FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

thumb_up100%

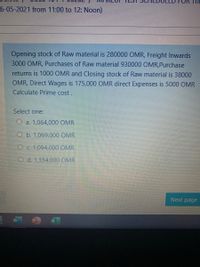

Transcribed Image Text:6-05-2021 from 11:00 to 12: Noon)

Opening stock of Raw material is 280000 OMR, Freight Inwards

3000 OMR, Purchases of Raw material 930000 OMR,Purchase

returns is 1000 OMR and Closing stock of Raw material is 38000

OMR, Direct Wages is 175,000 OMR direct Expenses is 5000 OMR

Calculate Prime cost.

Select one:

O a. 1,064,000 OMR

O b. 1,069,000 OMR

O c. 1,094,000 OMR

O d. 1,354,000 OMR

Next page

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- PA1. 10.1 When prices are rising (inflation), which costing method would produce thehighestvalue for gross margin? Choose between first-in, first-out (FIFO); last-in, first-out (LIFO); and weighted average (AVG). Evansville Company had the following transactions for the month. Number of Units Cost per Unit $6,000 7,000 7,500 Purchase 2 Purchase 3 Purchase 4 Calculate the gross margin for each of the following cost allocation methods, assuming A62 sold just one unit of these goods for $10,000. Provide your calculations. A. first-in, first-out (FIFO) B. last-in, first-out (LIFO) C. weighted average (AVG)arrow_forwardTotal Material cost is 500000 OMR Fixed cost is 0. Calculate Total Variable cost Select one: O a. 253000 Units O b. 251000 OMR O c. 252000 Units O d. 500000 OMR gearrow_forwardIn the cost-volume- profit graph (above), what is represented by the point marked "A"? Question 1 options: Breakeven point Fixed expenses Operating income area Operating loss areaarrow_forward

- 3. ManutacturIng coste. Selected dala concorning last yoar's operatlons of Televans Company áre as follows (000s omitted): Inventorlos Daginning Ending Finlshod goods. Work In procOs... $90 $110 • 30 85 Maturlals. 75 Other data: Materlals usead.... $326 Tolal manulacturing costs clarged to Jobs during tho year (Includes malerials, cdirect labor, and factory overhead applled at a rale of 30% of dlrect labor cost).. Cost of goods avallablo for sale.. Markoting and administrativo exponses. 686 826 25 Flequirad: Compute the following: (1) Cost of materlals purchased. (2) Direct labor cost charged to production. (3) Cost of goods manufactured. (4) Cost of goods sold.X (ICMA adaptod) O50arrow_forwardPrepare the Income Statement of Rotary Limited for the year ended 28 February 2021 using the following methods of costing: 2.1 Marginal costing | 22 Absorption costing INFORMATION The following information was extracted from the accounting records of Rotary Limited for the year ended 28 February 2021: Inventory on 01 March 2020 Nil Production for the year 35 000 units Sales for the year 30 000 units Fixed costs: Manufacturing R700 000 Sales and administration R480 000 Variable costs per unit: Manufacturing R48 Sales and administration R12 Selling price per unit R150arrow_forwardQuestion 1: Estimation of WC The management of ABC Company Limited has called for a statement showing the WC needed to finance a level of activity of 3,00,000 units of output per year. The cost statement of the company's product, for the above-mentioned activity level, is given below: Cost per unit TK 20 Direct material Direct labor Overhead Total cost Target profit Target selling price 5 TK 15 40 10 TK 50 1. Past records show that raw materials are held in stock, on an average, for two (2) months; 2. Work in process (WIP) will approximate to 15 days production; 3. Finished goods remain in warehouse on average for 1 month; 4. Suppliers for materials extend one month's credit; 5. Two months credit is normally allowed to customers (assume all sales are on credit) 6. A minimum cash balance of TK 5,00,000 is expected to be maintained; 7. The production pattern is assumed to be even during the year. Prepare a Statement of Working Capital Requirementsarrow_forward

- Problem: AAA Company produces and sells Product X: Annual Demand 24,000 units Annual cost to held one unit of inventory P11.52 Order Cost P38.40 Beg. Inventory P 0 a. What is the Economic Order Quantity? b. How much is the total Order Costs? c. How much is the total Carrying Costs?arrow_forwardI. Cost Behavior and Estimation (HP 6) The owners of Mormont Co., Jorah and Lyanna, are expecting sales for August, 2019 to be 250,000 units. Information about Mormont's Sales and costs over the past three months, are as follows: Units Sold Sales Cost of Goods Sold Wage & Salary Expense Admin Expense May O 200,000 300,000 $3,450,000 $5,175,000 $1,575,000 $2,312,500 $950,000 $975,000 $1,300,000 $1,600,000 June July 500,000 $8,625,000 $3,787,500 $1,925,000 $2,500,000 Required: Based on the information provided, provide a projected income statement, using the contribution margin format. 5arrow_forwardrrarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education