ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

Transcribed Image Text:Question 1

Consider an economy with two firms and a government. Firm 1 produces 10000 units of good X, which

it sells for $20 per unit. It uses this revenue to pay $140000 in wages, $10000 in taxes, and $10000 in

interest on a loan, with the rest as profits. Firm 1 sells some of its output to consumers, and some to

Firm 2 as an intermediate good in their production process.

Firm 2 uses good X as an input into its manufacturing process. It buys 8000 units of good X and uses

them to create 1000 units of good Y, which it sells for $400 per unit. It pays $200000 in wages and

$20000 in taxes, with the rest as profits.

The government takes in taxes from only these two firms, and uses it to pay wages to provide

government services, for instance national defense.

Please calculate GDP using the three different methods. (Of course, you'll arrive at the same answer;

however, indicate clearly what values you're using in each case to arrive at the final answer, so as to

illustrate you know what is included in each method of calculating GDP.)

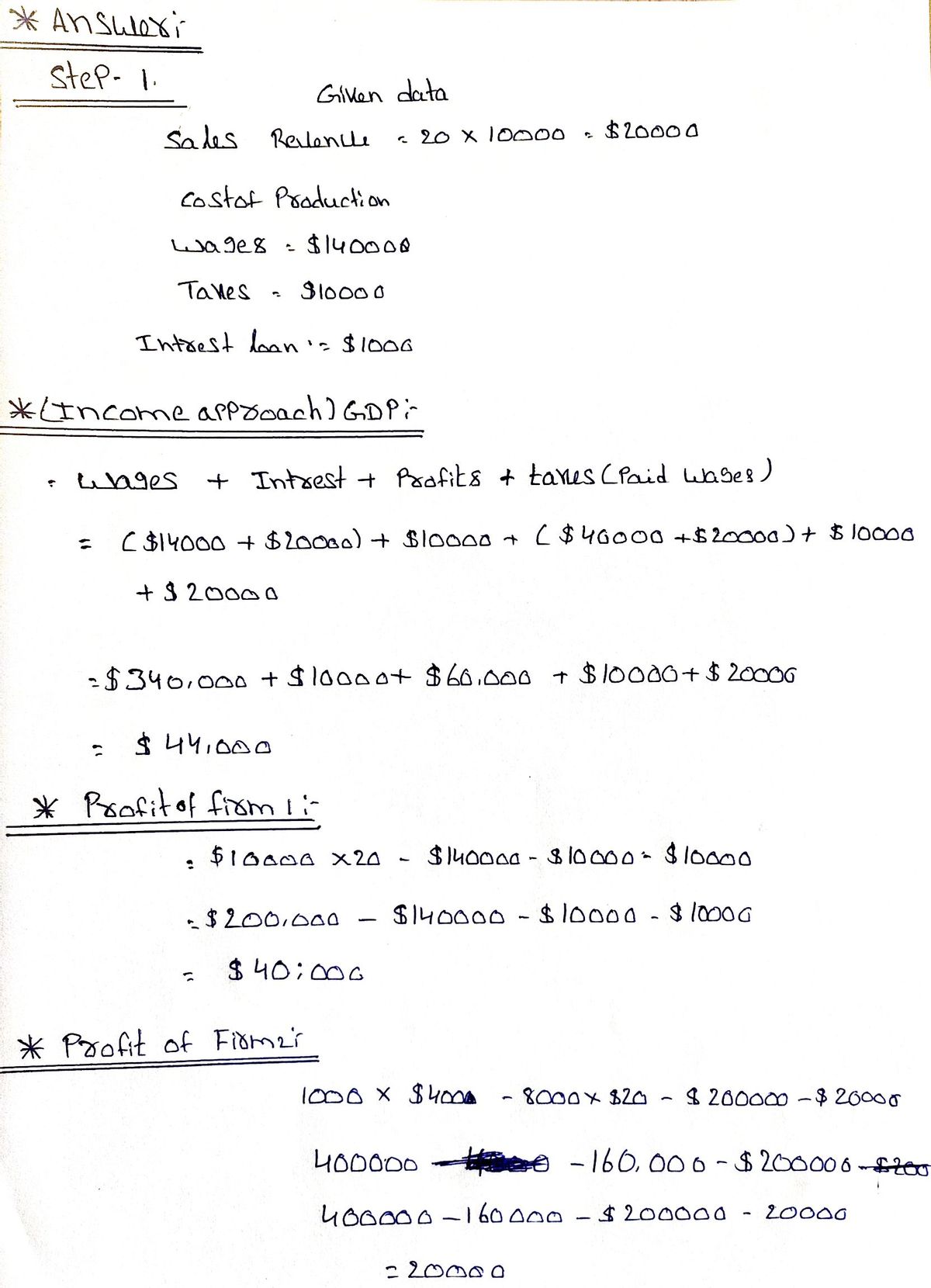

1)Income approach:

2)Expenditure approach:

3)Product (value-added) approach:

Expert Solution

arrow_forward

Step 1

*Answer:

