FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

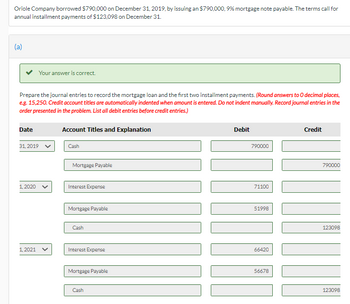

Transcribed Image Text:**Oriole Company Mortgage Loan and Installment Payments Journal Entries**

Oriole Company borrowed $790,000 on December 31, 2019, through a 9% mortgage note payable. The terms specify annual installment payments of $123,098, due on December 31.

### Journal Entries

#### December 31, 2019

- **Cash**: Debit $790,000

- **Mortgage Payable**: Credit $790,000

#### January 1, 2020

- **Interest Expense**: Debit $71,100

- **Mortgage Payable**: Debit $51,998

- **Cash**: Credit $123,098

#### January 1, 2021

- **Interest Expense**: Debit $66,420

- **Mortgage Payable**: Debit $56,678

- **Cash**: Credit $123,098

**Instructions**: Prepare the journal entries to record the mortgage loan and the first two installment payments. Round answers to whole numbers. Credit account titles are automatically indented when the amount is entered. Record journal entries in the order presented. List all debit entries before credit entries.

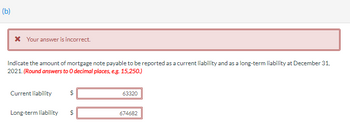

Transcribed Image Text:(b)

Your answer is incorrect.

Indicate the amount of mortgage note payable to be reported as a current liability and as a long-term liability at December 31, 2021. (Round answers to 0 decimal places, e.g. 15,250.)

- Current liability: $63,320

- Long-term liability: $674,682

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- D1.arrow_forwardAble Inc. borrowed $60,000 on October 1, 2019 and agreed to pay back $75,000 on October 1, 2022. How much did Able show in interest payable and interest expense in its annual financial statements at December 31, 2021? O Interest expense $5,000; interest payable $11,250 Interest expense $5,000; interest payable $3,750 O Interest expense $5,000; interest payable $5,000 Both interest expense and interest payable $11,250 O Interest expense is $11,250 and interest payable is $5,00Oarrow_forwardOn July 1, 2020, Thomas Company, which follows calendar year accounting, issued $240.000 note to be repaid over four years in monthly installments of $5,000. What would be the proper balance sheet presentation of this transaction at December 31, year 2020. Show it: The Current Portion of the Long-Term Debt and the Long-Term Debt.arrow_forward

- On January 1, 2018, King Inc. borrowed $190,000 and signed a 5-year, note payable with a 10% interest rate. Each annual payment is in the amount of $47,569 and payment is due each Dec. 31. What is the journal entry on Jan. 1 to record the cash received and on Dec. 31 to record the annual payment? (You will need to prepare the first row in the amortization table to determine the amounts.) If an amount box does not require an entry, leave it blank. Jan. 1 fill in the blank 2 fill in the blank 3 fill in the blank 5 fill in the blank 6 Dec. 31 fill in the blank 8 fill in the blank 9 fill in the blank 11 fill in the blank 12 fill in the blank 14 fill in the blank 15arrow_forwardTolino Company signed a 5-year note payable on January 1, 2020, of $200,000. The note requires annual principal payments each December 31 of $40,000 plus interest of 6%. The entry to record the annual payment on December 31, 2021, includes:arrow_forwardBase Line Co. receives $250,000 when it issues a $250,000, 8%, mortgage note payable to finance the construction of a building at December 31, 2016. The terms provide for annual installment payments of $40,000 on December 31. Instructions Prepare the mortgage payment schedule and journal entries to record the mortgage loan and the first two installment payments. In this order Date | Particulars | Debit $ | Credit $ and in a text filearrow_forward

- 7) On December 1, 2022, Olympia Hot Yoga issued a note payable to Columbia Bank for $45,000 with an annual interest rate of 6% and a term of six months (due May 31, 2023). What is the amount of interest expense recognized by Olympia Hot Yoga in 2022? What is the amount of interest expense recognized by Olympia Hot Yoga in 2023? What is the total amount Olympia Hot Yoga will pay to Columbia Bank on the maturity date?arrow_forwardSunland Company borrowed $760,000 on December 31, 2019, by issuing an $760,000, 9% mortgage note payable. The terms call for annual installment payments of $118,423 on December 31. (a) Your answer is correct. Prepare the journal entries to record the mortgage loan and the first two installment payments. (Round answers to 0 decimal places, e.g. 15,250. Credit account titles are automatically indented when amount is entered. Do not indent manually. Record journal entries in the order presented in the problem. List all debit entries before credit entries.) Date Dec. 31, 2019 ec. 31, 2020 Account Titles and Explanation Cash Mortgage Payable Interest Expense Mortgage Payable Cash Debit 760,000 68400 50023 Credit 760,000 118423arrow_forwardOn April 1, 2019, Flamengo Co. signed a one-year, 8% interest-bearing note payable for $50,000. Assuming that Flamengo Co. maintains its books on a calendar year basis, how much interest expense should be reported in the 2020 income statement? a.$1,000. B.$2,000. C.$4,000. D.$3,000. Which of the alternatives results from the accrual of interest: A.Increase in liabilities and decrease in stockholders' equity. B.Increase in assets and stockholders' equity. C.Increase in assets and liabilities. D.Increase in liabilities and increase in stockholders' equity. Unfortunately, Flamengo Co. is involved in a lawsuit. When would the lawsuit be recorded as a liability on the balance sheet? A.When the loss is probable and the amount can be reasonably estimated. B.When the loss probability is reasonably possible and the amount can be reasonably estimated. C.When the loss is probable regardless of whether the loss can be reasonably estimated. D.When the loss…arrow_forward

- On January 1, 2019, Company C issues $200,000 of its 6% bonds which mature in 10 years. Interest is paid annually on December 31. The market (effective) rate of interest is 4%. If the bond sells as 88.2, what the amount of interest expense reported on the Income Statement for 2019 (hint: prepare an amortization schedule)arrow_forwardOn June 30, 2020, Amoro Company takes out a $5,000 loan documented through a note payable. Interest will be 16% annually and the note matures on June 30, 2021. The interest to be accrued at December 31, 2020 will be: о $400 0 $800 0 $0 0 $467arrow_forwardOn January 2, 2023, Eagle Corp. borrowed $25,000 from Bank Three. The loan was to be repaid in equal principal installments of $5,000, payable on December 31 of each year. beginning on December 31, 2023. Disregarding interest, the amount of the $25,000 loan that should be considered a long-term liability on the company's balance sheet for the year ended December 31, 2024 would be:arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education