FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

I'm specifically having trouble figuring out what is beginning WIP for direct materials and conversion costs.

Provide step by step explanation.

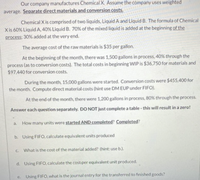

Transcribed Image Text:Our company manufactures Chemical X. Assume the company uses weighted

average. Separate direct materials and conversion costs,

Chemical X is comprised of two liquids, Liquid A and Liquid B. The formula of Chemical

Xis 60% Liquid A, 40% Liquid B. 70% of the mixed liquid is added at the beginning of the

process: 30% added at the very end.

The average cost of the raw materials is $35 per gallon.

At the beginning of the month, there was 1,500 gallons in process, 40% through the

process (as to conversion costs). The total costs in beginning WIP is $36,750 for materials and

$97,440 for conversion costs.

During the month, 15,000 gallons were started. Conversion costs were $455,400 for

the month. Compute direct material costs (hint use DM EUP under FIFO).

At the end of the month, there were 1,200 gallons in process, 80% through the process.

Answer each question separately. DO NOT just complete a table - this will result in a zero!

How many units were started AND completed? Completed?

a.

b. Using FIFO, calculate equivalent units produced

C.

What is the cost of the material added? (hint: use b.).

d. Using FIFO, calculate the cost per equivalent unit produced.

e. Using FIFO, what is the journal entry for the transferred to finished goods?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Note:- Do not provide handwritten solution. Maintain accuracy and quality in your answer. Take care of plagiarism. Answer completely. You will get up vote for sure.arrow_forwardDo not give image formatarrow_forwardDefine the Cost Pool, Cost Object and Cost Driver. Please help me I really need the answer, clear explanation please, thank you!arrow_forward

- Define cost pool, cost object and cost driver and explain. Thank you in advance!arrow_forwardSuppose that Target uses FIFO costing method but decided to change to the LIFOmethod. What are the steps Target would take to account for and report the change?arrow_forwardCompare/contrast cost assignment and cost allocation. Be sure to include direct assignment (tracing) and driver tracing in your discussion.arrow_forward

- Classify the different costs as unit, batch, product, or facility. Answers (unit, batch, product, or facility) may be used more than once and some answers may not be used at all. Research and development Electricity Building security costs Quality control Design costsarrow_forwardDecisions where relevant cost analysis might be used effective is Sell or process decisions. Explain IN YOUR OWN WORDS what "sell or process decision" is AND MUST USE EXAMPLES IN YOUR DESCRIPTION.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education