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- Search 1 X Chap7 Hw (1).docx Format Tools Help a Assignments - Principles of M No Spacing 2 W S # 3 BIU A. A. E Consider the following national income accounting data for an economy in a recent year. All figures are in billions of dollars. Personal Taxes Social Security Contributions Rents Taxes on Production & Imports Corporate Income Taxes Interest Proprietor's Income. Transfer Payments Dividends e X Compensation of Employees Net Exports Undistributed Corporate Profits Government Purchases Net Private Domestic Investment Econ 2105 Chap7 Fw 111.docx x + /bomcoldodma figpchkicefolgmifalc/views/app.html Imports Personal Consumption Expenditures Consumption of Fixed Capital (Depreciation) Net Foreign Factor Income Corporate Profits Statistical Discrepancy d C $ 4 r With the above data, follow Tables 7.3, 7.4, and 7.5 in the textbook for guidelines and acceptable steps to calculate: (a) Gross Domestic Product (GDP) by both the expenditures and the income approaches. EXTI Th % 5 t g Oll 6…arrow_forwardUse the following table to answer this question The components of GDP in the accompanying table were produced by the Bureau of Economic Analysis. Consumer spending Durable goods Nondurable goods Services Investment spending Fixed investment spending Nonresidential Structures Equipment and software Residential Change in private inventories Net exports Exports Imports Government purchases of goods and services Federal Category National defense Nondefense State and local What is the value of l? O A. $9,710.2B. O B. $2,130.4B. O C. $2,674.8B. O D. $5,794.4B Components of GDP in 2020 (billions of dollars) $1,082.80 2,833.00 5,794.40 2,134.00 1,503.80 480.3 1,023.50 630.2 -3.6 1,662.40 2,370.20 979.3 662.2 317.1 1.695.50arrow_forwardConsider an economy with a corn producer, some consumers, and a government. In a given year, the corn producer grows 30 million bushels of corn and the market price for corn is $5 per bushel. Of the 30 million bushels produced, 20 million are sold to consumers, 5 million are stored in inventory, and 5 million are sold to the government to feed the army. The corn producer pays $60 million in wages to consumers and $20 million in taxes to the government. Consumers pay $10 million in taxes to the government, receive $10 million in interest on the government debt, and receive $5 million in Social Security payments from the government. The profits of the corn producer are distributed to consumers.(a) Calculate GDP using (i) the product approach, (ii) the expenditure approach, and (iii) the income approach.(b) Calculate private disposable income, private sector saving, government saving, national saving, and the government deficit. Is the government budget in deficit or surplus? Explain your…arrow_forward

- 18. If consumers in the U.S. buy $3.5 billion of clothes made by businesses in Bangladesh, how is this accounted for in the expenditure categories? a. this is spending on a consumer good so GDP rises b. the clothes are imports so they reduce GDP c. the clothes are both consumer goods and imports so GDP doesn't change d. the GDP could rise or fall, it depends on whether the clothes were taxedarrow_forwardWhich of the following will not effect Potential GDP in Country X? government institutions O the unemployment rate O the amount of capital available technologyarrow_forwardConsider an economy that produces wood, boats, and has a marketing agency.This year domestic wood production generates revenues of $80. Of this $80 worth of wood, $40were purchased by the boat producer and $40 were sold abroad to a foreign company. The woodproducer paid $40 worth of wages and $10 worth of taxes.The boat producer combines the services of the marketing agency, the wood it purchased from thewood producer, and $20 worth of labor (wages) to produce $120 worth of boats. Its revenues,which include a boat produced in the previous year and that was carried as inventory, are $130.Domestic families buy all these boats. This company pays $10 worth of taxes.The marketing agency, whose sole client is the boat company, generates a revenue of $40 whichis enough to cover its labor costs of $40. This company pays no taxes.The government in this economy uses the $20 worth of taxes and builds a port. The cost of theport is $40 that are paid to workers. This port is partially financed by…arrow_forward

- Suppose you have the following information about production levels of Ibs. of caviar and bottles of wine, and the market-clearing prices for each of the nine allocations: 5. Caviar Wine Pricecaviar Pricewine GDP Allocation $50,000 50,000 50,000 50,000 50,000 50,000 50,000 50,000 50,000 $166.67 187.50 $350.00 175.00 A 90 100 B 80 200 214.29 250.00 300.00 116.67 87.50 70 300 60 400 E 50 500 70.00 375.00 500.00 58.33 50.00 F 40 600 G 30 700 H 20 800 750.00 43.75 I 10 900 1500.00 38.89 A. How much wine must be sacrificed to produce 1 more lb. of caviar? B. Is allocation point A efficient? (As in class, prove your conclusion with math) C. Which allocation point is efficient? (As in class, prove your conclusion with math) D. Suppose government assesses a tax of $40 per bottle of wine, but no tax on caviar. i) what will be the new equilibrium? Why? ii) how much of the tax is forward shifted? Explain iii) how much of the tax is backward shifted? Explainarrow_forwardPlease help quickly. I will give a thumbs up if you help fast!!arrow_forwardWhich country has the highest ratio of government spending to GDP? United States China O Japan O Swedenarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education