FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

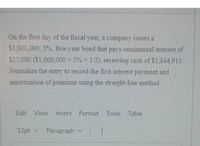

Transcribed Image Text:On the first day of the fiscal year, a company issues a

$1,000,000, 5%, five-year bond that pays semiannual interest of

$25,000 ($1,000,000 × 5% x 1/2), receiving cash of $1,044.913.

Joumalize the entry to record the first interest payment and

amortization of premium using the straight-line method.

Edit View Insert Format Tools Table

12pt v

Paragraph v

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- The following payroll liability accounts are included in the ledger of Wildhorse Company on January 1. FICA Taxes Payable $760.00 Federal Income Taxes Payable 1,204.60 State Income Taxes Payable 108.95 Federal Unemployment Taxes Payable 288.95 State Unemployment Taxes Payable 1,954.40 Union Dues Payable 870.00 In January, the following transactions occurred. Jan. 10 Sent check for $870.00 to union treasurer for union dues. 12 Sent check for $1,964.60 for FICA taxes and federal income taxes withheld. 17 Paid state income taxes withheld from employees. 20 Paid federal and state unemployment taxes. At January 31, the company completed the monthly payroll register, which shows salaries and wages $55,000. The company makes an entry for employer payroll taxes: FICA taxes 7.65% (the 7.65% FICA tax rate consists of the Social Security tax rate of 6.2% on salaries and wages up to $55,000 and the Medicare tax rate of 1.45% on…arrow_forwardJournalize the payroll on March 15, and the accrual of employee payroll taxesarrow_forwardWhat is the fiscal year? Why might companies choose to use a fiscal year that is not a calendar year?arrow_forward

- In 20--, the annual salaries paid each of the officers of Abrew, Inc., follow. The officers are paid semimonthly on the 15th and the last day of the month. Compute the FICA taxes to be withheld from each officer's pay on (a) November 15 and (b) December 31. Round your answers to the nearest cent. If an amount is zero, enter "0". a. November 15 Name and Title AnnualSalary OASDI TaxableEarnings OASDI Tax HI TaxableEarnings HI Tax Hanks, Timothy, President $163,200 $fill in the blank 1 $fill in the blank 2 $fill in the blank 3 $fill in the blank 4 Grath, John, VP Finance 138,000 fill in the blank 5 fill in the blank 6 fill in the blank 7 fill in the blank 8 James, Sally, VP Sales 69,600 fill in the blank 9 fill in the blank 10 fill in the blank 11 fill in the blank 12 Kimmel, Joan, VP Mfg. 54,000 fill in the blank 13 fill in the blank 14 fill in the blank 15 fill in the blank 16 Wie, Pam, VP Personnel 51,600 fill in the blank 17 fill in the blank 18 fill in the blank 19…arrow_forwardSandler Company completed the following two transactions. The annual accounting period endsDecember 31.a. On December 31, calculated the payroll, which indicates gross earnings for wages ($260,000),payroll deductions for income tax ($28,000), payroll deductions for FICA ($20,000), payrolldeductions for United Way ($4,000), employer contributions for FICA (matching), and stateand federal unemployment taxes ($2,000). Employees were paid in cash, but payments for thecorresponding payroll deductions have not been made and employer taxes have not yet beenrecorded.b. Collected rent revenue of $1,500 on December 10 for office space that Sandler rented toanother business. The rent collected was for 30 days from December 11 to January 10 and wascredited in full to Unearned Revenue.Required:1. Give the entries required on December 31 to record payroll.2. Give ( a ) the journal entry for the collection of rent on December 10 and ( b ) the adjusting journal entry on December 31.3. Show how any…arrow_forwardThe following totals for the month of June were taken from the payroll register of Concord Company. Salaries and wages FICA taxes withheld Income taxes withheld Medical insurance deductions Federal unemployment taxes State unemployment taxes$640004896 17600 3200 384 3456 The entry to record the accrual of Concord's Company's payroll taxes would include a credit to FICA Taxes Payable for$3840. credit to Payroll Tax Expense for$3840. debit to Payroll Tax Expense for$8736. credit to Payroll Tax Expense for$8736arrow_forward

