end of the year. d. Acquired equipment for $64,000 cash. e. Declared and issued 100 shares of $20 par common stock as a stock dividend, when the market price of the stock was $32 a share. f. Recognized depreciation for the year,…arrow_forwardPlease read through the questions carefully and enter answers carefully with the table providedarrow_forward

- Note:- Do not provide handwritten solution. Maintain accuracy and quality in your answer. Take care of plagiarism. Answer completely. You will get up vote for sure.arrow_forwardUsing the following answer keys, you are to identify in which activity each of the transactions is classified and its effect on cash flows. Cash Flow Classification.using the capital letter only: . .Operating Activity • L.Investing Activity • F..Financing Activity • OL.Operating and Investing Activity • N.Noncash Transaction Effect on Cash Flows.using the capital letter only: • .Increase • D.Decrease N.No Effect Transaction Cash Flow Classification Effect on Cash Flows Paid a cash dividend. Decreased accounts receivable. Increased inventory. Retired long-term debt with cash. Sold long-term securities at a loss. Issued stock for equipment. Decreased prepaid insurance. Purchased treasury stock with cash. Retired a fully depreciated truck (no gain or loss). Transferred cash to money market account.arrow_forward3. Using the following answer keys, you are to identify in which activity each of the transactions is classified and its effect on cash flows. Cash Flow Classification...using the capital letter only: O...Operating Activity I...Investing Activity F...Financing Activity OI...Operating and Investing Activity N...Noncash Transaction Effect on Cash Flows...using the capital letter only: I...Increase D...Decrease N...No Effect Transaction Cash Flow Classification Effect on Cash Flows Declared and paid a cash dividend. Sold short-term trading securities at a gain. Retired fully depreciated equipment. Sold a machine at a loss. Purchased long-term available-for-sale securities. Decreased accounts receivable. Purchased 90-day Treasury bill. Incurred a net loss. Declared and issued a stock dividend. Sold treasury stock.arrow_forward

- Which of the following is most likely to appear in the operating section of a cash fl ow statement under the indirect method? C . Cash received from customers.arrow_forward3arrow_forwardPlace an X' in the appropriate columns for each of the following situations to indicate how amounts are classified and how or whether cash is affected: Effect on Cash Operating Investing Financing Activity Inflow (+) Situation Outflow No Activity Activity () Effect a. Paying off accounts payable with cash. b. Retirement of common stock with cash. e. Issuance of bonds for |cash. |d. Acquired land by issuing | common stock. e. Paid cash for inventory. E Collection of accounts receivable with customer cash.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education