FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

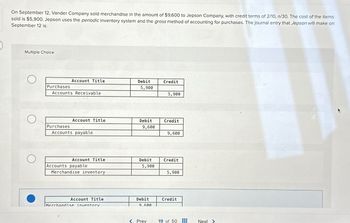

Transcribed Image Text:On September 12, Vander Company sold merchandise in the amount of $9,600 to Jepson Company, with credit terms of 2/10, n/30. The cost of the items

sold is $5,900. Jepson uses the periodic inventory system and the gross method of accounting for purchases. The journal entry that Jepson will make on

September 12 is:

Multiple Choice

О

Account Title

Debit

Credit

Purchases

5,900

Accounts Receivable

5,900

О

Account Title

Debit

Credit

Purchases

9,600

Accounts payable

9,600

Account Title

Debit

Credit

Accounts payable

5,900

Merchandise inventory

5,900

Account Title

Debit

Credit

Merchandise inventory

9.600

< Prev

19 of 50

Next >

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- p. Using the perpetual inventory system, journalize the entries for the following selected transactions: i. Sold merchandise to customers who used MasterCard and VISA, $9,500. The cost of the merchandise sold was $5,300. ii. Paid an invoice from First National Bank for $385, representing a service fee for processing MasterCard and VISA sales. Date Description Post. Debit Credit Ref. 90269-1arrow_forwardCan you help me explain how does it work? what is $5000 stand for and $2400 stand for? A seller uses a perpetual inventory system and on April 4 it sells $5,000 in merchandise with a cost of $2,400 to a customer on credit terms of 3/10, n/30. Complete the two journal entries to record the sales transaction by selecting the account names from the drop-down menus and entering the dollar amounts in the debit or credit columns. The first journal entry is to record the revenue part of the transaction and the second journal entry is to record the cost part.arrow_forward2arrow_forward

- Mayfair Company completed the following transactions and uses a perpetual Inventory system. June 4 Sold $2,700 of merchandise on credit (that had cost $1,600) to Natara Morris, terms n/15. June 5 Sold $30,000 of merchandise (that had cost $18,000) to customers who used their Zisa cards. Zisa charges a 14 fee. June 6 Sold $21,000 of merchandise (that had cost $12,600) to customers who used their Access cards. Access charges a 3% fee. June 8 Sold $18,000 of merchandise (that had cost $2,900) to customers who used their Access cards. Access charges a 2 fee. June 13 Wrote off the account of Abigail McKee against the Allowance for Doubtful Accounts. The $2,160 balance in McKee's account was from a credit sale last year. June 18 Received Morris's check in full payment for the June 4 purchase. Required: Prepare journal entries to record the preceding transactions and events. View transaction list Journal entry worksheet Sold $2,700 of merchandise on credit to Natara Morris, terms n/15. Note:…arrow_forwardHelp mearrow_forwardJournalize the following merchandise transactions. The company uses the perpetual inventory system. a. Sold merchandise on account, $14,900 with terms 2/10, net 30. The cost of the goods sold was $9,685. If an amount box does not require an entry, leave it blank. b. Received payment within the discount period. If an amount box does not require an entry, leave it blank.arrow_forward

- On March 10, the Stone Company sold merchandise listing for $3,000 to the Dillard Company, terms 1/10, n/30. On March 14, $200 worth of merchandise was returned because it was the wrong size. On March 20, Stone Company received a check for the amount due. Required Record the journal entries made by Stone Company for these transactions Stone uses the periodic inventory system General Journal Description Date Mar 10 Accounts Receivable Cath Sold merchandises Dund Company terms 1/16/30 14 Merchande returned by Dars Company 20 Cash Remittance received from Dard Company # 1 Debit 1.000 00 Credit 1.000 0 O 0arrow_forwardGlobal Company sold merchandise for $11,700 on account. The cost of the items sold was $7,900. If the company uses the perpetual inventory system, which of the following best reflects the journal entry that should be prepared to record this transaction? Debit Credit A. Sales revenue 11,700 Accounts receivable 11,700 Cost of goods sold 7,900 Merchandise inventory 7,900 B. Accounts receivable 11,700 Merchandise inventory 7,900 Sales revenue 3,800 C. Accounts receivable 3,800 Sales revenue 3,800 D. Accounts receivable 11,700 Sales revenue 11,700 Cost of goods sold 7,900 Merchandise inventory 7,900 Group of answer choices A. B. C. D.arrow_forwardPrepare journal entries to record the following transactions for a retail store. The company uses a perpetual inventory system and the gross method. Apr. Apr. Apr. Apr. Apr. 2 Purchased $6,100 of merchandise from Lyon Company with credit terms of 2/15, n/60, invoice dated April 2, and FOB shipping point. Paid $280 cash for shipping charges on the April 2 purchase. Returned to Lyon Company unacceptable merchandise that had an invoice price of $650. Apr. 3 4 17 18 Apr. 21 28 Sent a check to Lyon Company for the April 2 purchase, net of the discount and the returned merchandise. Purchased $11,500 of merchandise from Frist Corp. with credit terms of 1/10, n/30, invoice dated April 18, and FOB destination. After negotiations, received from Frist a $600 allowance toward the $11,500 owed on the April 18 purchase. Sent check to Frist paying for the April 18 purchase, net of the allowance and the discount.arrow_forward

- Journalize the following transactions for Armour Inc. Oct. 7 Sold merchandise on credit to Rondo Distributors, for $1,200, terms n/30. The cost of the merchandise was $720. Purchased merchandise, $10,000, terms FOB shipping point, 2/15, n/30, with prepaid freight charges of $525 added to the invoice. Journalize the transactions above using the periodic inventory system. If an amount box does not require an entry, leave it blank. Oct. 7 Oct. 8 Journalize the transactions above using the perpetual inventory system. Oct. 7- Sale Cost Oct. 8arrow_forwardTravis Company purchased merchandise on account from a supplier for $12,300, terms 2/10, net 30. Travis Company paid for the merchandise within the discount period. Under a perpetual inventory system, record the journal entries required for the above transactions. If an amount box does not require an entry, leave it blank. a. b.arrow_forwardNixa Office Supply uses a perpetual inventory system. On September 12, Nixa Office Supply sold 26 calculators costing $23 for $31 each to Sura Book Store, terms n/30. Journalize the September 12 transaction for Nixa. (Credit account titles are automatically indented when amount is entered. Do not indent manually) Debit Credit Date Account Titles and Explanation Sept. 12 (To record credit sale) Sept. 12 (To record cost of merchandise sold)arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education