- The following company information is available: Days sales outstanding 27 Days sales in inventory 19 Days accounts payable outstanding 29 How long is the company's operating cycle? Group of answer choices 56 days 8 days 75 days 46 daysarrow_forwardFigure 6.1 The form below shows the amounts that appear in the Earnings to Date column of the employees' earnings records for 10 full- and part-time workers in Unger Company. These amounts represent the cumulative earnings for each worker as of October 4, the company's last payday. The form also gives the gross amount of earnings to be paid each worker on the next payday, October 11. In the state where Unger Company is located, the tax rates and bases are as follows: Tax on Employees: FICA—OASDI 6.2% on first $137,700 FICA—HI 1.45% on total earnings SUTA 0.5% on first $8,000 Tax on Employer: FICA—OASDI 6.2% on first $137,700 FICA—HI 1.45% on total earnings FUTA 0.6% on first $7,000 SUTA 1.8% on first $8,000 In the appropriate columns of the form shown below, do the following: 1. Compute the amount to be withheld from each employee's earnings on October 11 for (a) FICA—OASDI, (b) FICA—HI, and (c) SUTA, and determine the total employee taxes.2.…arrow_forwardLakeview Company completed the following two transactions. The annual accounting period ends December 31. a. On December 31, calculated the payroll, which indicates gross earnings for wages ($80,000), payroll deductions for income tax ($8,000), payroll deductions for FICA ($6,000), payroll deductions for American Cancer Society ($3,000), employer contributions for FICA (matching), and state and federal unemployment taxes ($600). Employees were paid in cash, but payments for the corresponding payroll deductions have not yet been made and employer taxes have not yet been recorded. b. Collected rent revenue of $6,000 on December 10 for office space that Lakeview rented to another business. The rent collected was for 30 days from December 11 to January 10 and was credited in full to Deferred Revenue. Required: 1. & 2. Prepare the journal entries to record payroll on December 31, the collection of rent on December 10 and adjusting journal entry on December 31. 3. Show how any of the…arrow_forward

- The following accounts, with the balances indicated, appear in the ledger of Garcon Co. on December 1 of the current year: The following transactions relating to payroll, payroll deductions, and payroll taxes occurred dur ing December:Dec 2. Issued Chedc No. 410 for $3,400 to Jay Bank to purchase U5. savings bonds for employees.2. Issued Check Na 411 to Jay Bank for $27,046 in payment of $9,273 of social security tax, $2,318 of Medicare tax, and $15,455 of employees'federal income tax due. Dec. 13. Journalized the entry to record the biweekly payroll. A summary of the payroll record follows: 13. Issued Check No. 420 in payment of the net amount of the biweekly payroll.13. Journalized the entry to record payroll taxes on employees' eamings of December 13: social security tax, $4,632; Medicare tax, $1,158; state unemployment tax, $350; federal unemployment tax. $125.16. Issued Check No. 424 to Jay Bank for $27,020, in payment of $9,264 of social security tax. $2316 of Medicare tax. and…arrow_forwardEhrlich Co. began business on January 2. Salaries were paid to employees on the last day of each month, and social security tax, Medicare tax, and federal income tax were withheld in the required amounts. An employee who is hired in the middle of the month receives half the monthly salary for that month. All required payroll tax reports were filed, and the correctamount of payroll taxes was remitted by the company for the calendar year. Early in the following year, before the Wage and Tax Statements (Form W-2) could be prepared for distribution to employees and for filing with the Social Security Administration, the employees’ earnings records were inadvertently destroyed. None of the employees resigned or were discharged during the year, and there were no changes in salary rates. The social security tax was withheld at the rate of 6.0% and Medicaretax at the rate of 1.5% on salary. Data on dates of employment, salary rates, and employees’ income taxes withheld, which are summarized as…arrow_forwardA company's payroll for the month ended January 31 is summarized as follows: Total wages Federal income tax withheld FICA taxes (employee portion withheld) FICA taxes (employer portion) $10,000 $1,200 $700 $700 The company remits payroll taxes on the 15th of the following month. In its financial statements for the month ended January 31, what amounts should the company report as total payroll tax liability and as payroll tax expense? O Payroll tax liability: $1,400; Payroll tax expense: $700 O Payroll tax liability: $1,900; Payroll tax expense: $1,400 O Payroll tax liability: $2,600; Payroll tax expense: $700 O Payroll tax liability: $1,900; Payroll tax expense: $700 O Payroll tax liability: $1,200; Payroll tax expense: $1,400arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education