Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

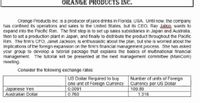

Transcribed Image Text:ORANGE PRODUCTS INC.

Orange Products Inc. is a producer of juice drinks in Florida, USA. Until now, the company

has confined its operations and sales to the United States, but its CEO, Ray Jalkio wants to

expand into the Pacific Rim. The first step is to set up sales subsidiaries in Japan and Australia.

then to set a production plant in Japan, and finally to distribute the product throughout the Pacific

Rim. The firm's CFO, Janet Jackson, is enthusiastic about the plan, but she is worried about the

implications of the foreign expansion on the firm's financial management process. She has asked

your group to develop a tutorial package that explains the basics of multinational financial

management. The tutorial will be presented at the next management committee (ManCom)

meeting.

Consider the following exchange rates:

US Dollar Required to buy

one unit of Foreign Currency

Number of units of Foreign

Currency per US Dollar

Japanese Yen

Australian Dollar

0.0091

109.89

0.760

1.316

Transcribed Image Text:2. Orange Products begins producing the same liter of orange juice in Japan. The

product costs 250 yen to produce and ship to Australia, where it can be sold for 6

Australian dollars. How much is the US dollar profit on the sale?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 5 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Australians buy 1.28 billion litres of sugar-sweetened drinks per annum (2012 figures). Consider the average price of these drinks to be $1.6/litre. Assuming a sales tax (hypothetical scenario) of 25% on soft drinks the price will be increased to $2/litre. The price elasticity of demand for soft drinks is -0.89. How will the increase in the price of soft drinks affect the demand for soft drinks? How much additional revenue will be raised by this tax?arrow_forwardSantel cash operates a chain of exclusive ski boutiques in the western United States. The store purchases several hats styles from a single distributor at $12 each. All other cost incurred by the company are fixed. Sandhill cash sells the hats for $30 each. If it cost total 135,000 per year what is the breakeven point in units?in sales dollars? What is sandhills's contribution margin ratio? And what is their variable cost ratio?arrow_forwardMark Sexton and Todd Story, the owners of S&S Air, have been in discussions with an aircraft dealer in Europe about selling the company's Eagle airplane. The Eagle sells for $98,000 and has a variable cost of $81,000 per airplane. Amalie Diefenbaker, the dealer, wants to add the Eagle to her current retail line. Amalie has told Mark and Todd that she feels she will be able to sell 15 airplanes per month in Europe. All sales will be made in euros, and Amalie will pay the compnay 78,400 euros for each plane. Amalie proposes that she order 15 aircraft today for the first month's sales. She will pay for all 15 aircraft in 90 days. This order and payment schedule will continue each month. Mark and Todd are confident they can handle the extra volumen with their existing facilities, but they are unsure about the potential financial risks of selling their aircraft in Europe. In their discussion with Amalie, they found out that the current exchange rate is $1.25/euro. This means that they…arrow_forward

- Flatland Corp. harvested potatoes at a cost of FC 1,000,000 and sold them to Pot Corp. for FC 2,500,000. Pot Corp. sold the potatoes to its customers and received FC 4,000,000. If the national VAT is 20%, how much tax did Pot Corp. pay?arrow_forwardJamestown Industries sells $48,000 in gift cards and expects 20% breakage. Cost of goods sold is 25% of each gift card. When the expected gift cards are redeemed, how much cost of goods sold will Jamestown record? O $12,000 $24,000 O $10,000 O $9,600arrow_forwardThe selling price of imported olive oil is $20 per case. Your cost is 15 Euros per case, and the exchange rate is currently 1.25, so it takes 1.25 Euros to buy $1. Your argest customer has ordered 15,000 cases of olive oil. How much is the pretax profit for this transaction? $120,000 $100,000 $90,000 $80,000 $60,000arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education