Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

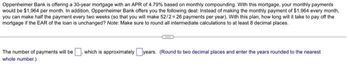

Transcribed Image Text:Oppenheimer Bank is offering a 30-year mortgage with an APR of 4.79% based on monthly compounding. With this mortgage, your monthly payments

would be $1,964 per month. In addition, Oppenheimer Bank offers you the following deal: Instead of making the monthly payment of $1,964 every month,

you can make half the payment every two weeks (so that you will make 52/2 = 26 payments per year). With this plan, how long will it take to pay off the

mortgage if the EAR of the loan is unchanged? Note: Make sure to round all intermediate calculations to at least 8 decimal places.

The number of payments will be, which is approximately years. (Round to two decimal places and enter the years rounded to the nearest

whole number.)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- You are considering two payment options on a $500,000 20-year mortgage having an interest rate of 2.8% compounded monthly. The first option is to make monthly payments at the start of each month, while the second option is to make payments at the end of each month. How much interest will be saved by choosing the first option? Ⓒa. $1,521.60 O b. $1,721.60 O c. $1,921.60 O d. $2,121.60 Oe. $2,321.60 Clear my choicearrow_forwardA borrower is making a choice between a mortgage with monthly payments or biweekly payments. The loan will be $200,000 at 6 percent interest for 20 years. a. How would you analyze these alternatives? b. What if the biweekly loan was available for 5.75 percent? How would your answer change? c. If you take the monthly payment and agree to pay ½ of it every two weeks, when would your loan reach maturity?. Please correct and with steps.arrow_forwardSuppose that you are currently making monthly paymentson a $163,133.00 20-year mortgage at 3.84% interest compound monthly. For the last 5 years , you have been paying the regular, monthly payments. You now have the option to refinance your current mortgage with a new 12-year mortgage that has an interest rate of 2.99% compounded monthly. Note that the lender of the new loan has a closing cost fee of $1,100 (for title insurance,home appraisal costs, etc. )for the new ( refinanced)mortgage. The lender stipulates that closing cost must be paid in cash and cannot be part of the new loan. You are to determine whether you would save or lose money in interest if you were to refinance your home. Take the closing into account when determining if you would save or lose money.arrow_forward

- You purchase a home costing $480,000 with a 20% down payment. After shopping around for a mortgage, you select a lender who offers you two options for 30-year mortgages with monthly payments: Option I: A rate of 2.75% (APR) and an upfront fee (due immediately) of $3,840 Option II: A rate of 2.65% (APR) and an upfront fee (due immediately) of $9,600. a. Compute the monthly loan payment for each option. b. Compute the outstanding loan balance after 10 years for each option. c. If you prefer a lower true interest rate, which one should you choose? d. If you anticipate staying in the house for 10 years, which option should you choose?arrow_forwardOppenheimer Bank is offering a 30-year mortgage with an APR of 4.88% based on monthly compounding. With this mortgage, your monthly payments would be $2,050 per month. In addition, Oppenheimer Bank offers you the following deal: Instead of making the monthly payment of $2,050 everymonth, you can make half the payment every two weeks (so that you will make 52/2=26 payments per year). With this plan, how long will it take to pay off the mortgage if the EAR of the loan is unchanged? Note: Make sure to round all intermediate calculations to at least 8 decimal places. a. What is the number of payments?b. How long will it take to pay off the mortgage if the EAR of the loan is unchanged?arrow_forwardSuppose you borrow $1million to purchase a house. The bank offers you the fixed borrowing rate 4% APR compounded semi-annually for a 5-year term. You decide on making semi-monthly payments (every half-month) with an amortization period of 30 years. How much do you still owe at the end of the 5-year term? The answer is within $50 of the following value.arrow_forward

- suppose you are buying your first condo for 145,000 and you will make $15,000 down payment. you have arranged to finnace the remainder with a 30 year monthly payment amortized mortgage at a 55 nominal interest rate with first payment due in one month what will your monthly payments be? how much of first month payment is the prindipalarrow_forwardYou have purchased a guaranteed investment contract (GIC) from an insurance firm that promises to pay you a 5% compound rate of return per year for 6 years. If you pay $20,000 for the GIC today and receive no interest along the way, you will get __________ in 6 years (to the nearest dollar). (Round your answer to the nearest whole dollar).arrow_forwardSuppose your gross monthly income is $5,300 and your current monthly payments are $575. If the bank will allow you to pay up to 36% of gross monthly income (less current monthly payments) for a monthly house payment, what is the maximum loan you can obtain if the rate for a 30-year mortgage is 4.65%? (Round your answer to the nearest cent.)arrow_forward

- Suppose that you take out a 40-year $175000 mortgage with an APR of 6%. You make payments for 3 years and then you consider refinancing the original loan. The new loan would have a term of 15 years, have and APR of 5.7% and be in the amount of the unpaid balance on the original loan. The administrative cost of taking out the second loan would be $1700. What are the monthly payments on the original loan? What would the monthly payment of the second loan be? What would the total amount you would pay if you continued with the original 40-year loan without refinancing? What would the total amount would you pay with the refinancing?arrow_forwardYou have found your dream house. The selling price is 120,000. You will put $20,000 down and obtain a 25-year fixed-rate mortgage at 8.75% (APR compounded semiannually) for the rest. You plan to prepay the loan by making an additional payment each month along with your regular payment. How much extra must you pay each month if you wish to pay off the load in 20 years? (Assume there is no early payment penalty).arrow_forwardYou are offered an add-on loan for $4,500 at 18% for 5 years. What is the monthly payment? What is the amount of interest? What is the true interest rate cost of this loan? If you could pay the same loan above at a compound rate: What would the monthly payment be? What would the amount of interest be? Prepare a monthly payment schedule for each loan above using Excel, and submit it. Suppose that you are only allowed to make a balloon payment to the principal of the compound interest loan. You have $1,000 to put down at the beginning of year three. How many payments will you save?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education