Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

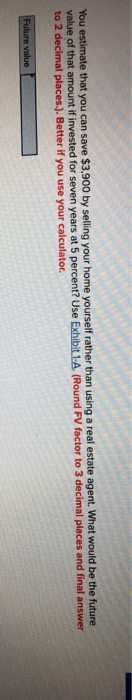

Transcribed Image Text:You estimate that you can save $3,900 by selling your home yourself rather than using a real estate agent. What would be the future

value of that amount if invested for seven years at 5 percent? Use Exhibit 1-A. (Round FV factor to 3 decimal places

to 2 decimal places.). Better if you use your calculator.

and final answer

Future value

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- It is all one question, 3 parts if you can't solve pls skip , like is guaranteedarrow_forwardBilly Dan and Betty Lou were recently married and want to start saving for their dream home. They expect the house they want will cost approximately $255,000. They hope to be able to purchase the house for cash in 7 years. To determine the appropriate discount factor(s) using tables, click here to view Tables I. II. II. or IV in the appendix. Alternatively, if you calculate the discount factor(s) using a formula, round to six (6) decimal places before using the factor in the problem. Required a. How much will Billy Dan and Betty Lou have to invest each year to purchase their dream home at the end of 7 years? Assume an interest rate of 9 percent. b. Billy Dan's parents want to give the couple a substantial wedding gift for the purchase of their future home. How much must Billy Dan's parents give them now if they are to reach the desired amount of $255,000 in 9 years? Assume an interest rate of 9 percent. Complete this question by entering your answers in the tabs below. Required A…arrow_forwardPlease Use an excel spreadsheet and show all of the steps to solve the following Please: You buy a house of $450,000 today. You put a down payment of 20% and borrow a fixed-rate mortgage of $360,000 with interest rate of 4% and 15 years. After 3 years, your house is appreciated to the value of $550,000 and market interest rate goes up to 6.5%. How much money will you make in book after 3 years?arrow_forward

- A real estate investor is considering the purchase of an apartment building that currently provides income of $30,000 and is expected to grow in income by 3% for the next 4 years. You would receive income from today, year 0, through year 4. At the end of year 4, they expect to sell the property for $800,000. The investor has a discount rate of 6%. How much should an investor be willing to pay for this property? Note:- Do not provide handwritten solution. Maintain accuracy and quality in your answer. Take care of plagiarism.Answer completely.You will get up vote for sure.arrow_forwardSuppose Rachel and Nadia buy a house and have to take out a loan for $191000. If they qualify for an APR of 4.25% and choose a 30 year mortgage, we can find their monthly payment by using the PMT formula. If Rachel and Nadia decide to pay $1500 per month, we can use goal seek to see how many years it will take to pay off the loan. Use the PMT function and goal seek (as needed) to answer the following questions about Rachel and Nadia's mortgage. a. What is their monthly payment on the 30 year loan? $ b. If they qualify for the same APR on a 15 year loan, what will the new monthly payment be? $ c. If Rachel and Nadia have monthly payments of $1500 each month, how long will it take for them to pay off their loan? years d. If they want to have monthly payments of $650 and still pay the loan off in 30 years, what interest rate would they have to qualify for? %arrow_forwardFind the future value, using the future value formula and a calculator. (Round your answer to the nearest cent.) $350 at 42% simple interest for 2 years $4 Need Help? Read Itarrow_forward

- Can someone explain how to do this pls?arrow_forwardYour younger sibling asks you to borrow $20. You, a smart financial professional, agree but also charge interest on the $20. You plan to collect $5 from your sibling each week for 8 weeks to repay the initial loan. What is the NPV of this project, assuming you invest the $5 at 12%? a. $4.84 b. $2.11 c. $0 d. $6.88arrow_forwardNeed both questions. ....attempt if you will solve both questions. ...thanks please provide excel functions as well rhank youarrow_forward

- Use a financial calculator or computer software program to answer the following questions: a) Melanie is trying to save money for retirement and has a future goal of $750,000 at the end of 20 years. Determine the present value of her goal using a discount rate of 12%. b) How would the present value change if the $750,000 is to be received at the end of 15 years instead? Explain the impact and show your work?arrow_forwardRead the passage and answer the following question(s). dis ins Homeowner and Renters Insurance: Protect Your Belongings You may be able to save hundreds of dollars a year on homeowners insurance by shopping around. You can also save money with these tips: Consider a higher deductible. Increasing your deductible by just a few hundred dollars can make a big difference in your premium. Ask your insurance agent about discourks. You may be able to get a lower premium if your home has safety features such as dead-bolt locks, smoke detectors, an alarm system, storm shutters or fire retardant roofing material. Persons over 55 years of age or long-term customers may also be offered discounts. OD. Insure your house NOT the land under it. After a disaster, the land is still there. If you don't subtract the value of the land when deciding how much homeowners insurance to buy, you will pay more than you should. Don't wait till vou have lorarrow_forwardIt has been proposed that in order to retire with the same lifestyle you currently have, you will need to have at least 1.5 million dollars saved by retirement. How much would you have to invest right now in order to achieve your goal? Assume you can find an investment that pays 5.6% compounded monthly. You're current age is 30 and youwould like to retire in 35 years. 2. What interest rate would you need in order to reach this goal if you had $8000 to invest?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education