Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

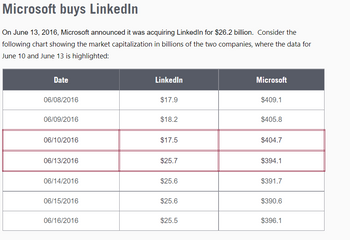

On the news, LinkedIn's market capitalization increased to nearly $26 billion, while Microsoft's market capitalization actually dropped $10.6 billion. Explain the drop in Microsoft's market capitalization. What is going on?

Transcribed Image Text:Microsoft buys LinkedIn

On June 13, 2016, Microsoft announced it was acquiring LinkedIn for $26.2 billion. Consider the

following chart showing the market capitalization in billions of the two companies, where the data for

June 10 and June 13 is highlighted:

Date

06/08/2016

06/09/2016

06/10/2016

06/13/2016

06/14/2016

06/15/2016

06/16/2016

LinkedIn

$17.9

$18.2

$17.5

$25.7

$25.6

$25.6

$25.5

Microsoft

$409.1

$405.8

$404.7

$394.1

$391.7

$390.6

$396.1

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- In November 2007, for example, General Motors (GM) announced that it would take a write-off of about $39 billion, meaning that it was reducing net income for the third quarter of the year by that amount. Discuss why General Motors’ stockholders probably didn’t suffer as a result of the reported loss. What do you think was the basis for our conclusion?arrow_forwardA firm's current ratio has steadily increased over the past 5 years, from 1.9 to 3.8. What would a financial analyst probably conclude from this information? A. The firm's fixed assets turnover has improved. B. The firm's liquidity position has improved. C. The firm's financial leverage has improved. D. All of the abovearrow_forwardBob's Inc has the following balance sheet and income statement data see image... The new CFO thinks that inventory are excessive and could be lowered to cause the current ratio to equal industry average 3.00 w/o affecting either sales or net income. assuming that inventories are sold off and not replaced to get the current ratio to the target level and that the funds generated are used to buy back common stock at book value, by how much would the ROE change?arrow_forward

- 9. The Brownian Motion is used to model the liquid assets (i.e. "cash") of our startup company Math Finance Inc. You are our company's CFO (Chief Financial Officer). The initial value of our assets is 5 (measured in tens of thousands of dollars). The drift and volatility for the first two years turns out to be 2 and 3 respectively. During the next two years, the drift and volatility was observed to be 3 and 4 respectively. What can you say about the probabilistic behavior of our assets at the end of year four? Give proper mathematic explanation. What is the probability that our assets will be worth at least $150,000?arrow_forwardIf you owned a company, would you prefer the market value of its assets to rise $10million or the market value of its liabilities to fall $10million?arrow_forwardClapTrap is a rapidly growing image messaging company. The company's growth strategy requires rapid reinvestment currently, with dividend payouts increasing as growth opportunities gradually disappear. You have the following financial information about ClapTrap: Earnings in the most recently concluded fiscal year were $$6.286.28. The company will retain all its earnings this year (from t=00 to t=11 ), reinvesting in new projects with a return on new investment of 44.044.0%. The next year (from t=11 to t=22 ), the company will retain 85.085.0% of its earnings. Return on new investment is expected to be 30.030.0%. In the following year (from t=22 to t=33 ), the company will retain 69.069.0% of its earnings with an expected return on new investment of 20.020.0%. The company will then enter a period of stable growth, retaining 49.049.0% of its earnings in perpetuity. a) What are the expected dividends per share for each period from t=11 to t=33 ? The expected dividends per share for…arrow_forward

- Empirical research on payout patterns in recent years indicates that Group of answer choices since 2000, firms are paying higher dividends and executing fewer stock repurchases after the Tech crash in March 2000, investors began to demand more dividends and firms obliged fewer firms are paying dividends since the Tech crash in March 2000 since 2000, firms are paying lower dividends and executing more stock repurchasesarrow_forwardApple’s market capitalization in mid-2016 was $484 billion, and its beta was 1.03. At that same time, the company had $25 billion in cash and $69 billion in debt. Based on this data, estimate the beta of Apple’s underlying business enterprise. please show written work!!arrow_forwardFrom mid-2008 to early 2009, the Dow Jones IndustrialAverage declined by more than 50%, while real interestrates were low or falling. What does this scenario suggest should have happened to investment?arrow_forward

- [EXCEL] Zero growth: Nynet, Inc., paid a dividend of $4.18 last year. The company's management does not expect to increase its dividend in the foreseeable future. If the required rate of return is 18.5 percent, what is the current value of the stock? Please use Excel.arrow_forwardYou observe that a firm's ROE has increased from the previous year, but both its profit margin and equity multiplier are below the previous year's levels. Which of the following statements is CORRECT? Its return on assets must be lower than the previous year. Its total assets turnover must be lower than the previous year. Its TIE ratio must be higher than the previous year. Its total assets turnover must be higher than the previous year.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education