FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

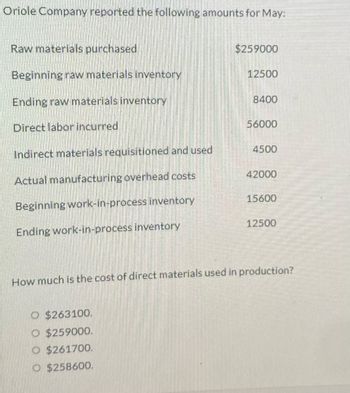

Transcribed Image Text:Oriole Company reported the following amounts for May:

Raw materials purchased

Beginning raw materials inventory

Ending raw materials inventory

Direct labor incurred

Indirect materials requisitioned and used

Actual manufacturing overhead costs

Beginning work-in-process inventory

Ending work-in-process inventory

$259000

O $263100.

O $259000.

$261700.

O $258600.

12500

8400

56000

4500

42000

15600

12500

How much is the cost of direct materials used in production?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- McGown Corp has the following information: Raw Materials Inventory Work in Process Inventory Finished Goods Inventory Additional information for the year is as follows: Raw materials purchases Direct labor Manufacturing overhead applied Indirect materials. Beginning Ending Inventory Inventory (1/1) (12/31) $28,200 $30,900 $16,800 $ 23, 100 $30,300 $ 27,900 Multiple Choice Compute the direct materials used in production. $110,600 $30.900 $107, 900 $ 84,300 $ 85,100 $ 0 Prexarrow_forwardCullumber Company reported the following amounts for May: Raw materials purchased Beginning raw materials inventory Ending raw materials inventory Direct labor incurred Indirect materials requisitioned and used Actual manufacturing overhead costs Beginning work-in-process inventory Ending work-in-process inventory $257000 $257000. $256800. ◆ $259900. O $261100. 12300 8200 54000 4300 40000 15400 12300 How much is the cost of direct materials used in production?arrow_forwardAnswerarrow_forward

- Product Cost Flows Complete the following T-accounts: Materials Inventory 1,120 Answer Answer 18,120 250 Wages Payable 9,000 1,050 Finished Goods Inventory 1,500 Answer Answer 1,200 Manufactured Overhead 175 Answer Answer 18,000 4,500 0 Work in Process Inventory 3,500 Answer Answer 9,000 Answer 500 Cost of Goods Sold Answer Save AnswersNextarrow_forwardCurrent Attempt in Progress The following information is available for Marin Company. Raw materials inventory Work in process inventory Finished goods inventory Materials purchased Direct labor Manufacturing overhead Sales revenue (a) January 1, 2022 $17,600 eTextbook and Media 11,400 22,700 2022 $126,000 184,800 151,200 764,400 December 31, 2022 $25,200 14,500 17,640 Compute cost of goods manufactured. (Assume that all raw materials used were direct materials.) MARIN COMPANY Cost of Goods Manufactured Schedule QUO Attempte:0 of 3 used Submit Answerarrow_forwardThe journal entry to issue $700 of direct materials and $80 of indirect materials to production involves debit(s) to the O A. Manufacturing Overhead account for $780 OB. Work-in - Process Inventory account for $700 and Manufacturing Overhead account for $80 O C. Work-in - Process Inventory account for $780 O D. Work-in - Process Inventory account for $700 and Finished Goods Inventory account for $80arrow_forward

- 5arrow_forwardComplete the information in the cost computations shown here: Raw materials Beginning inventory Purchases Materials available for use Ending inventory Materials used in production Work in process inventory Beginning inventory Materials used in production Direct labor Overhead applied Manufacturing costs incurred Ending inventory Cost of goods manufactured Finished goods inventory Beginning inventory Cost of goods manufactured Goods available for sale Ending inventory Cost of goods sold $341 1,533 323 $931 1,536 $22,450 936 $25,008 $21,792arrow_forwardCurrent Attempt in Progress Waterway Company developed the following data for the current year: Beginning Work in Process Inventory Direct materials used Actual overhead Overhead applied Cost of goods manufactured Total manufacturing costs $290000 $516000. $226000. $806000. $504000. 146000 298000 226000 278000 794000 Waterway Company's ending Work in Process Inventory isarrow_forward

- Requirement 1. Calculate direct materials inventory on August 31, 2022. Determine the formula and then calculate the direct materials inventory value at August 31, 2022. (Work in millions. Use a minus sign or parentheses for numbers to be subtracted.) Direct materials available for production Direct materials inventory, August 31, 2022 Requirement 2. Calculate fixed manufacturing overhead costs for August. (Work in millions. Use a minus sign or parentheses for numbers to be subtracted.) Fixed manufacturing overhead costsarrow_forwardYour answer is incorrect. Concord Company reported the following year-end information: Beginning work in process inventory $41000 Beginning raw materials inventory Ending work in process inventory Ending raw materials inventory Raw materials purchased Direct labor Manufacturing overhead 23000 O $933000 $892000 $931000 $890000 43000 21000 560000 210000 120000 How much is Concord's total cost of work in process for the year?arrow_forwardJustine Industries is calculating its Cost of Goods Manufactured at year-end. The company's accounting records show the following: The Raw Materials Inventory account had a beginning balance of $17,000 and an ending balance of $12,000. During the year, the company purchased $55,000 of direct materials. Direct labor for the year totaled $121,000, while manufacturing overhead amounted to $151,000. The Work in Process Inventory account had a beginning balance of $22,000 and an ending balance of $21,000. Assume that Raw Materials Inventory contains only direct materials. Compute the Cost of Goods Manufactured for the year. (Hint: The first step is to calculate the direct materials used during the year.) ~arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education