FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

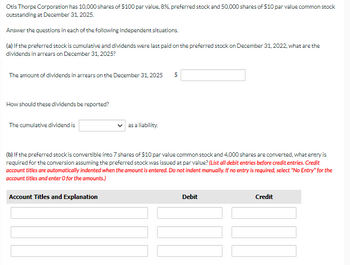

Transcribed Image Text:Otis Thorpe Corporation has 10,000 shares of $100 par value, 8%, preferred stock and 50,000 shares of $10 par value common stock

outstanding at December 31, 2025.

Answer the questions in each of the following independent situations.

(a) If the preferred stock is cumulative and dividends were last paid on the preferred stock on December 31, 2022, what are the

dividends in arrears on December 31, 2025?

The amount of dividends in arrears on the December 31, 2025 $

How should these dividends be reported?

The cumulative dividend is

as a liability.

(b) If the preferred stock is convertible into 7 shares of $10 par value common stock and 4,000 shares are converted, what entry is

required for the conversion assuming the preferred stock was issued at par value? (List all debit entries before credit entries. Credit

account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the

account titles and enter O for the amounts.)

Account Titles and Explanation

Debit

Credit

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps

Knowledge Booster

Similar questions

- National Supply's shareholders' equity included the following accounts at December 31, 2023: Shareholders Equity Common stock, 5 million shares at $1 part Paid-in capital-excess of par Retained earnings Required: 1. National Supply reacquired shares of its common stock in two separate transactions and later sold shares. Prepare the entries for each of the transactions under each of two separate assumptions: the shares are (a) retired and (b) accounted for as treasury stock. February 15, 2024 Reacquired 480,000 shares at $9 per share. February 17, 2825 Reacquired 480,000 shares at $6.50 per share. November 9, 2826 Sold 335,000 shares at $8 per share (assume FIFO cost). 2. Prepare the shareholders' equity section of National Supply's balance sheet at December 31, 2026, assuming the shares are (a) retired and (b) accounted for as treasury stock. Net Income was $20 million in 2024, $22 million in 2025, and $24 million in 2026. No dividends were paid during the three-year period. Complete…arrow_forwardSplish Brothers Inc. has 10,800 shares of 8%, $100 par value, cumulative preferred stock outstanding at December 31, 2022. No dividends were declared in 2020 or 2021.If Splish Brothers wants to pay $395,000 of dividends in 2022, what amount of dividends will common stockholders receive? Dividends allocated to common stock $enter Dividends allocated to common stock in dollarsarrow_forwardOn January 1, 2021, Novak Corp. had 479,000 shares of common stock outstanding. During 2021, it had the following transactions that affected the Common Stock account. February 1 Issued 117,000 shares March 1 Issued a 10% stock dividend May 1 Acquired 103,000 shares of treasury stock June 1 Issued a 3-for-1 stock split October 1 Reissued 59,000 shares of treasury stock Part 1 Incorrect answer icon Your answer is incorrect. Determine the weighted-average number of shares outstanding as of December 31, 2021.Assume the same facts as in part (b), except that net income included a loss from discontinued operations of $ 426,000 (net of tax). Compute earnings per share for 2021. (Round answer to 2 decimal places, e.g. $2.55.) Novak Corp.Income Statementchoose the accounting period select an opening name for this statement $ enter a dollar amount per share rounded to 2 decimal places select an income…arrow_forward

- Vishalarrow_forwardAt January 1, 2025, Coronado Company's outstanding shares included the following. 252,000 shares of $50 par value, 7% cumulative preferred stock 823,000 shares of $1 par value common stock Net income for 2025 was $2,579,000. No cash dividends were declared or paid during 2025. On February 15, 2026, however, all preferred dividends in arrears were paid, together with a 5% stock dividend on common shares. There were no dividends in arrears prior to 2025. On April 1, 2025, 457,000 shares of common stock were sold for $10 per share, and on October 1, 2025, 109,000 shares of common stock were purchased for $21 per share and held as treasury stock. Compute earnings per share for 2025. Assume that financial statements for 2025 were issued in March 2026. (Round answer to 2 decimal places, e.g. 2.55.) Earnings per share $arrow_forwardDon't give answer in image formatarrow_forward

- Manner, Inc. has 5,000 shares of 6%, $100 par value, noncumulative preferred stock and 20,000 shares of $1 par value common stock outstanding at December 31, 2018. There were no dividends declared in 2017. The board of directors declares and pays a $55,000 dividend in 2018. What is the amount of dividends received by the common stockholders in 2018? Note: show calculation. Essay Toolbar navigation I Uarrow_forwardHerman Inc. has 180,000 shares of $5 par common stock outstanding at the beginning of the year 2022. The following transactions affecting stockholders’ equity occured suring the year. Assume Paid-in Capital—Treasury Stock has a zero beginning balance. · January 15: Purchased common stock as treasury shares, 6,000 shares at $20. · April 15: Sold common treasury stock, 2,400 shares at $14. The journal entry on April 15, 2022 will include: A) A credit to Treasury Stock for $120,000 B) A debit to Retained Earnings for $14,400 C) A debit to Treasury Stock for $48,000 D) A debit to Paid-in-Capital, Treasury Stock for $14,400arrow_forwardVihnoarrow_forward

- Required:1. Indicate the amount of annual dividend on each issue of the preferred shares by completingthe last column of the above table 2. Assume that there are one year of dividends in arrears at the beginning of 2020, and Essexdeclared total dividends of $40,000 in 2020. What is the amount of dividends that thecommon shareholders will receive in 2020?arrow_forwardOn January 1, 2021, Nash Corp. had 502,000 shares of common stock outstanding. During 2021, it had the following transactions that affected the Common Stock account. February 1 March 1 May 1 June 1 October 1 (a) Issued 125,000 shares Issued a 10% stock dividend Acquired 97,000 shares of treasury stock Issued a 3-for-1 stock split Reissued 62,000 shares of treasury stock * Your answer is incorrect. Determine the weighted-average number of shares outstanding as of December 31, 2021. The weighted-average number of shares outstanding 123083arrow_forwardAt January 1, 2025, Skysong Company's outstanding shares included the following. 283,000 shares of $50 par value, 7% cumulative preferred stock 942,000 shares of $1 par value common stock Net income for 2025 was $2,521,000. No cash dividends were declared or paid during 2025. On February 15, 2026, however, all preferred dividends in arrears were paid, together with a 5% stock dividend on common shares. There were no dividends in arrears prior to 2025. On April 1, 2025, 449,000 shares of common stock were sold for $10 per share, and on October 1, 2025, 109,000 shares of common stock were purchased for $19 per share and held as treasury stock. Compute earnings per share for 2025. Assume that financial statements for 2025 were issued in March 2026. (Round answer to 2 decimal places, e.g. 2.55.) Earnings per share LAarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education