FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

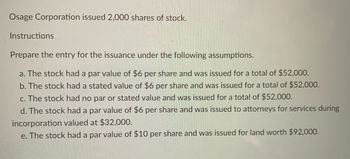

Transcribed Image Text:**Osage Corporation Stock Issuance Overview**

**Context:** Osage Corporation has issued 2,000 shares of stock.

**Instructions:**

Prepare the journal entries for the stock issuance based on the different scenarios provided below:

a. The stock has a par value of $6 per share and is issued for a total amount of $52,000.

b. The stock has a stated value of $6 per share and is issued for a total amount of $52,000.

c. The stock has no par or stated value and is issued for a total amount of $52,000.

d. The stock has a par value of $6 per share and is issued to attorneys as payment for services during the incorporation process, with a value of $32,000.

e. The stock has a par value of $10 per share and is issued in exchange for land valued at $92,000.

**Notes for Consideration:**

- Par value refers to the face value or nominal value of the stock as stated in the corporate charter.

- Stated value is an assigned value per share that the board of directors may set to account for shares issued without a par value.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps with 2 images

Knowledge Booster

Similar questions

- Prepare the journal entry to record Rony Company's issuance of 35,000 shares of its common stock assuming the share have a : a. $4par value and sell for $16 cash per share b. S4 stated value and sell for $16 per share.arrow_forwardSage Corporation issued 392 shares of $10 par value common stock and 128 shares of $50 par value preferred stock for a lump sum of $17,424. The common stock has a market price of $20 per share, and the preferred stock has a market price of $90 per share.Prepare the journal entry to record the issuance.arrow_forwardNebraska Inc. issues 2,750 shares of common stock for $88,000. The stock has a stated value of $20 per share. The journal entry to record the stock issuance would include a credit to Common Stock forarrow_forward

- Nebraska Inc. issues 3,000 shares of common stock for $45,000. The stock has a par value of $10 per share. The journal entry to record the stock issuance would include a credit to Common Stock for:arrow_forwardPronghorn Corp began operations on April 1 by issuing 52,200 shares of $4 par value common stock for cash at $15 per share. In addition, Pronghorn issued 2,300 shares of $1 par value preferred stock for $5 per share.Journalize the issuance of the common and preferred shares. (Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter 0 for the amounts.)arrow_forwardPrepare the journal entry to record Zende Company's issuance of 75,000 shares of $5 par value common stock assuming the shares sell for: a. $5 cash per share. b. $6 cash per share. View transaction list Journal entry worksheet 1 > Record the issuance of 75,000 shares of $5 par value common stock assuming the shares sell for $5 cash per share. Note: Enter debits before credits. 3/ F6 F7 F8 F9 F10arrow_forward

- On May 10, a company issued for cash 2,000 shares of no-par common stock (with a stated value of $5) at $14, and on May 15, it issued for cash 2,000 shares of $18 par preferred stock at $58. Journalize the entries for May 10 and 15, assuming that the common stock is to be credited with the stated value. If an amount box does not require an entry, leave it blank. May 10 May 15arrow_forwardOn May 10, a company issued for cash 1,600 shares of no-par common stock (with a stated value of $4) at $17, and on May 15, it issued for cash 2,000 shares of $17 par preferred stock at $61. Journalize the entries for May 10 and 15, assuming that the common stock is to be credited with the stated value. If an amount box does not require an entry, leave it blank.arrow_forwardhester Inc. issued shares of its $6.60 par value common stock for $17.00 per share. In recording the issuance of the stock, Chester credited the Additional Paid-In Capital—Common Stock account for $1,060,800. Required: How many shares were issued?fill in the blank 1 sharesarrow_forward

- Prepare the journal entry to record Jevonte Company’s issuance of 41,000 shares of its common stock assuming the shares have a: $3 par value and sell for $19 cash per share. $3 stated value and sell for $19 cash per sharearrow_forwardDogarrow_forwardIf Dakota Company issues 2,900 shares of $9 par common stock for $55,100, a. Common Stock will be credited for $55,100. b. Cash will be debited for $26,100. c. Paid-In Capital in Excess of Par will be credited for $29,000. d. Paid-In Capital in Excess of Par will be credited for $26,100.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education