FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

Transcribed Image Text:Reassignment takeAssignmentMain.do?invoker=&takeAssignmentSession Locator=&inprogress=false

eBook

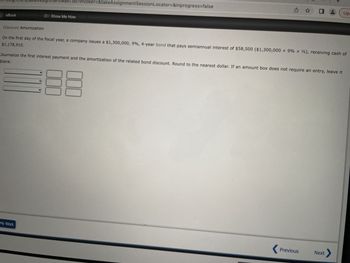

Discount Amortization

Show Me How

My Work

0

$1,178,910.

On the first day of the fiscal year, a company issues a $1,300,000, 9%, 4-year bond that pays semiannual interest of $58,500 ($1,300,000 x 9% x 12), receiving cash of

blank.

Journalize the first interest payment and the amortization of the related bond discount. Round to the nearest dollar. If an amount box does not require an entry, leave it

000

+

< Previous Next

Up

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Instructions On the first day of the fiscal year, a company issues a $1,450,000, 5% , five-year bond that pays semiannual interest of $36,250 ($1,450,000 x 5% *%), receiving cash of $1,408,720. Journalize the first interest payment and the amortization of the related bond discount Round to the nearest dollar. Refer to the Chart of Accounts for exact wording of account titles Journal DATE DESCRIPTION JOURNAL POST REF DEBIT CREDITarrow_forwardOn the first day of the fiscal year, a company issues a $5,000,000, 10%, 4-year bond that pays semiannual interest of $250,000 ($5,000,000 × 10% × ½), receiving cash of $5,336,638. Journalize the bond issuance. If an amount box does not require an entry, leave it blank.arrow_forwardOn the first day of the fiscal year, a company issues a $8,300,000, 6%, 8-year bond that pays semiannual interest of $249,000 ($8,300,000 × 6% × ½), receiving cash of $6,901,364. Journalize the first interest payment and the amortization of the related bond discount. Round to the nearest dollar. If an amount box does not require an entry, leave it blank. Interest Expense fill in the blank 2 fill in the blank 3 Discount on Bonds Payable fill in the blank 5 fill in the blank 6 Cash fill in the blank 8 fill in the blank 9arrow_forward

- On the first day of the fiscal year, a company issues a $8,300,000, 10%, 8-year bond that pays semiannual interest of $415,000 ($8,300,000 × 10% × ½), receiving cash of $9,267,140. Journalize the first interest payment and the amortization of the related bond premium, round to the nearest dollar. If an amount box does not require an entry, leave it blank. blank - Select - - Select - - Select - - Select - - Select - - Select -arrow_forwardMedhurst Corporation issued $89,000 in bonds for $86,000. The bonds had a stated rate of 8% and pay interest quarterly. What is the journal entry to record the first interest payment? If an amount box does not require an entry, leave it blank.arrow_forwardOn the first day of the fiscal year, a company issues a $500,000, 8%, 10-year bond that pays semiannual interest of $20,000 ($500,000 × 8% × 1/2), receiving cash of $530,000. Journalize the entry for the issuance of the bonds. If an amount box does not require an entry, leave it blank.arrow_forward

- Please do not give solution in image format ?arrow_forwardOn January 1, Year 1, Price Company issued $291,000 of five-year, 5 percent bonds at 98. Interest is payable annually on December 31. The discount is amortized using the straight-line method. Required Prepare the journal entries to record the bond transactions for Year 1 and Year 2. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) View transaction list Journal entry worksheet 1 > Record the entry for issuance of bonds. Note: Enter debits before credits. Date General Journal Debit Credit Jan 01 Record entry Clear entry View general journalarrow_forwardOn the first day of the fiscal year, a company issues a $621,000, 11%, 10-year bond that pays semiannual interest of $34,155 ($621,000 × 11% × 1/2), receiving cash of $652,050. Required: Journalize the entry to record the first interest payment and amortization of premium using the straight-line method. Refer to the Chart of Accounts for exact wording of account titles. Chart Of Accounts CHART OF ACCOUNTS General Ledger ASSETS 110 Cash 111 Petty Cash 112 Accounts Receivable 113 Allowance for Doubtful Accounts 114 Notes Receivable 115 Interest Receivable 121 Merchandise Inventory 122 Supplies 131 Prepaid Insurance 140 Land 151 Building 152 Accumulated Depreciation-Building 153 Equipment 154 Accumulated Depreciation-Equipment LIABILITIES 210 Accounts Payable 221 Salaries Payable 231 Sales Tax Payable 241 Notes Payable 242 Interest Payable 251 Bonds Payable 252 Discount on Bonds…arrow_forward

- On Jan. 1, Year 1, Foxcroft Inc. issued 120 bonds with a face value of $1,080 for $132,600. The bonds had a stated rate of 8% and paid interest semi-annually. What is the journal entry to record the issuance of the bonds? If an amount box does not require an entry, leave it blank. Jan. 1arrow_forwardOn the first day the fiscal year, a company issue a $437,000, 7%, 10years bond that pays semiannual interest of $15,295 ($437,000 x 7% x 1/2), receiving cash of $458,900. Journalize the entry for the first interest payment and amortization of premium using the straight-in line method. If an amount box does not require an entry, leave in blank. ____________ _____ _______ _____________ ______ ________arrow_forwardplease help solve and explain equationarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education